We concluded in our article Is Gold Or Silver A Better Investment Going Into 2020 that precious metals stocks are the best investment going into 2020. We said that silver is a better investment than gold, but precious metals stocks are better than both gold and silver. That said, we want to have a better understanding on why and how precious metals stocks are a buy. Are they a strong buy or not? We conclude from the 7 charts in this article that precious metals stocks are a STRONG buy going into 2020. This is why we believe investors can buy precious metals stocks as 2020 kicks off.

The charts never lie. And as per our ‘start with the chart’ principle outlined in our 100 Investing Tips For Long Term Investors we look at a multitude of precious metals stocks charts in this article.

We cover individual precious metals miners indices on multiple timeframe. They all have one consistent ‘breakout’ message. More importantly we look at relative strength and our market darling First Majestic Silver.

Buy Precious Metals Stocks Before 2020 Starts?

Interestingly precious metals miners are an unusually high risk business. You would expect a premium price tag for these stocks. Nothing is further from the truth. Precious metals stocks don’t have this premium.

Last year we published our top precious metals stocks for 2019. Unlike this Forbes article we don’t have the same viewpoint on top precious metals stocks for 2020! Note that so far this forecast was spot-on: some of the largest cap precious metals stocks were outperformers so far (at the time of writing).

However we believe that 2020 is shaping up to be the year in which mid caps and maybe even explorers might be the outperforming segment of precious metals stocks.

As suggested by the charts below we believe it is time to buy precious metals stocks especially the ones in the higher risk segment.

Precious Metals Stocks: Short Term Charts

“One day does not make a market”, is what investors tend to say.

What we add is “one index does not make a trend.” However if multiple indices bring the same message you better believe there is a trend.

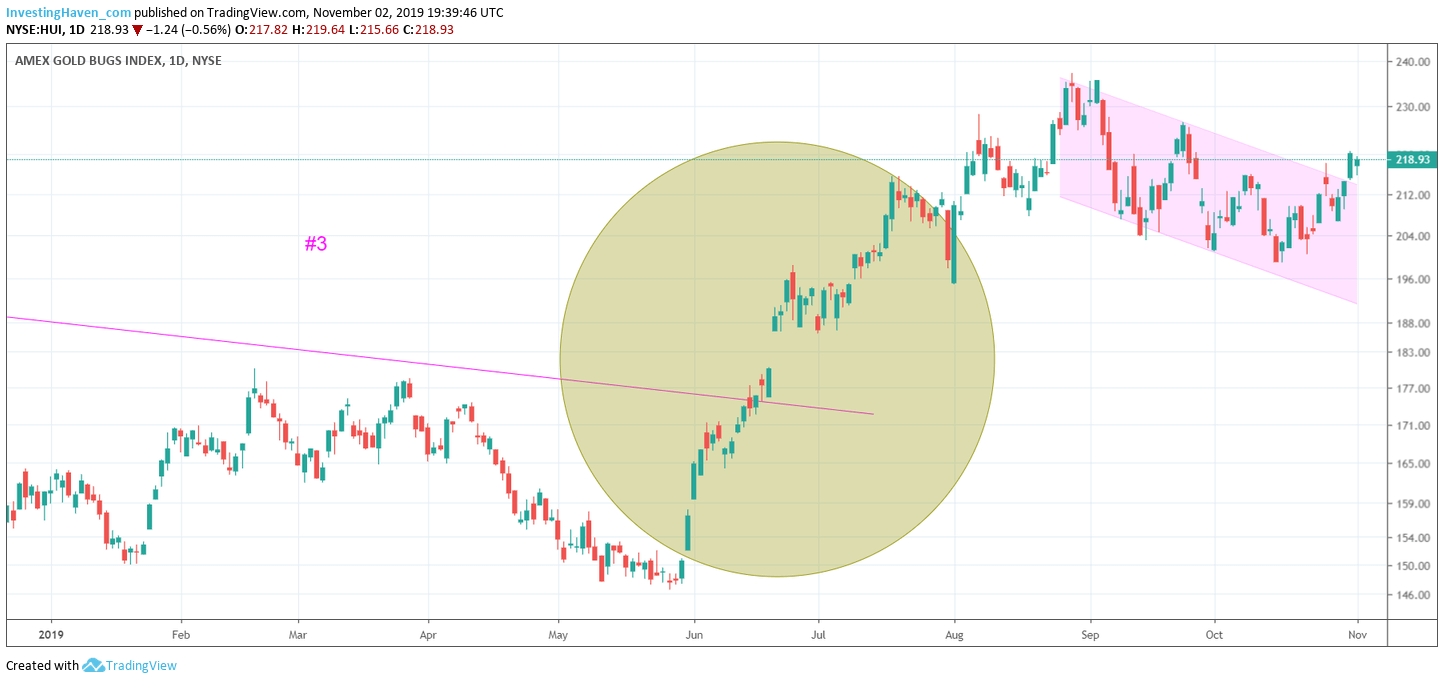

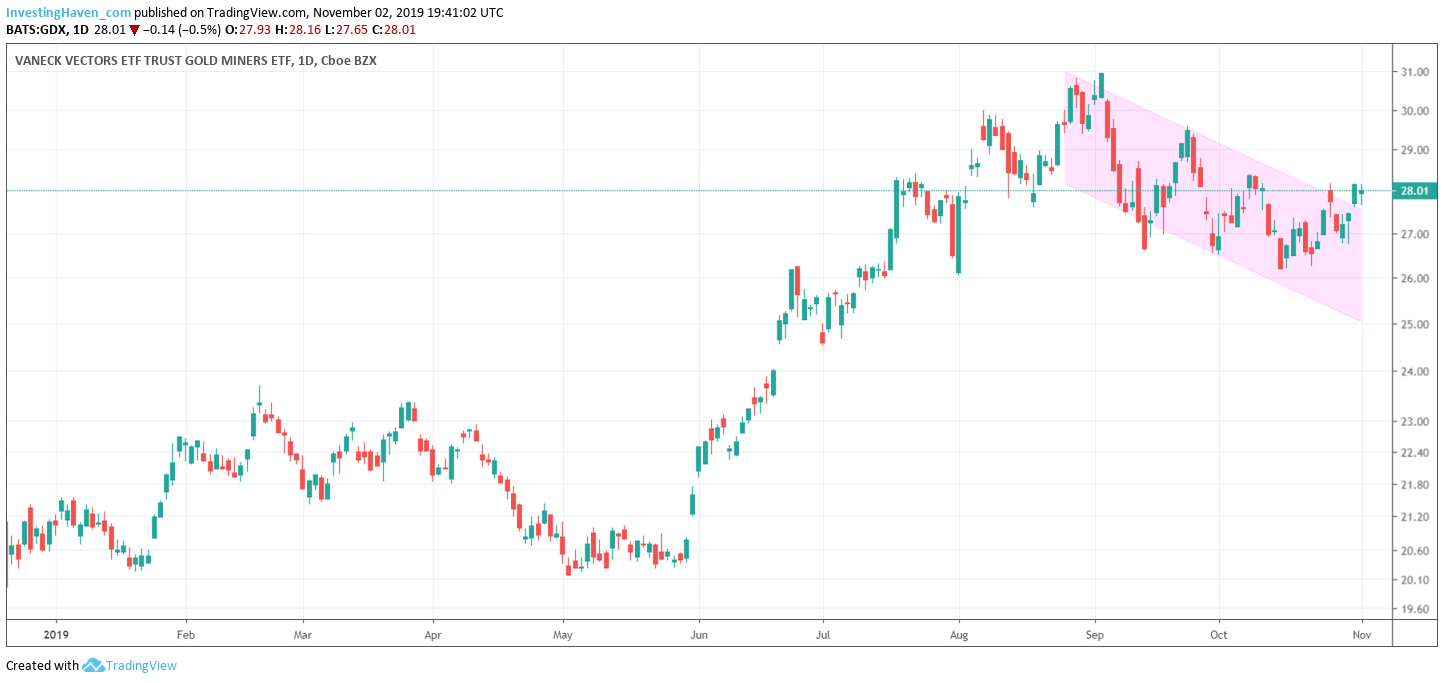

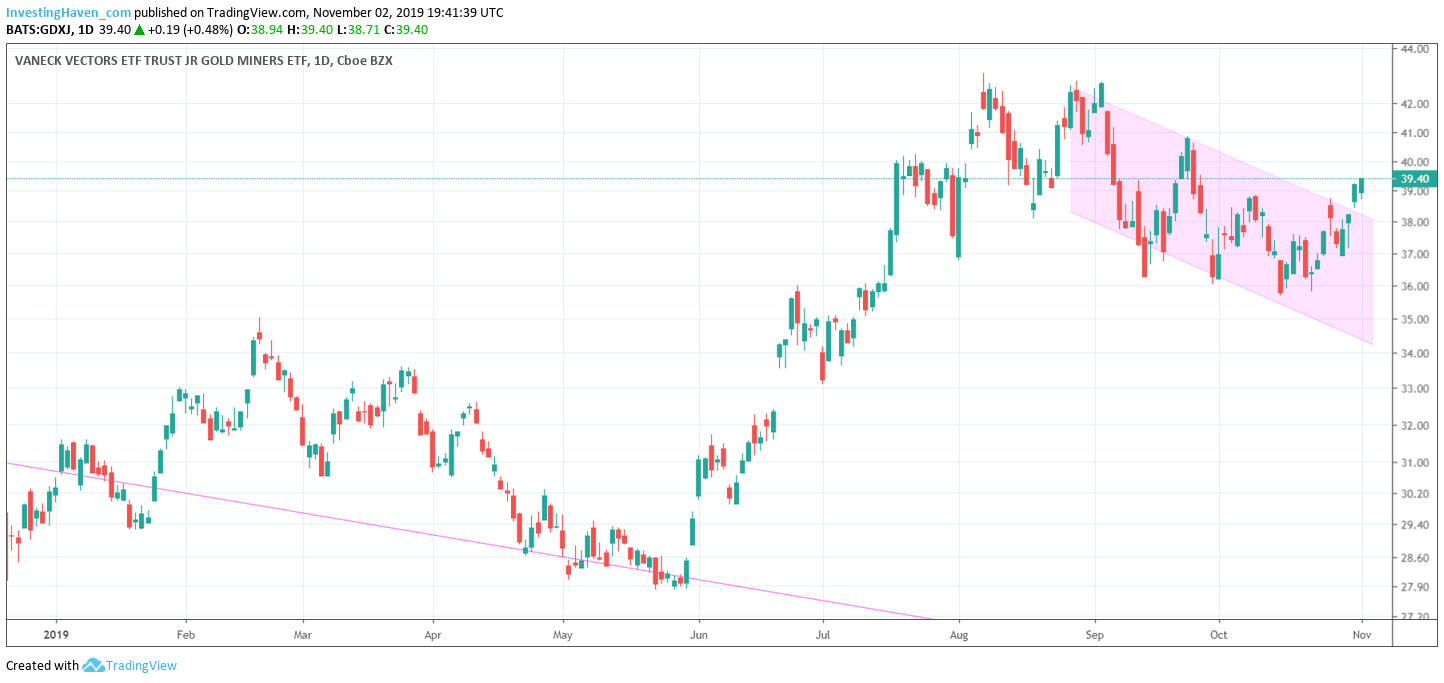

There are 3 leading indices for precious metals stocks: HUI, GDX, GDXJ. And just from a short term chart trend perspective they all suggest that it is time to buy precious metals stocks before 2020 starts.

That’s because they are breaking out now! And this type of breakout suggests to buy precious metals stocks.

The HUI daily chart shows a breakout since it started correcting in the first week of September. This breakout should hold for 3 more consecutive days in order to validate!

The GDX has a similar setup.

And so does the GDXJ.

The GDXJ may be less important from a market cap perspective (GDXJ has only junior miners). But it is important from a confirmation perspective. If junior miners join the party you can be sure there is wide participation!

We conclude from the short term charts that precious metals stocks are a buy going into 2020!

Precious Metals Stocks: Long Term Charts

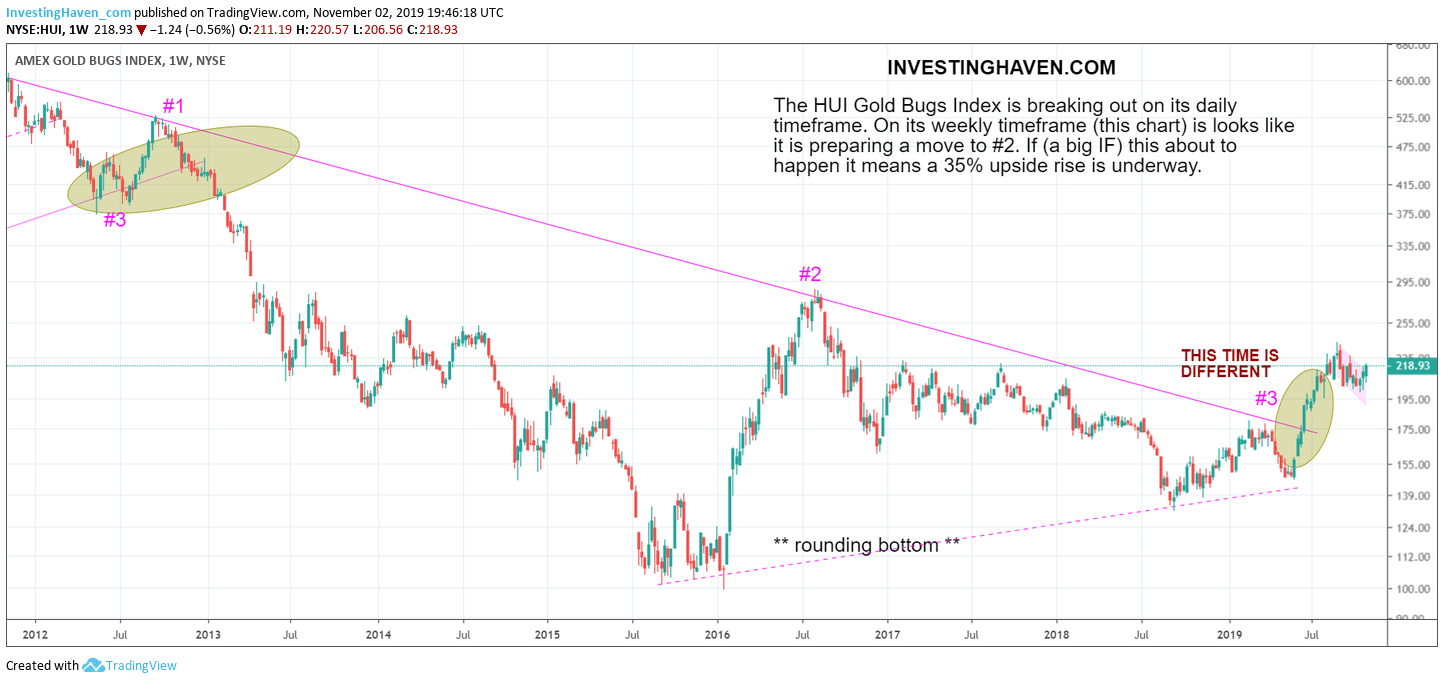

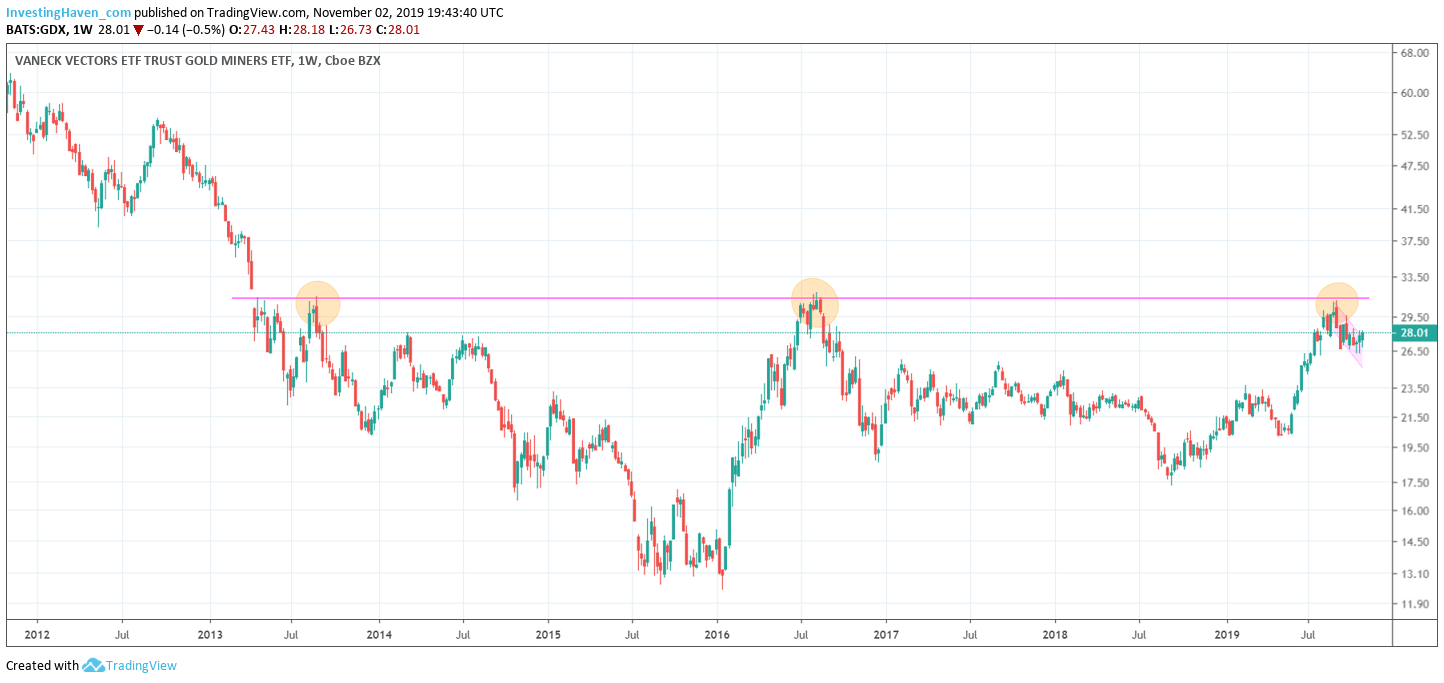

The long term charts are equally interesting and even more important. We only look at HUI and GDX.

The recent retracement is not visible on the long term HUI chart. All we see is an uptrend since 2019. Bullish after breaking out of #3 on the chart!

The GDX chart tells a different story. THE important test did not take place yet. However THE important test is coming up. To be precisely the critical price point is approx 32 points.

We see a clear willingness of GDX of moving to 32 points currently. Bullish short term, and much will depend on what happens at 32 points.

More importantly this giant rounding bottom between 2016 and today is a hugely bullish formation.

The long term precious metals stocks charts have a strongly bullish setup. They confirm it is time to buy precious metals stocks. In fact they amplify the message from the long term precious metals stocks indices charts.

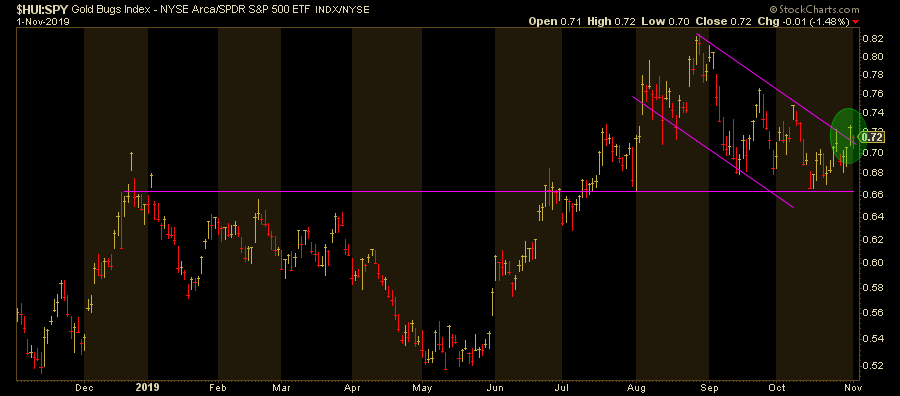

Precious Metals vs the S&P 500: Relative Strength

Investors should always look at relative strength! It is not only important to analyze the sector of interest but also the sector as it relates to the broader market!

That’s why the precious metals stocks index HUI to the S&P 500 index is a great measure of relative strength.

What we see on the daily precious metals stocks to S&P 500 chart is also a breakout similar to the daily charts shown earlier. This is the start of a breakout to be clear. So more work is required to confirm this.

But provided this ratio continues to rise in the next few days we have another confirmed buy signal for precious metals stocks before 2020 starts.

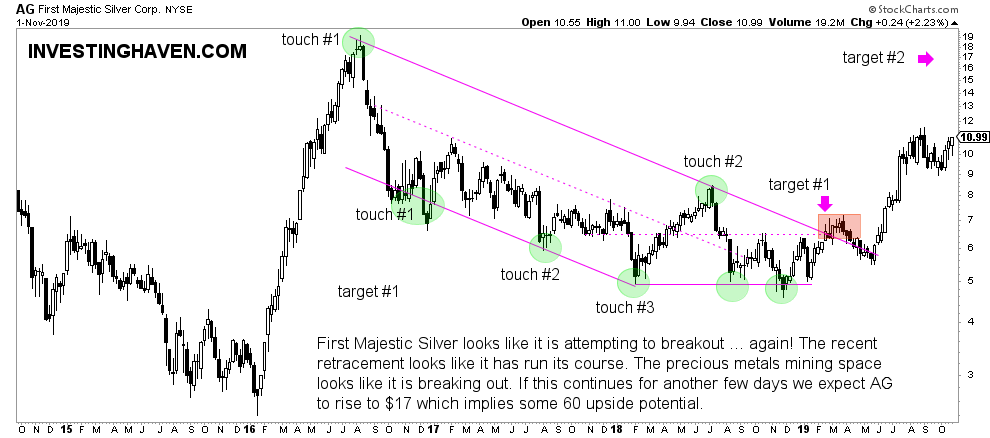

Precious Metals Miners Favorite: First Majestic Silver

To wrap up we obviously have to look at our market darling when it comes to precious metals stocks: First Majestic Silver.

Below is the weekly chart of First Majestic Silver. We have featured this chart so many times in the last 12 months, and InvestingHaven followers were really lucky to have followed the ideas we published on First Majestic Silver.

Not only did we spot the breakout and the subsequent rise of close to 90 pct. We also were spot-on in forecasting the top in the first week of September.

It is always prudent to take profits off the table. But it is equally important to follow the subsequent trend. It appears now that First Majestic Silver is continuing its rise after a short break in Sept/Oct. This is great news for precious metals investors as First Majestic Silver is about to flash another strong buy signal!