Where is the price of crude oil (OIL) headed in 2019? Can we do a reasonably reliable crude oil price forecast for the remainder of 2019? This article has a surprising answer to the crude oil price forecast question which certainly does not align with a consensus view.

A first intuitive reaction is to check financial media, and look for reliable forecasts of analysts and economists. Which better place than Reuters can be find?

In our article we will thoroughly challenge the official poll results from Reuters from respected analysts and economists. Their crude oil price forecast for 2019 may come true, but it’s not the viewpoint that investors should take.

We feel very strong that per our 100 investing tips an intermarket viewpoint is the one and only relevant one. This is why.

Crude Oil Price Forecast 2019: Grim Outlook by Analysts

The first place to look for info for a crude oil price forecast for 2019 is financial media. Specifically Reuters published the results of a crude oil forecast survey among 36 economists and analysts.

Must be reliable input, right?

The Reuters survey concludes that the (Brent) crude oil price will average $66.44 a barrel in 2019. A few months ago the same survey got to the $67.32 price forecast.

As per Reuters it is the 4th month in which analysts have cut their oil price forecasts.

Prices could rally gradually over the course of the year, if the OPEC and partners agree to more production cuts in April, and if U.S. sanctions on Iran and Venezuela lead to tightening global crude supply.

More importantly, this quote should be read thoroughly:

“In the short-term, oil markets are going to be characterized by supply tightness on international markets thanks to the OPEC cuts and U.S. sanctions on PDVSA,” Edward Bell of Emirates NBD bank said. “Over the rest of 2019, though, the rising oil price sits incongruously with slowing economic growth in major markets.”

There you have it.

Economic outlook is grim, which is what media is saying for half a year now. Consequently, the crude oil forecast for 2019 cannot be too optimistic.

Crude Oil Price Forecast: Evidence of the Opposite

It is that last point made above that is of interest to us.

Are economic conditions really the basis for a crude oil price forecast? Our answer: “no.”

Let’s go back 5 years in time, and see what happened right before the historic crude oil price crash!

If economic conditions would correlate with the crude oil price forecast we would have seen horrendous economic forecasts in 2014, right?

Wrong!

The official sources that are references worldwide did not mention anything whatsoever about a coming crude oil crash.

The U.S. Energy Information Administration (EIA), publisher of the 2014 global energy report, did not refer to anything like a market imbalance, on the contrary!

Or what to think of the OPEC, the other global reference in the oil market, in their June 2014 crude oil report.

There is sufficient evidence that higher economic growth in the current quarter will materialize, helping to compensate for the subdued performance of the global economy in 1Q14. This, along with expectations of higher growth in the second half of the year, is seen resulting in annual growth of 3.4%. Indeed, the expected rebound in the US economy and slight acceleration of growth in China – as indicated by manufacturing PMIs – provides a positive signal for a rebound in the global economy in the second half of the year, although with some uncertainties regarding the pace of growth.

There you have it. The economic conditions were supportive of a crude oil price. This info was published two months before the historic crash of -80% started!

Or what about supply/demand factors from the same OPEC report?

Taking these developments into account, the supply-demand balance for 2H14 shows that the demand for OPEC crude in the second half of the year stands at around 30.3 mb/d, slightly higher than in the first half of the year. This compares to OPEC production, according to secondary sources, of close to 30.0 mb/d in May. Global inventories are at sufficient levels, with OECD commercial stocks in days of forward cover at around 58 days in April. Moreover, inventories in the US – the only OECD country with positive demand growth – stand at high levels. Non-OECD inventories are also on the rise, especially in China, which has been building Strategic Petroleum Reserves (SPR) at a time when apparent demand is weakening due to slowing economic activities. Overall, the ongoing rise in supply would be adequate to satisfy the growth in oil demand in 2H14, resulting in a well-balanced market.

Not Accenture’s crude oil report, nor CNN referring to OPEC data, were able to forecast the crude oil price crash that was underway.

Crude Oil Price Forecast 2019: Our Intermarket Viewpoint

Clearly, the traditional crude oil forecasting methods do not apply whatsoever.

Fundamental data are useless for a relevant crude oil price forecast.

Economic data are useless for a relevant crude oil price forecast.

There is no correlation between the economic outlook and the crude oil price.

Then what is influencing the crude oil price forecast?

It’s intermarket dynamics!

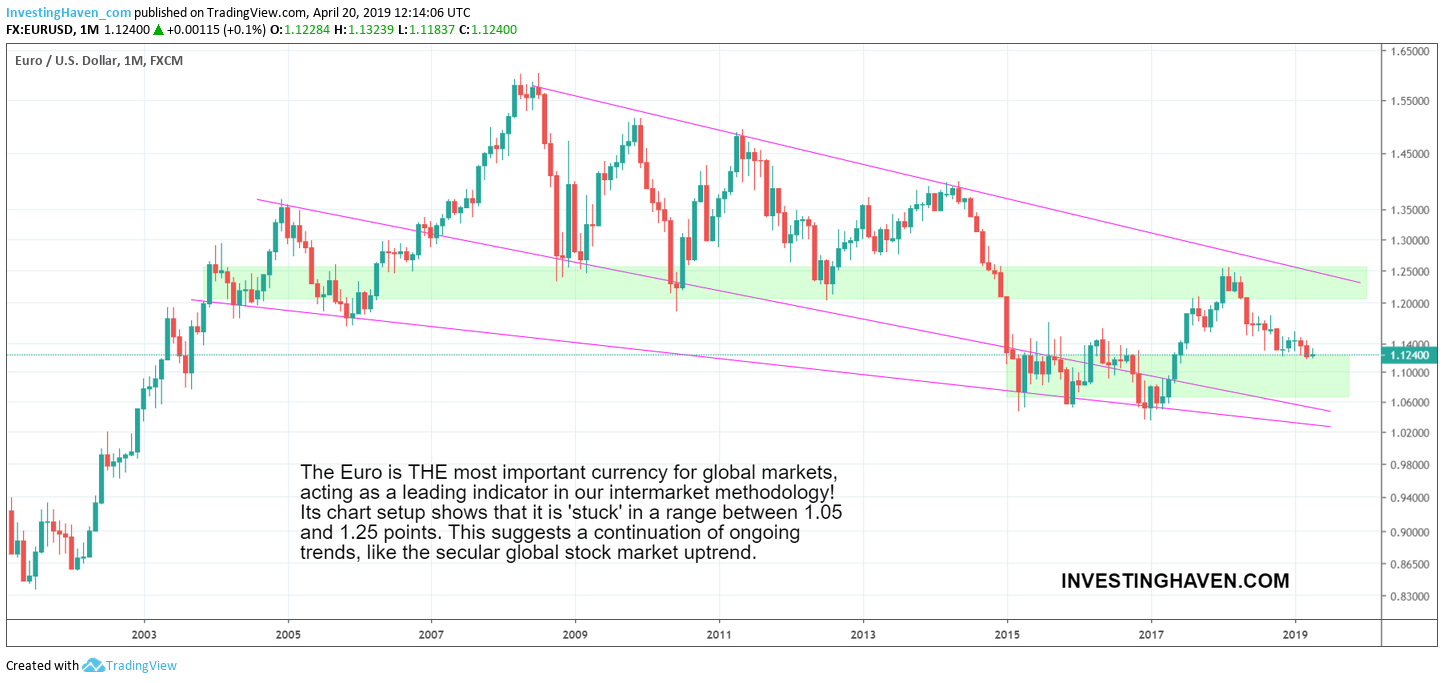

As seen on below chart, our leading indicator for global markets, the EURO peaked at its major secular resistance right before the crude oil price crash started.

Uncoincidentally, this happened right at a time when the crude oil secular chart trend was about to break down.

What we are saying is that intermarket dynamics are way more important that any other fundamental, economic or supply/demand data point.

The Crude Oil Chart

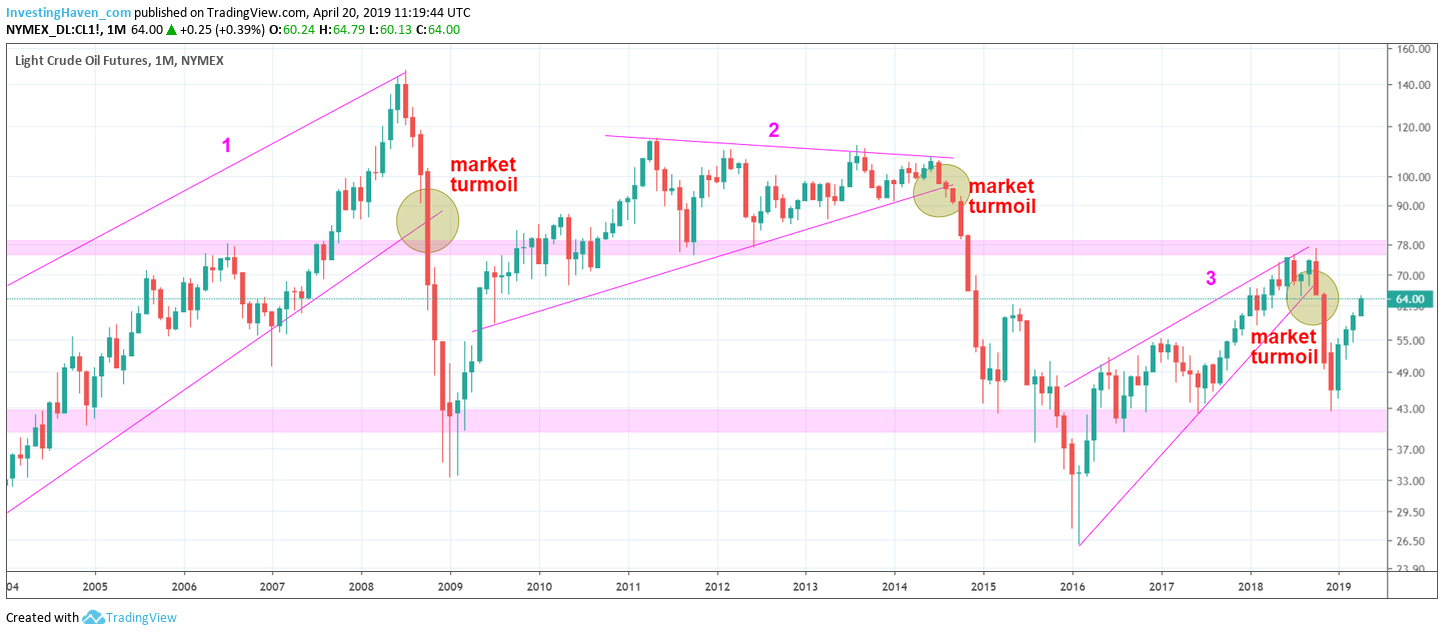

Clearly, the monthly crude oil price chart has a concise setup.

The first thing to watch is the 2 giant rising wedge patterns. The one in 2010-2014 preceded the mega crash. The other one last year preceded the mini crash.

The second thing, horizontally, is the major resistance at 78 USD per barrel as well as secular support at 40-43 USD per barrel.

As said crude oil is a complex commodity which means its price chart should be read both horizontally and diagonally. It has two types of patterns which makes it complicated to trade and forecast.

Based on the current chart setup as well as the EURO (leading indicator, outlined above) it is clear that crude oil is range bound. It is clearly attempting to rise to 78 USD in 2019. This is our base crude oil price forecast for 2019.

However, by far the most important thing to watch for a crude oil price forecast for 2019 is where the Euro is headed. As the Euro will approach its secular support and resistance it is crucial to see if an acceleration is starting.

An accelerated rise in the Euro will be supportive for the crude oil price. If this happens near the 78 USD per barrel level we can reasonably forecast wildly bullish crude oil prices. The opposite is true as well.