KEY TAKEAWAYS

- Goldman raised its end-2026 gold target to $5,400/oz, up from $4,900.

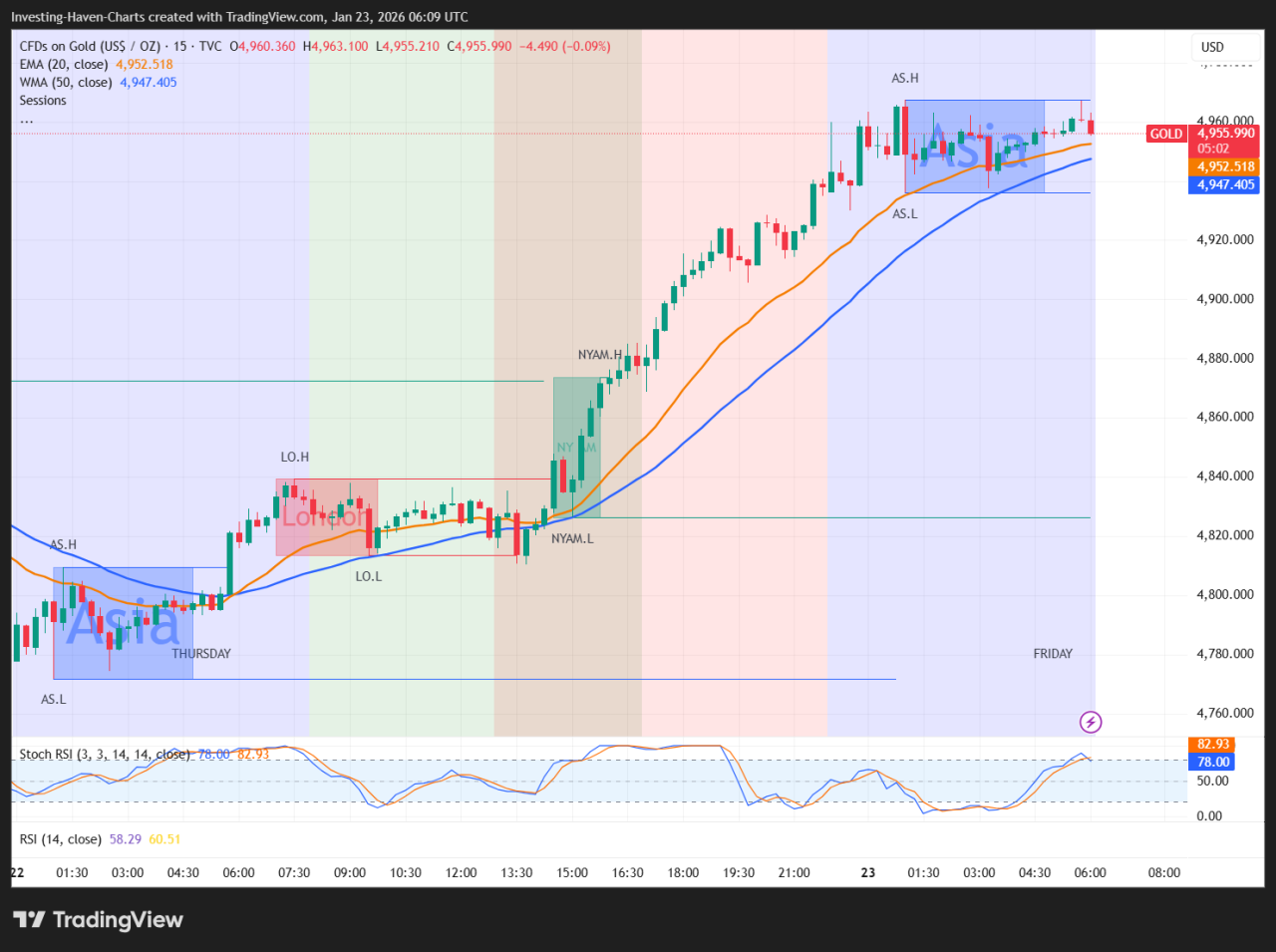

- Gold rose $77.00, or 1.59%, from the Jan 22 peak to the Jan 23 futures settle.

- Reserve buying and steady private demand shaped the bank’s outlook and market response.

Goldman’s $5,400 forecast shifted expectations, lifting prices and tightening positioning.

Gold’s move shows steady buying rather than a speculative spike.

Goldman Sachs lifted its end-2026 gold target to $5,400/oz on Jan 22, 2026. On the same day, spot gold touched $4,887.82.

By Jan 23, U.S. futures settled around $4,913.40, a clear step higher as traders adjusted positions.

RECOMMENDED: Goldman Sachs Just Raised Its 2026 Gold Price Target to $5,400

Why Goldman Raised Its Gold Forecast

Goldman changed its forecast after reassessing who is buying gold and why.

The bank pointed to sustained reserve accumulation by central banks and continued private-sector allocations.

These buyers reduce the amount of metal that returns to the market during rallies.

This in turn supports higher prices over time and lowers the risk of sharp pullbacks caused by sudden selling.

The bank also expects this demand to stay consistent through 2026.

That expectation led Goldman to raise its long-term anchor rather than issue a short-term trading call.

ALSO READ: Central Banks Are On A Gold-Buying Stampede In 2026

How Gold Prices Responded

The price reaction was measured but clear. Gold reached $4,887.82 on Jan 22.

The next day, U.S. futures settled at $4,913.40, representing more than 1.5% growth in a few hours.

This was not a one-hour spike. Futures volume increased, and several funds adjusted exposure to align with the higher end-2026 outlook.

What Comes Next For Gold Prices

Gold now trades with a higher reference point.

Further gains would likely depend on continued reserve purchases or stronger physical demand.

On the risk side, a stronger dollar or profit-taking in exchange-traded funds could slow momentum.

RECOMMENDATION: Wall Street Strategist Dumps Bitcoin, Goes All-In on Gold

Conclusion

Goldman’s $5,400 target reset expectations across the market.

The initial 1.59% rise shows controlled follow-through, with prices responding to demand signals rather than hype.

Should you invest $1,000 In Gold Today?

Before you invest in Gold, you’re going to want to read out latest Premium gold analysis which will be published in just a few days.

We called the rally long before it happened, now we have a look at what could be next.