The commodities space is sending bullish signals. Not only is the precious metals complex very close to a giant breakout, as said in What Happens If Gold’s Price Breaks Out. More importantly, most grains are showing strongly bullish signs and several soft commodities as well some energy prices are showing some initial bullish signs. The inflation expectations major breakout is certainly related to this. Overall, this is great news for commodities investors although there is not sufficience evidence yet to justify going ‘all in’. There may be commodities though that qualify as one of the top investing opportunities of 2019.

We recommend our followers to look back at what we wrote in some critical commodities as well our inflation forecasts:

A Gold Price Forecast For 2019

A Silver Price Forecast For 2019

5 Charts Reveal Our Commodities Outlook for 2019

An Inflation Forecast For 2019

A Crude Oil Price Forecast For 2019

The red line is that our forecasts were mildly bullish, in the case of gold and silver potentially wildly bullish.

One day does not make a market. But there are sufficient signals that our forecasts may materialize. And this week’s price action in the commodities space adds some more evidence to this.

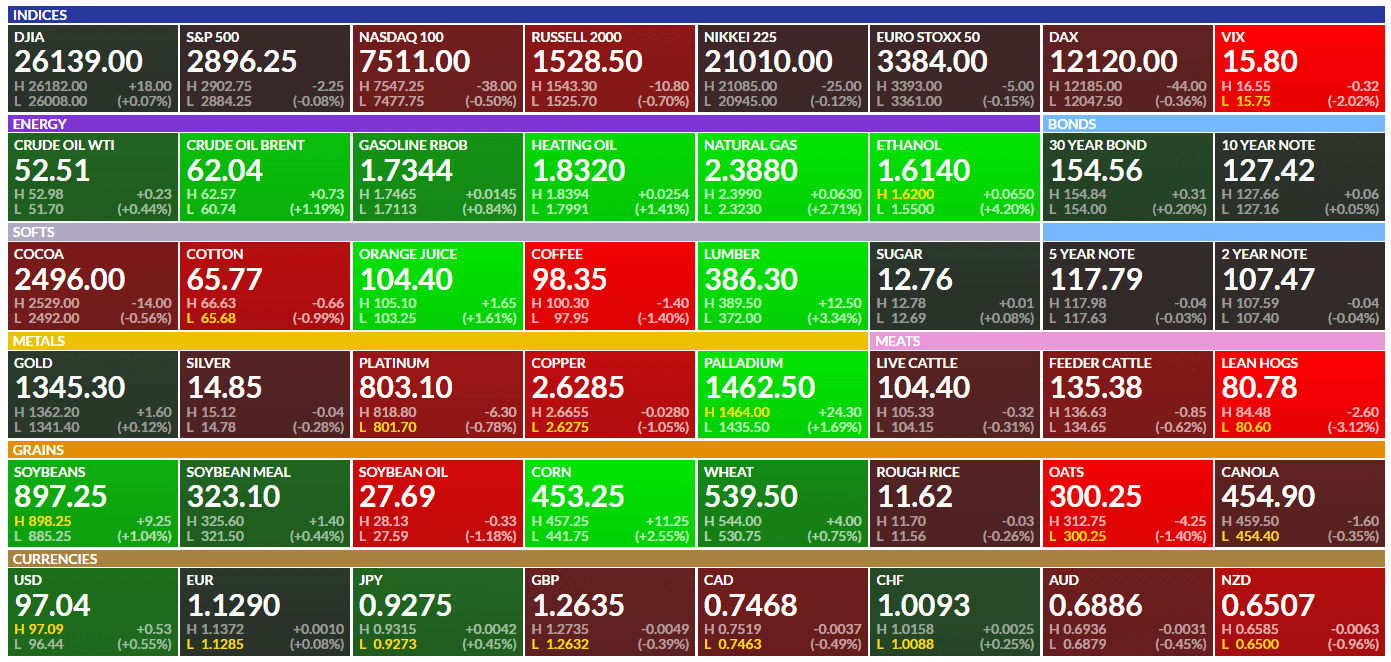

Below is an overview of all commodity prices as per the Finviz Futures dashboard. The green figures come from softs, grains and some energy markets. It’s not only today, but also a few times earlier this week that we saw a similar picture.

Especially the giant breakout in the inflation expectations indicator (TIP ETF) provides evidence that commodities may do well in the short to medium term.

We keep a very close eye on this potentially new trend, as commodities tend to move very aggressively (in both directions). We want to be ahead of major investing opportunities, certainly avoid chasing prices higher at all cost!