After 10 straight years of a decline we now have a confirmed new uptrend in agricultural commodities. Is this a big deal, after all it’s not a ‘sexy’ asset class when compared to the contemporary electric vehicles, crypto, etc. It may be true that agricultural commodities are not hot, it may also be true that ‘nobody’ is talking about this, but it doesn’t mean that their returns are less attractive, on the contrary. What we do know from history is that once this asset class moves higher it sets pretty aggressive moves. Does it matter whether profits come from sector a, sector b or sector c? We did not cover agricultural commodities in our Commodities Outlook 2021 but we would certainly add this segment as a top performer in 2021 based on the current setup we see in the commodities complex.

Two years ago we wrote this in the public domain The Bear Market Of 2019: Agricultural Commodities

Our assessment back then was clear and accurate: agricultural commodities were declining, and they would continue to decline for a while.

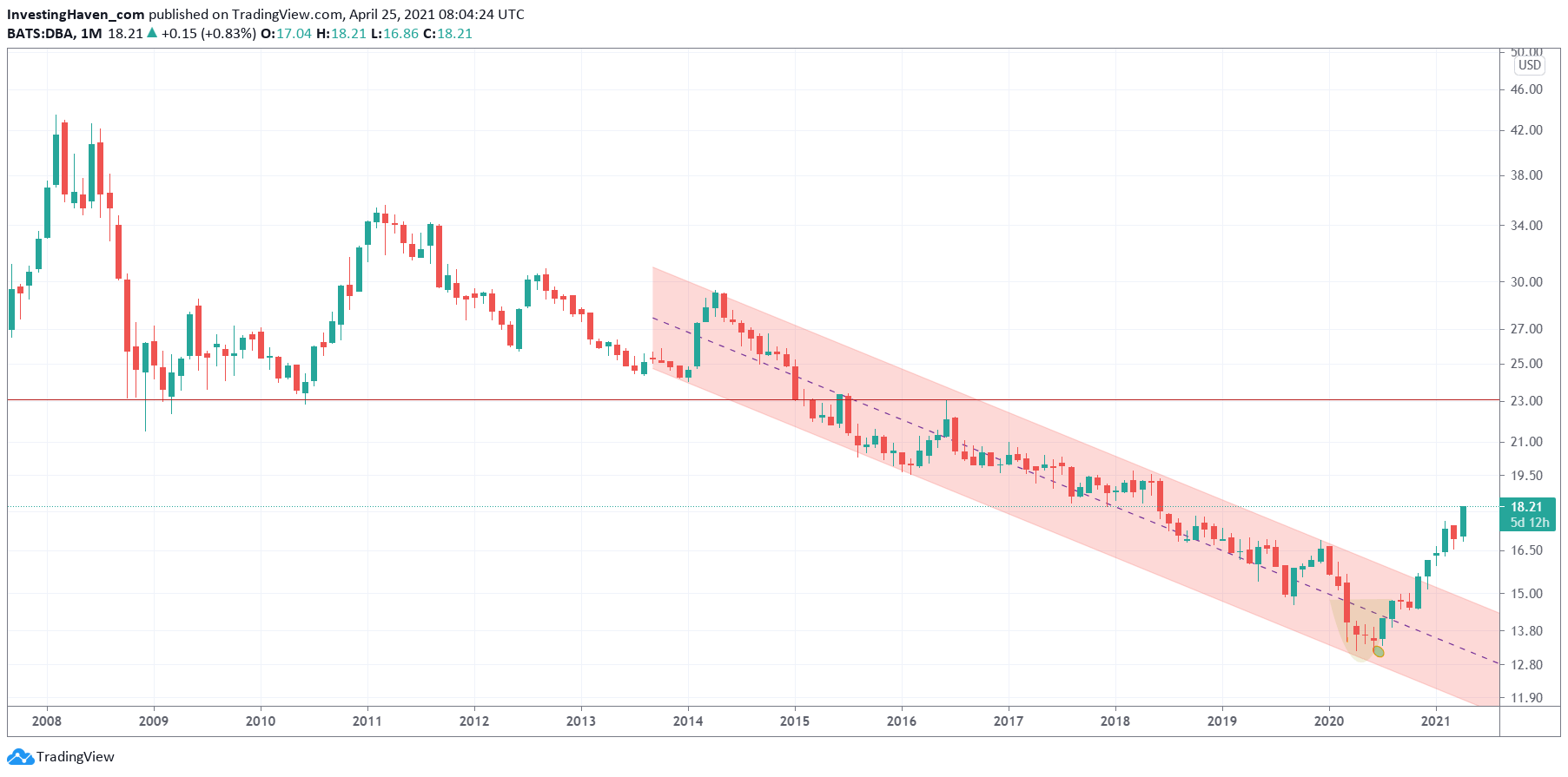

Today, we see the confirmation of a new uptrend which is a conclusion we derive from the monthly chart:

- A bear market that started in 2008.

- A short lived bounce in 2010 didn’t change the picture, on the contrary it was a dead cat bounce.

- Since 2011 there is a clear downtrend in the form of a falling channel.

- The downtrend was broken the upside 4 months ago.

- Any breakout requires 3 candles to be confirmed; the 4th candle that follows a breakout has confirmation value.

- April of 2021 is clearly set to close higher, it’s nearly impossible that agricultural commodities will decline 30% next week to close back inside the falling channel.

But wait a second the news is different. This is for instance what we find in the recent news flow Here is why agri commodities are expected to fall further. Here is the answer: charts don’t lie. Moreover, news is a lagging indicator. News, in our terminology ‘storytelling‘ very often, is contrarian to the real trend, watch out reading news if you are looking for really relevant investing insights.