Base metals went through a spectacular rise in recent months. Copper as an example did already exceed our 2020 forecasts, slightly exceeding our expectations. Our Copper Price Forecast is here, and we will refresh our forecast anytime soon to include our renewed 2021 viewpoint. How much more upside do base metals have?

In order to answer this question we will focus only on the chart, and we will use a longer timeframe to come up with an answer.

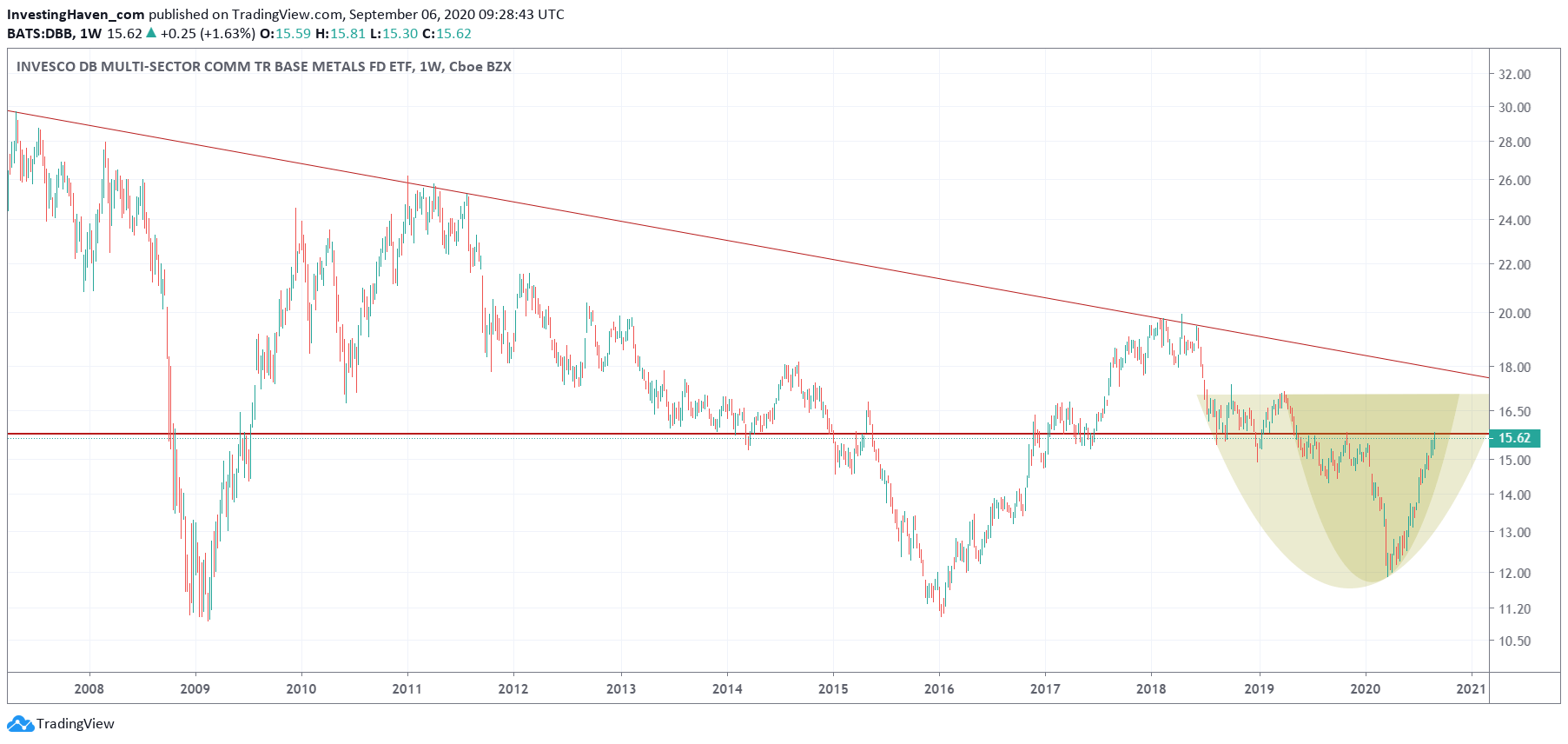

We believe base metals are hitting an important resistance are now, and the upside may still be there but we will start seeing some hesitation.

That’s the short version of our base metals medium term forecast.

This viewpoint is based on a few characteristics of the following chart setup:

- The base metals ETF (DBB) is hitting former multi-year support, now resistance.

- Assuming current levels will be taken out as there is good momentum in this sector we wil see even stronger resistance coming up 10 pct above current levels.

- In the unlikely event that this 2nd resistance level is taken out we will see multi-decade resistance just a little higher.

No need to give more detailed answers, right? There is ‘3-tier resistance’ coming up, so the most likely path for base metals is to start hesitating anytime soon.

In our Momentum Investing research we look at commodities, very thoroughly. We published a shortlist of 4 top stocks with a great outlook, one of them being a commodity stock in the coal sector. Not sure we will take a position in this stock, if not we’ll definitely be looking into the agricultural space later this year or in 2021.

![[:en]base metals[:nl]basismetalen[:]](https://investinghaven.com/wp-content/uploads/2017/05/base_metals.jpg)