Commodities did very well lately, and we are bullish long term as said in our commodities outlook 2021. That’s partly because of Euro strength, as explained in market leading indicator Euro bullish going into 2021 and some other 2021 forecasts. Consequently, the US Dollar is expected to be supportive for commodities. Other than relying on the Euro chart and individual commodities trend we have to do our due diligence and look at the message of the Dollar chart as well.

If anything, the long term Dollar chart is really trendless.

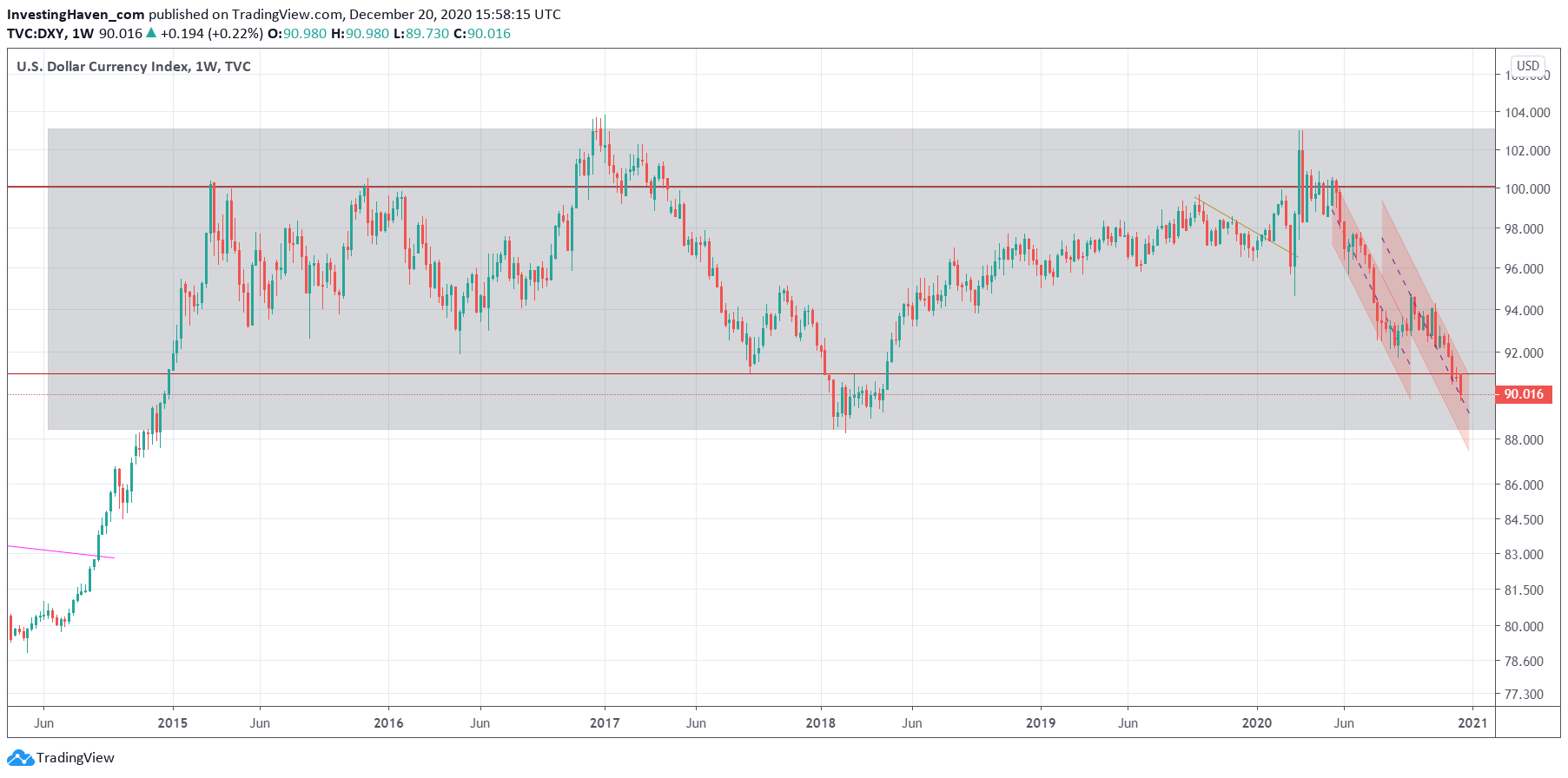

It may be trending in a range which we would say isn’t that wide: 88 to 104 points. From a long term perspective this is a rather narrow range.

Note that the trend since the Corona crash is strongly down, and we can see a parallel channel.

However, as per this long term chart and the consolidation area outlined on below weekly chart we are getting very close to the level where we expect the Dollar will stop falling: 88 points.

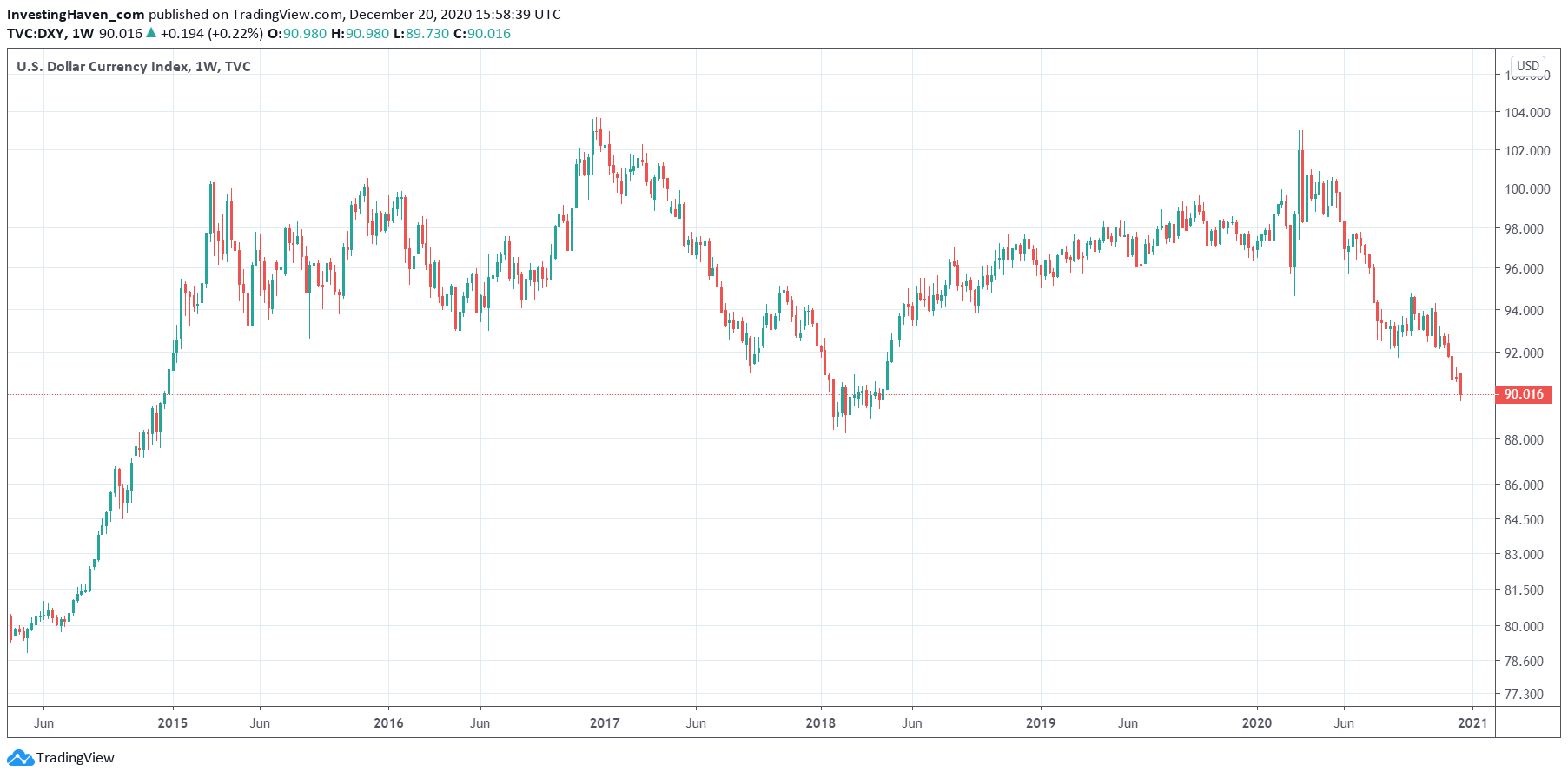

The chart without annotations makes another point: is this a giant topping pattern or a giant bullish reversal pattern? That’s the million (sorry, trillion) dollar question going into 2021 and 2022.

At this point in time it is not clear which scenario will play out. We need a few more months of data to understand the long term trend(s) in the US Dollar and, with that, in commodities.

- If (that’s a big IF) the Dollar will stop falling around 90 points it could qualify as a bullish setup.

- If (that’s a big IF) the Dollar will consolidate for a longer period of time around 88 points, it wouldn’t be that much of a threat to stocks and commodities.

This is a typical case of a market that won’t reveal a lot until it does. And it’s very dangerous to draw conclusions before anything becomes clear. We call it perma-everything. Better don’t do this, it hurts your financial health.