As per our gold price forecast 2019 the conditions are favorable for gold prices to rise in the first part of 2019. With this week’s Gold Commitment of Traders Report we see more evidence of this forecast. We expect gold prices to rise in the next few months, as also suggested by our top 3 long term gold charts.

Note as well that although not included in this article the historic gold (GOLD) price chart on 40 years confirms the findings of the current forecast based on the longest and most dominant gold market trend. We strongly recommend to check out this historic chart.

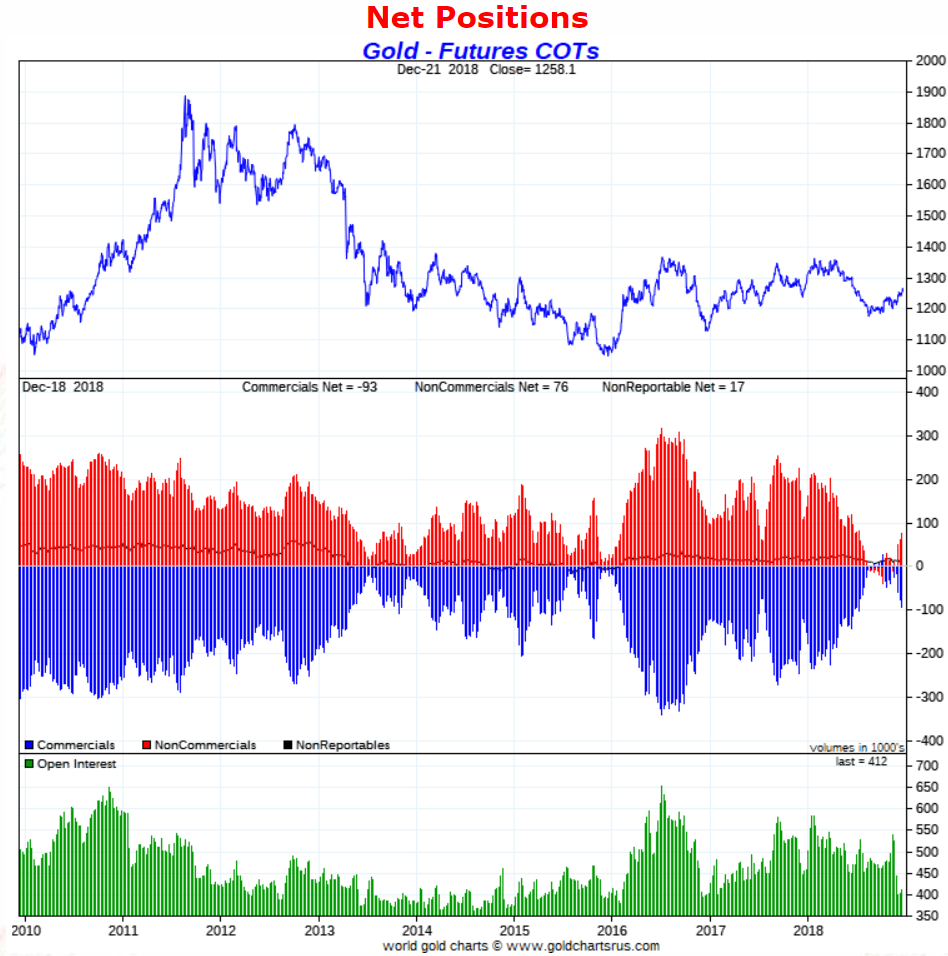

One of our leading indicators for the gold price, as per out method, is gold’s Commitment of Traders report, in short COT.

Based on the COT report we see that the downside in the gold price is extremely limited. We focus on the positions of the largest market participants (middle pane on below chart). The number of long contracts of non-commercials was recently at the lowest point in 9 years (red bars). This was not only historically low, it was even exceptional. It suggested that the downside in the gold price is extremely limited.

What happened in the meantime is that those positions started to rise slowly but surely, and this rise came with a slowly but surely rising gold price.

The other leading indicators, rates and the Euro, have not been diverging from gold’s COT report, which is of course also important to consider.

In that sense we expect a continuation of a rising gold price. We also expect that current market conditions which are suggesting a Stock Market Crash In 2019 (or at least a continuation of the current decline) as well as the Global Market Crash In 2019 (at least a continuation of weak global conditions) to lit a fire below the gold market.

In other words intermarket dynamics are favorable for precious metals, and it might trigger a strong inflow into the precious metals market which will feed the rising gold price and become a self-sustained trend.

Note this is a medium term forecast which we expect to play out into the first part of 2019.