As our silver price forecast for 2019 is visibly underway it is the silver miner stock segment that will be the beneficiary in 2019. We make the case in this article that First Majestic Silver is a silver stock to own in the first part of 2019, in line with our silver stocks forecast 2019. Moreover, we add a base case First Majestic Silver stock forecast for 2019 as well as a bullish forecast for silver stock First Majestic Silver.

The idea underlying this article is to make the point that First Majestic Silver provides leverage as the precious metals market is confirming that it is heading higher.

Moreover, as history has shown over and over again the silver market is a great leveraged play in a bullish precious metals environment but timing entries and exits is crucial. First Majestic Silver has a track record of short but extremely powerful rallies which is a very important aspect to consider in our First Majestic Silver stock forecast for 2019.

All this ties into Tsaklanos his 1/99 investing principles which says that 1% of stocks in a sector should be owned. In the case of the silver mining space, although we expect the whole sector to go strongly higher in 2019 it is wise to only look into 1% of silver miners. Within this 1% we believe First Majestic Silver is the top silver stock for 2019.

First Majestic Silver Stock Forecast 2019: Bullish fundamentals

Needless to say the price of silver will drive the silver mining space. It is one of the two important fundamentals for the silver mining space, particularly our bullish First Majestic Silver stock forecast for 2019.

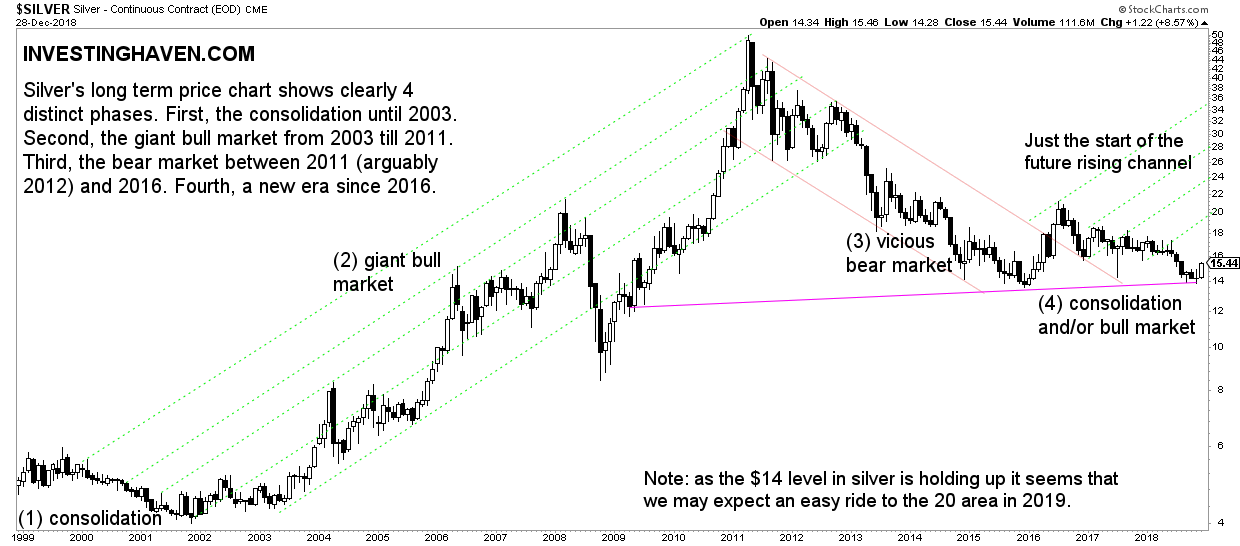

As outlined in our silver price forecast article already many months ago our baseline forecast is $17 to $21.50. We prefer to work with a range, not a specific price point, is what we said.

We also said that in case of a sudden and unexpected event we might see a breakout in silver above $21.50. In that scenario we forecast $26 for silver in 2019. The probability is just 20% though.

The monthly silver price chart makes the point.

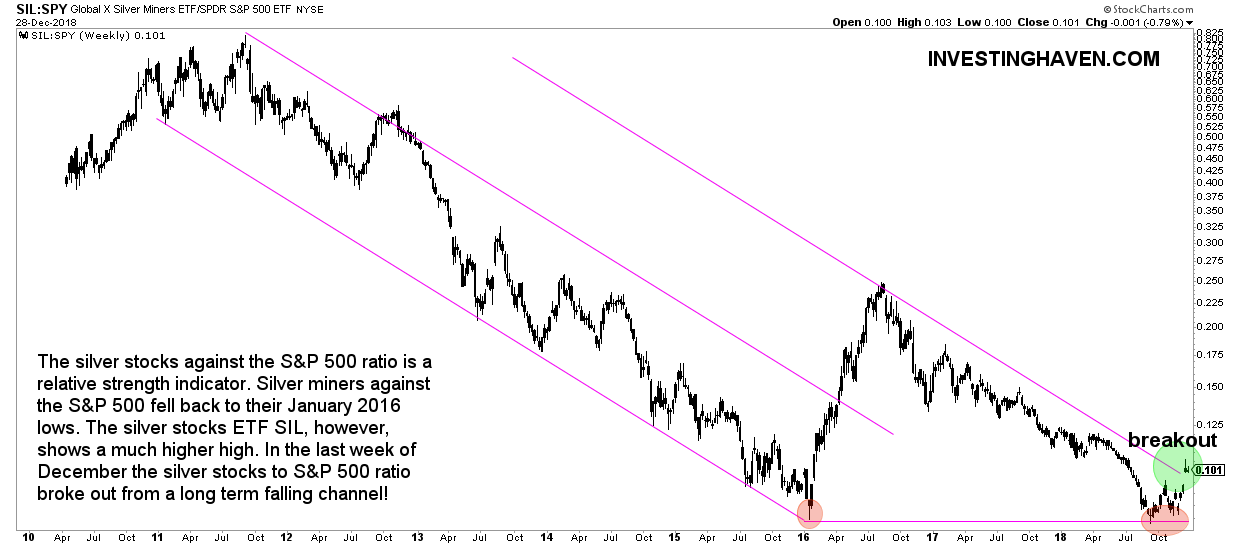

The other fundamental for our bullish First Majestic Silver stock forecast for 2019 is the silver stocks to S&P 500 ratio (below).

It shows breakout this week! This is huge news.

This ratio is not going to determine any price level which is useful for our silver stocks forecast for 2019. However, it is helpful in understanding whether silver miners are a buy, and, visibly, they are.

This really underpins our bullish First Majestic Silver stock forecast for 2019.

First Majestic Silver: financials going into 2019

Around summer we wrote this when First Majestic Silver showed strength against all other silver stocks: “Given all this, we believe that First Majestic Silver is bought on speculation. Prices can certainly go higher, but given the speculative nature the question is whether it is justified to go long at this point from a risk management perspective.” That’s close to the peak seen on below chart, in June of this year.

Since June 30th of this year, when First Majestic Silver published its earnings report, there has been no communication or news whatsoever according to First Majestic’s website. This confirms our point that silver stocks are highly reliant on the silver price.

From the earnings report published on November 7th 2018:

On May 10, 2018, the Company completed its acquisition of all of the issued and outstanding common shares of Primero Mining Corp. for a total consideration of $187.0 million in common shares of First Majestic. With the acquisition, First Majestic is integrating a large, world-class, silver and gold mine into its portfolio of operating mines. The San Dimas Silver/Gold Mine, becoming First Majestic’s seventh mine in Mexico, will result in significant growth in the Company’s production profile with an estimated doubling of silver equivalent ounces produced.

- Record silver equivalent production of 6.7 million ounces, a 31% increase compared to Q2 2018

- Record silver production of 3.5 million ounces, a 27% increase compared to Q2 2018

- Revenues of $88.5 million, an 11% increase compared to Q2 2018

- Cash flow per share was $0.11 per share (non-GAAP)

- Cash costs were $6.85 per payable silver ounce, a 10% decrease compared to Q2 2018

- All-in sustaining costs (“AISC”) were $15.12 per payable silver ounce, an 8% decrease compared to Q2 2018

That may look great, which it is, we believe these are the 2 points that need additional consideration:

- Ended the quarter with $72.4 million in cash and cash equivalents

- Realized average silver price reached a nine year low of $14.66 per ounce, a 12% decrease compared to Q2 2018

The fact that a silver miner at the depth of the silver bear market which is lasting now 7 years is holding $72M in cash, and is realizing silver at an average silver price of $14.66, the absolute support level of the last 7 years, is remarkable.

There is this other quote from their earnings report which makes us smile.

“As a result of the continued weakness in metal prices, the Company has updated its 2018 capital budget program and has reduced investments by $33.9 million to $114.8 million consisting of $55.7 million for sustaining investments and $59.1 million for expansionary projects. This represents a 23% decrease compared to the previous capital budget of $148.7 million. The revised annual budget includes capital investments totaling $56.5 million to be spent on underground development, $27.5 million towards property, plant and equipment, $22.7 million in exploration and $8.1 million towards corporate automation and innovation projects. Total capital expenditures in the first three quarters of 2018 totaled $81.4 million, representing approximately 71% of the $114.8 million revised budget.”

It shows that the company is able to adjust their CAPEX expenditures as part of market conditions, which, obviously, will benefit their results if and once the price of silver starts rising, which we expect will happen in the first part of 2019.

Interestingly, in checking the major news sites we did not find any signal of relevant news updates on the company: First Majestic on Marketwatch, First Majestic on Bloomberg, First Majestic in Google News. Just this article about First Majestic on SA is informative enough to read. It clearly shows that quality updates on First Majestic Silver are scarce.

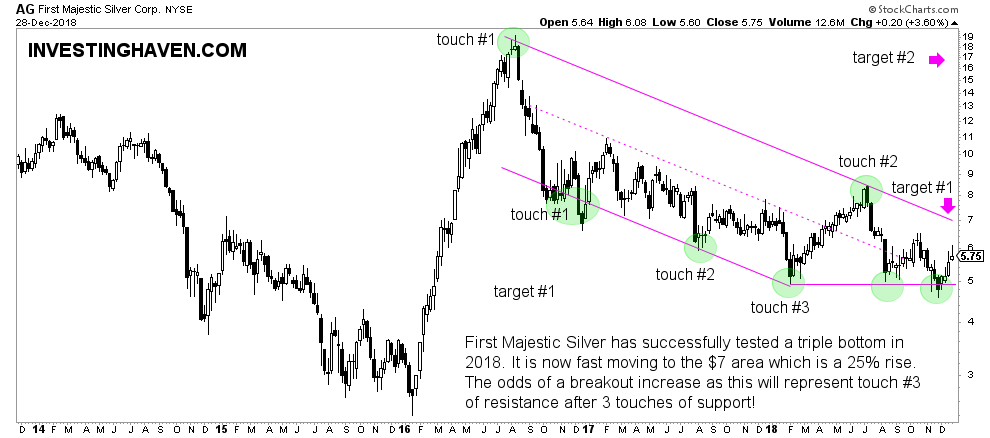

First Majestic Silver: Stock Forecast for 2019 based on weekly chart

The above information, both the fundamentals as well as financials, should be mapped now against the stock charts of First Majestic silver.

The fundamentals and financials confirm, fundamentally, our vision that First Majestic Silver’s stock price will provide serious leverage with every cent that the silver price goes up in 2019. Moreover, as we expect silver to move towards $17 as a base case and $20 as a bullish case we believe returns on First Majestic Silver will be enormous.

How does this map to the weekly chart?

The silver price moving to $17 which is a 12% increase against the prices at the time of writing will translate into a rise of AG to $7, a rise of 25%.

However, silver moving to $20 will likely push AG o the $16 area, an almost 3-fold increase against today’s price (177% to be more precise).

First Majestic Silver: Stock Forecast for 2019 based on monthly chart

The monthly chart confirms our bullish First Majestic Silver stock forecast for 2019. The monthly confirms the weekly chart, that’s outstanding!

It also adds one very, very important insight. First Majestic Silver has a track record of long falling trends. The rallies, however, are characterized as very short but extremely aggressive. That’s why timing entries and exits in this stock is extraordinarily important!

This implies, of course, that getting in early and exiting in a phased approach (certainly not too late) is crucial.

Our First Majestic Silver stock forecast for 2019 based on the weekly chart is $7 as a base case and $17 as the bullish case!