Crude oil has been making headlines recently, with discussions centered on its price movements suggesting a bullish trend. While the recent uptrend in oil prices has been strong, from our perspective, we don’t see a confirmed breakout, not yet at least. To gain a better understanding of where crude oil is headed, it’s essential to analyze retracement levels from its 2022 highs. In this article, we’ll explore these critical price levels and the factors that could influence crude oil’s future trajectory.

In our weekend analysis, shared with members of Momentum Investing, we cover energy as one of the commodities sectors, that have bull market setups. The alert is instantly available for anyone who registers: Opportunities In The Commodities Space.

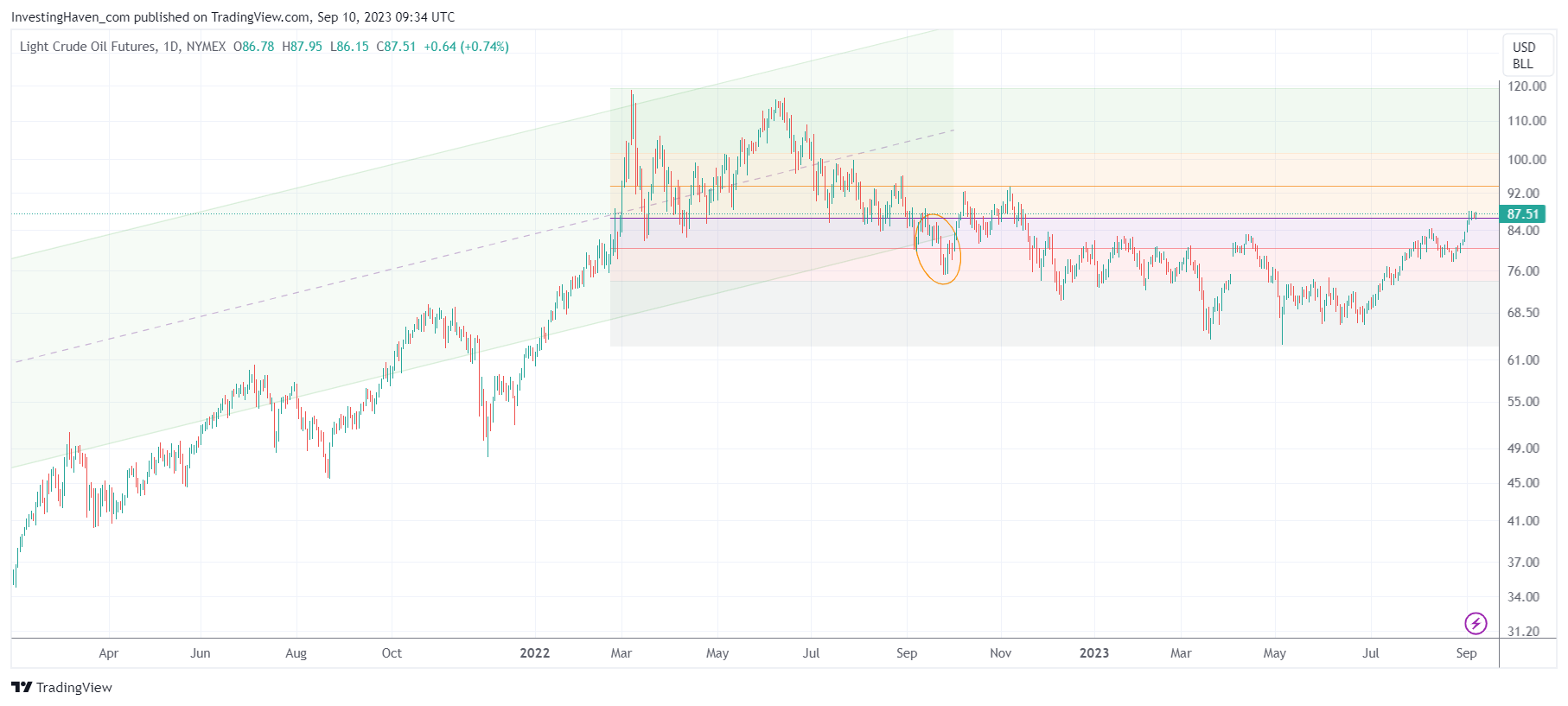

The Chart: A Roadmap to Crude Oil’s Potential

The provided chart is our roadmap to understanding crude oil’s price dynamics. One key feature is the 50% retracement level, a significant point that features prominently in our research materials and premium service alerts. This retracement level, which roughly corresponds to $87 per barrel, marks a crucial threshold for crude oil.

Another essential level to monitor is $93 per barrel, which aligns with the 38.2% retracement level. These levels are like milestones along the path of crude oil’s journey, each signifying a potential turning point. However, it’s important to remember that crude oil is infamous for its volatility. Prices can experience rapid and unpredictable swings, making it challenging to predict its movements with absolute certainty.

Breakout Confirmation

To declare a genuine breakout in crude oil, it’s not enough for prices to touch these critical levels briefly. What we’re looking for is a sustained move beyond these thresholds with a confirmation that lasts anywhere from 3 to 8 days. In essence, this means that the daily candle should avoid touching the specific price point during this confirmation period.

This cautious approach is essential because crude oil’s price movements can be deceiving. A brief spike above a key level may not necessarily signify a lasting breakout. By waiting for a more extended confirmation period, we can filter out false signals and increase our confidence in the trend’s sustainability.

Market Impact: Energy Sectors and Inflation Fears

Should crude oil manage to breach the $87 and $93 levels with a confirmed breakout, we can anticipate several market dynamics. Specific energy sectors, particularly those closely tied to oil production and exploration, are likely to experience positive price movements. Investors in these sectors might find favorable opportunities as crude oil’s rise bolsters their earnings potential.

However, it’s important to note that a crude oil breakout can introduce volatility into broader stock markets. Rising oil prices can lead to inflation concerns, which may prompt investors to reconsider their positions. Historically, higher oil prices have been associated with inflationary pressures, which can erode the purchasing power of currencies and lead to higher consumer prices.

In the long run, energy stocks should react positively to a crude oil breakout, as their earnings prospects improve with higher oil prices. But the immediate market reaction might involve a period of adjustment as investors digest the potential implications for inflation and interest rates.

Conclusion: The Path Ahead for Crude Oil

The current state of crude oil prices presents a potential opportunity for investors. The chart’s critical retracement levels, at $87 and $93 per barrel, serve as vital price points for potential breakouts. However, it’s crucial to exercise caution and wait for a sustained confirmation before making significant trading decisions.

As crude oil continues its journey, it has the potential to impact various sectors, from energy to broader financial markets. A breakout in oil prices can lead to profitable opportunities, but it may also introduce volatility and inflation concerns. So, the short term correlation between the price of crude oil and energy stocks might or might not work, presumably it will, then again crude oil and energy is a sector for investors (tough for traders).