The market is coming ‘our direction’, and our silver forecast 2021 published almost 9 months ago seems now underway. We forecasted the mid to higher 30ies to be hit in 2021. We believe silver is ready to start moving in that direction, after a 10 month consolidation period.

RELATED – Silver Is Now Officially In A New Secular Uptrend (added Sept 7th, 2024)

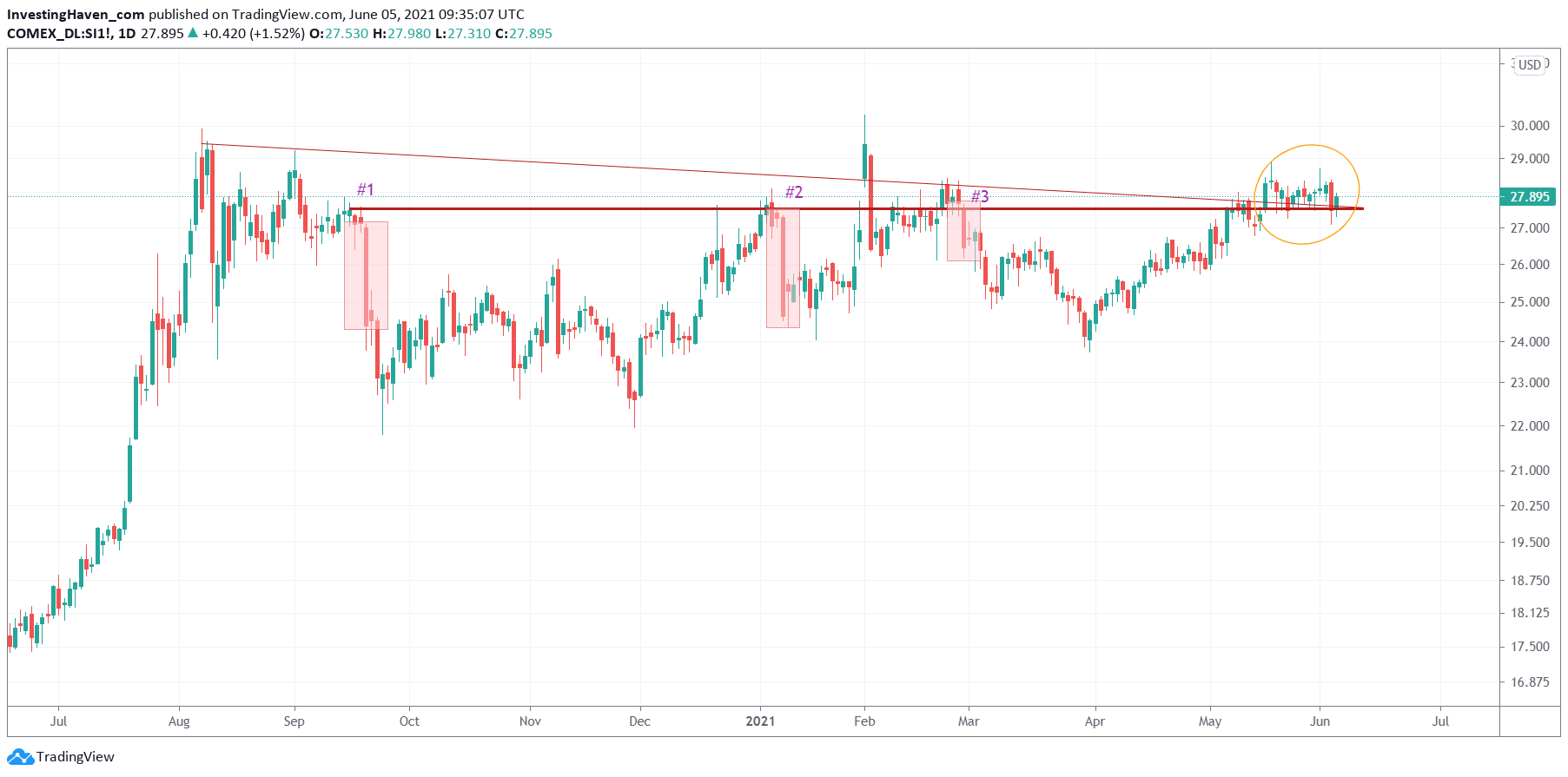

Last week we published this article Silver: When Will 30 USD Finally Be Broken To The Upside which featured the silver price chart and the ability of silver to trade above the 3 important trendlines.

On Thursday, June 3d, silver retraced only to test those trendlines. This is a ‘successful backtest’, in charting terms. And if silver trades higher by Tuesday and Thursday, coming week, we’ll have the ultimate confirmation of a successful backtest.

Last week we identified 5 distinct data points that make us believe that silver is about to move higher, not lower.

- The daily silver price chart. Silver is now above 3 trendlines, and did successfully test its breakout point on Thursday. Very promising, see below chart.

- The weekly silver price chart. In essence the backtest from last Thursday occurred at a secular level that goes back 11 years in time! Bullish.

- The USD is not yet in a position to push back precious metals. Eventually it will, but that’s not now.

- The bond market is opening the door for precious metals to thrive. Want to know more about this fascinating intermarket trend? Please read this article.

- Anecdotal evidence comes from our mailbox. In our Momentum Investing portfolio we went overweight in silver miners in the last 3 weeks. Some members are doubting this is a wise thing, especially because of the USD and the fact ‘we are buying high’. This, for us, is the ultimate evidence of silver to move higher: concerned investors amid a great silver chart and phenomenal intermarket dynamics.

We believe silver is ready to move higher. It might start as early as next week or in a few weeks. Whatever happens in the silver market we believe the downside is limited, and the upside potential far outpaces the downside risk.