One of the hottest stocks on the watchlist of InvestingHaven’s research team is First Majestic Silver (AG). Our First Majestic Silver stock forecast was very bullish: after a confirmed breakout we expect this pure play silver stock to rise 2 to 3 fold in a short time period. It is our top favorite for one of the TOP 3 investing opportunities of 2019. All depends on whether our silver price forecast (SILVER) materializes. Let’s revise the silver price outlook as well as First Majestic’s chart in this article which shows the long breakout in progress and, hence, nerve-wracking process.

Silver price outlook

So far, the silver price seems to be holding up well. However, it seems to have a very hard time breaking out from its long consolidation period.

Silver bulls really need to be patient. Their patience is tested in a way not seen many times before.

Interestingly, Bloomberg Intelligence published some data points that confirm our bullish outlook for the price of silver.

First, the Silver-Options Complacency indicator:

Priced for the least amount of movement in futures options history, the risk of a silver-price surge is elevated, in our view. Our graphic depicts the lowest-for-longest implied volatility since 1993. The trend in prices and volatility has been down, but at such extremes, the risks of a potential sharp reversal and longer-term bottom outweigh the continuing rewards for responsive sellers of the market and calls. When commodities reach such extremes, up is typically the path of least resistance.

Moreover, the indicator suggesting Silver Downside vs. Gold Is Limited:

Silver, the primary driver of its ratio vs. gold, is set to prevail, with the relationship potentially peaking from a 25-year high. With annual volatility that’s almost double gold’s, silver is 0.78 negatively correlated to the ratio vs. only 0.08 for gold, measured annually. Our graphic depicts the limited room for silver to decline vs. gold, with the ratio at levels last seen in 1993. The mean figure since then is about 65, vs. the current 85 ounces of silver per one of gold.

Their research team concludes:

With gold unchanged, revisiting the mean would imply a silver price near $20 an ounce vs. $15.50 on March 20, about a 30% advance. A peak in the dollar is a potential catalyst for boosting silver vs. gold. Commodities often find demand and less supply when prices are low, and vice versa when they’re relatively high.

These data points confirm our silver price forecast though they look at it from a totally different angle.

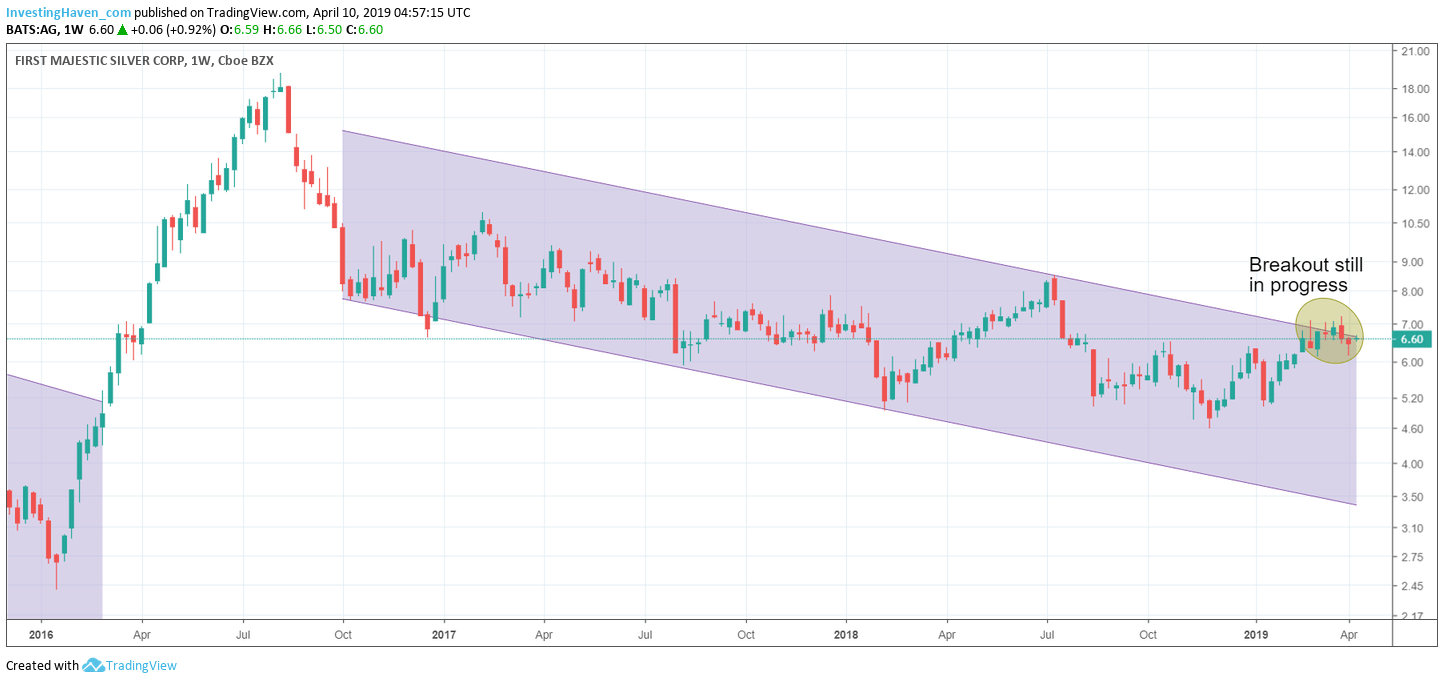

First Majestic Silver chart

All this means to First Majestic Silver that the fundamental case for a breakout is still there. It is a matter of time. It is a question of ‘when’, not ‘if’, most likely.

The chart of First Majestic Silver makes this point visual.

The breakout process is in progress for 7 consecutive weeks now! This is pretty unusual to take such a long time for a breakout to materialize.

Nerve-wracking? Yes for sure.

What will be the outcome? Long term to medium term we are pretty confident that a bullish breakout will materialize. It will push the price of First Majestic Silver 2 to 3 times higher.

Short term we absolutely must see strength in gold and silver prices. At this point in time the gold price is the key driver. So without strength in both metal prices we might we see an even longer consolidation around the breakout point of First Majestic Silver!