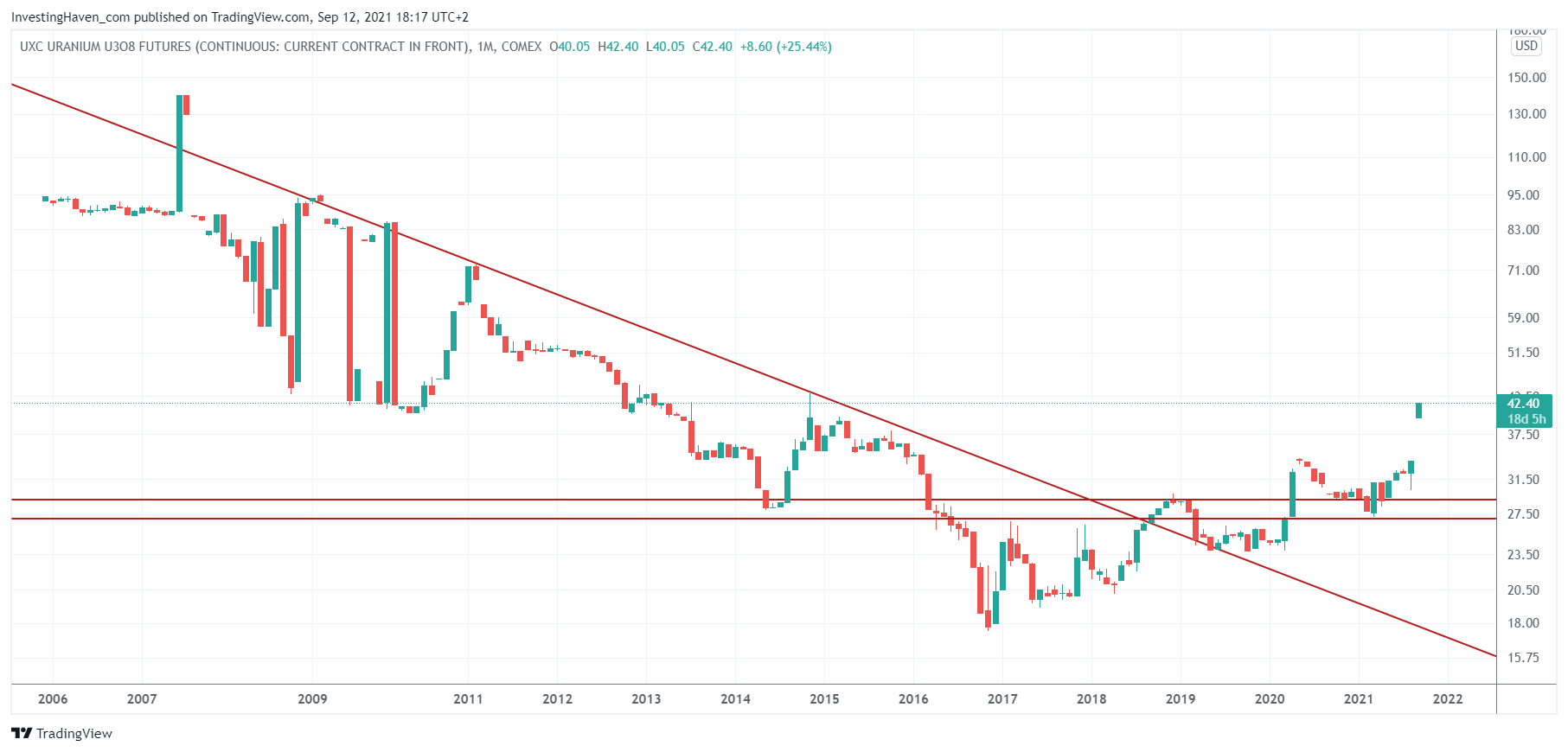

The uranium spot price broke out two weeks ago, and has risen quickly (maybe too quick?). We look at the long term trends in this market, both uranium spot and two uranium miners.

Sprott (the natural resources fund in Canada from billionaire Eric Sprott) decided to ‘hack’ the physical uranium market.

The monthly uranium chart shows a phenomenal breakout.

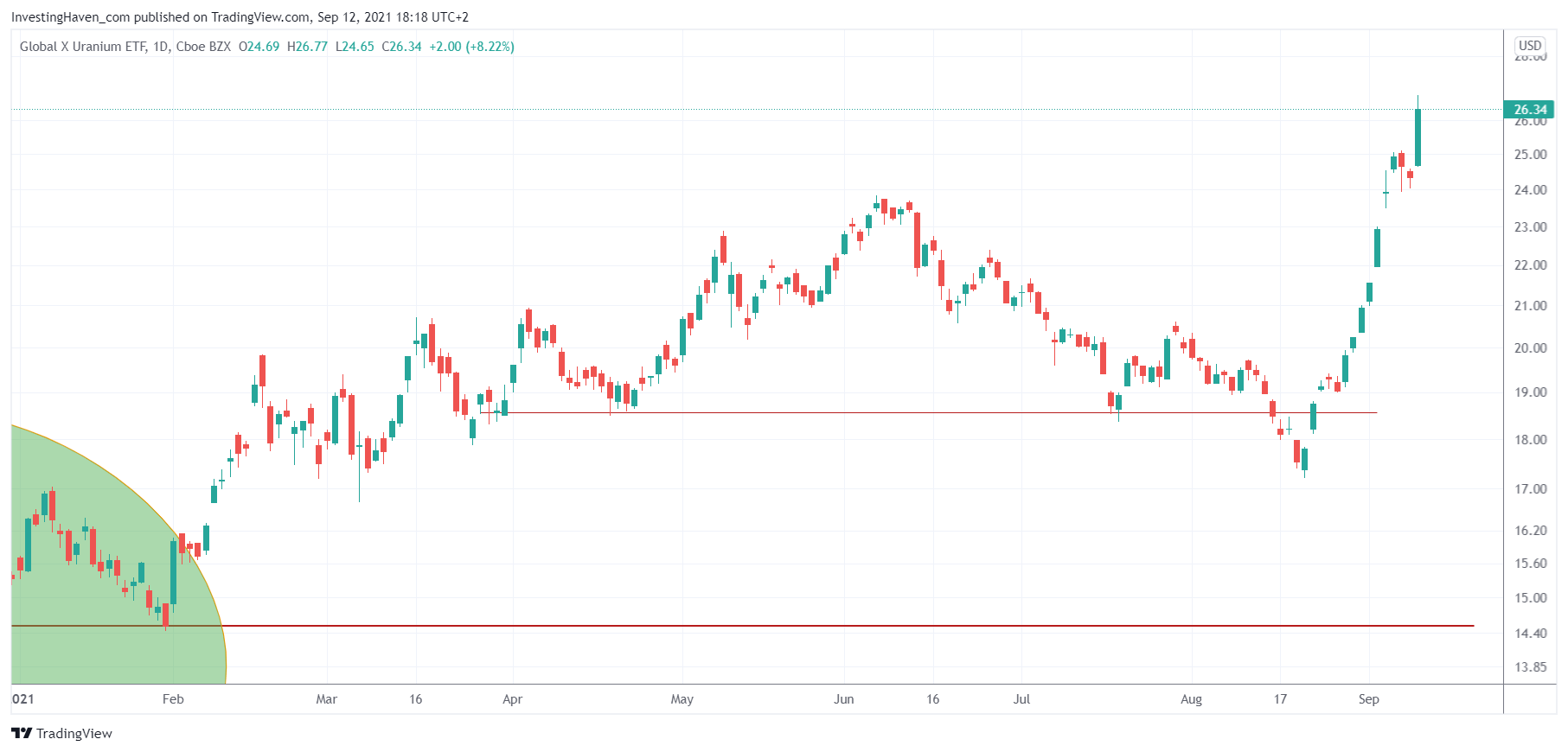

URA ETF was breaking down mid-August. However, Sprott turned things upside down in a dime. The breakout failed, and turned into an unusually bull run.

URA ETF was breaking down mid-August. However, Sprott turned things upside down in a dime. The breakout failed, and turned into an unusually bull run.

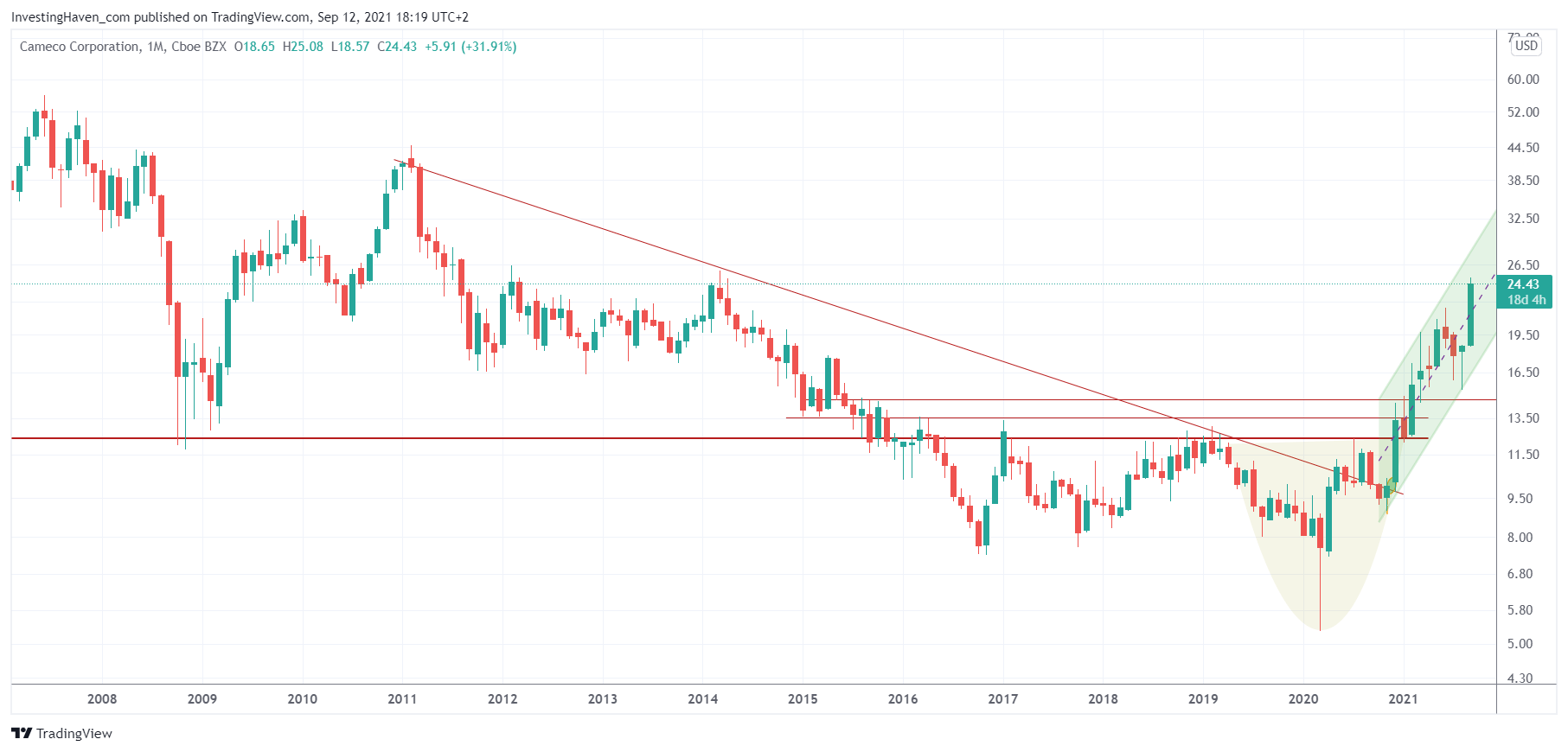

Cameco is the largest uranium producer. We zoom out and show you the monthly chart. We probably will hit resistance, but once above 28 USD it should go pretty fast to the lower 40ies.

Cameco is the largest uranium producer. We zoom out and show you the monthly chart. We probably will hit resistance, but once above 28 USD it should go pretty fast to the lower 40ies.

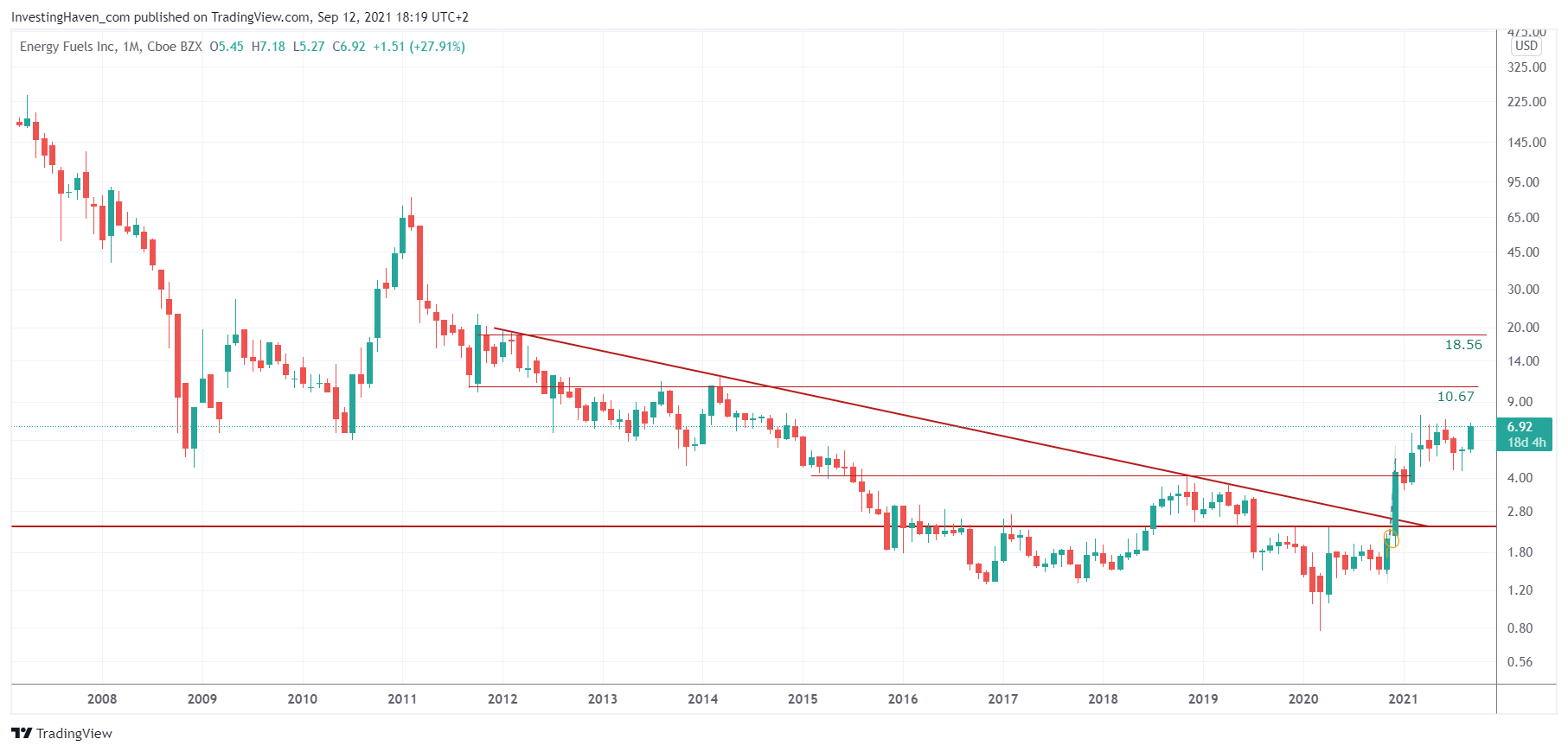

One volatile but also more risky way to play the uranium market is UUUU, as seen below (monthly chart) it was some crazy upside targets.

One volatile but also more risky way to play the uranium market is UUUU, as seen below (monthly chart) it was some crazy upside targets.

We decided not to enter the uranium market in our mid term oriented Momentum Investing service. However, long term positions in the uranium market may be justified. Watch out, though, there are some really small cap stocks in uranium that can be very volatile (especially when this bull run takes a pause).