Gold (GOLD) is about to enter a new bull market. June 20th 2019 is a historic day for the gold market. With a double breakout, not confirmed yet, this is likely the end of the 8 year bear market. On September 5th 2011 gold’s price set an all time high, and started a violent bear market. Today, 80 days before the 8th anniversary of gold’s bear market, the tide turns now. This is in line with our gold price forecast for 2019 which we published almost a year ago. And it is also in line with our forecast published on MarketWatch on May 3d this year: Why gold’s a ‘bargain’ at less than $1,300 an ounce.

Our work is regularly featured on MarketWatch. Almost 2 months ago, we were very vocal and convinced about a gold price breakout, and said so in Why gold’s a ‘bargain’ at less than $1,300 an ounce. There are 2 important quotes from that article:

“In 2019, capital has been flowing into stocks, U.S. Treasuries, and recently, the U.S. dollar,” says Taki Tsaklanos, founding author at financial analysis provider Investing Haven. After gold rose earlier this year, “investors bumped into gold’s bear market wall [of $1,375 an ounce]. This bear market wall proved to be too stubborn, so capital found its way to other defensive asset classes,” he adds.

Early May came with a weak gold market, and it looked gold needed some more time to recover and ready itself for a new breakout attempt. We expected this to happen over the summer. Today, on June 20th 2019, one day before the summer starts, the breakout is taking place, one or two months faster than expected.

For now, gold might see further declines, given that it is entering a seasonally weak period for precious metals, with June among the year’s worst months, says Tsaklanos. “The wildcard is monetary policies of central banks,” he says, with an unexpected policy change potentially prompting a sharp selloff in the euro, which could lead to more weakness in gold. But Tsaklanos expects “the gold market to build up energy during the summer.” Any breakthrough, he predicts, “is likely going to happen in October or November, and it would pave the way to $1,550.”

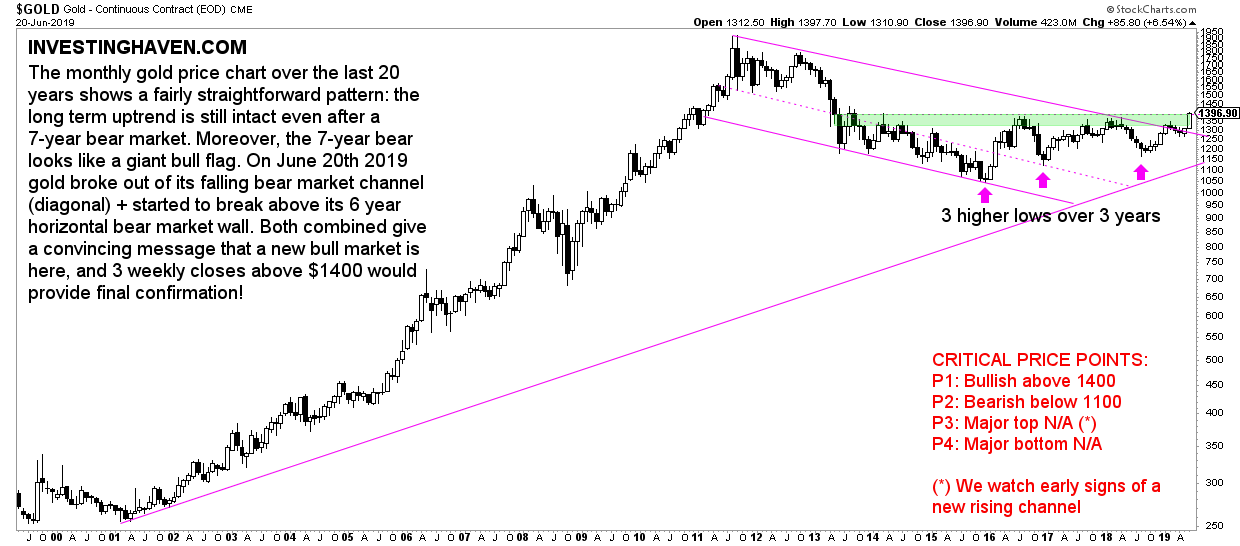

We look at the monthly gold price chart in this article.

Make no mistake a trend change on a monthly chart over 20 years is extremely powerful.

Visibly, gold is going through a double breakout right now. On the one hand it breaks out of its 8 year falling channel. On the other hand it breaks above its 6 year horizontal resistance.

This is huge news, for the two reasons outlined above.

What’s interesting is that hardly anyone was expecting gold to be bullish again. That’s what happens during bear markets: all bulls are shrugged off, and get frustrated because every bullish attempt fails. Investors give up, and it leads to a market in which no sellers are left (only buyers). That’s where the real magic starts.

As per our 100 investing tips:

‘Bear markets beget bull markets‘. It is at the depth of a bear market that all sellers leave, which makes place for a market to consolidate and set the basis to turn into a future bull market.

Patience is a virtue for investors. Timing as well. Both combined are the recipe for success.

We stick to our forecast that gold will rise to $1550 this year.

How to play this market now?

Pretty simple. One way is to go for the leveraged play, and look into the silver market. As said in today’s article Silver Price Breakout: Why This Time Is Different silver is hugely undervalued. We stick to our favorite silver stock First Majestic Silver (AG) as our top pick, and re-iterated our viewpoint today in First Majestic Silver On Its Way To Double In 2019.

The other way is to look into the gold mining space. We would not go into the very small miners. We prefer to stick to the best gold stocks out there. One of them is Royal Gold which is breaking out today, and we wrote about it in Royal Gold: Giant Breakout Out Of 15-Year Bullish Pattern.