One of the questions top of mind of investors is whether gold can set a new ATH in 2024. While the answer to this question is certainly YES, for reasons explained in our detailed gold analysis, there is an equally important viewpoint to consider.

The viewpoint we are talking about is the price of gold in world currencies, other than the US Dollar.

Gold Price Influencers

Before we look at the gold mania 2024, a topic that is pretty self-explanatory as evidenced by the one visual in the next section, below, we want to look at gold price drivers.

It is widely accepted that a bunch of data influence the price of gold. Among those price drivers, one that is often mentioned is central bank gold buying, economic activity, geopolitical risk.

We largely disagree with this.

There are 2 ways to look at gold price dynamics in our view.

First, there are leading indicators that help us understand the gold price trend combined with upside vs. downside potential in gold. One of them are rates (yes, we agree with this news item, emphasizing rates expectations driving the price of gold). The other one is the U.S. Dollar.

Second, by far the most important price influencer comes from the gold futures market, visible in the gold CoT data. It obviously does not make a lot of sense that the price of gold is set in the futures market, and not in the physical world of supply/demand. It’s this dynamic that is widely accepted to be the underlying mechanics for what is called ‘gold price manipulation‘, a topic that is increasingly gaining popularity.

Gold Price In World Currencies: Gold Mania 2024

This article is not meant to analyze the details of gold price influencers.

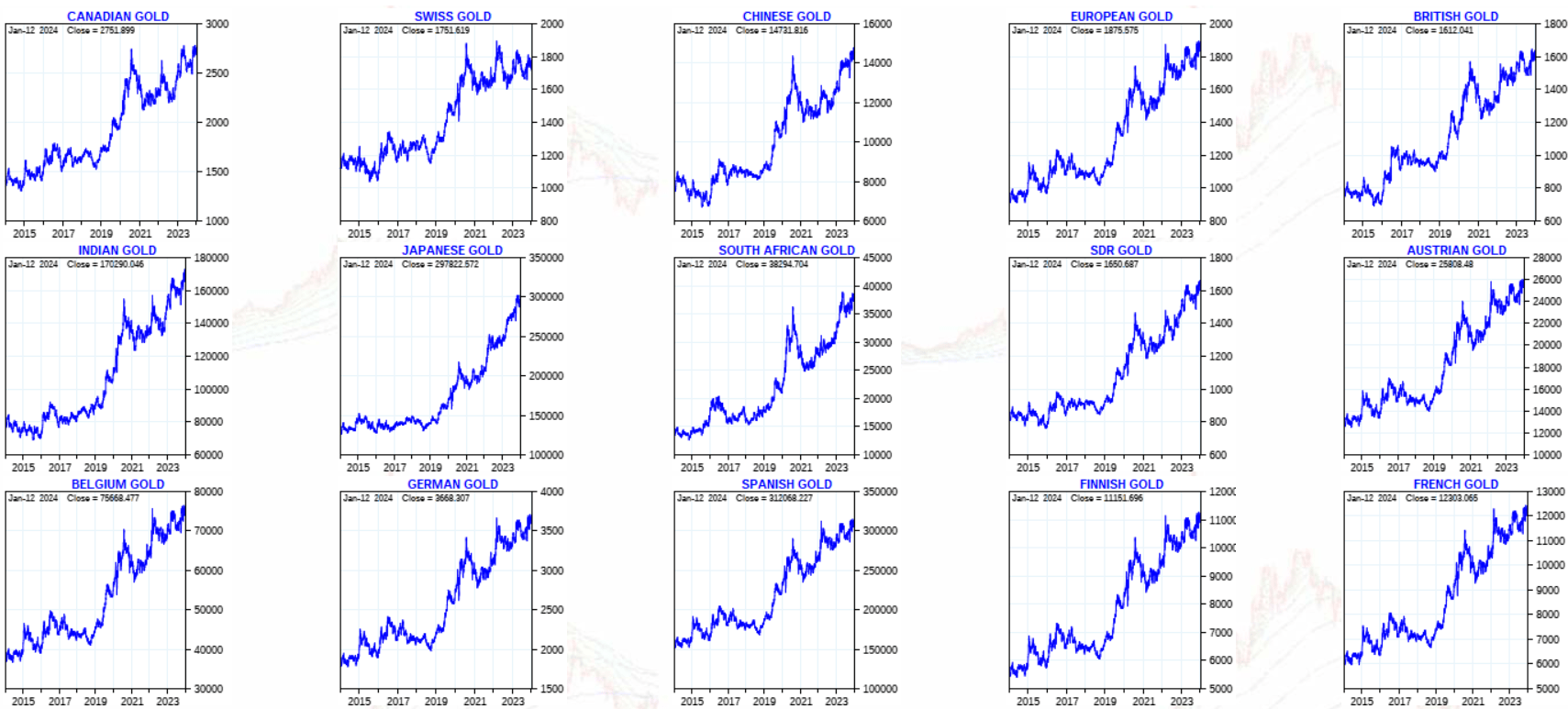

We want to focus on what we believe is a developing gold mania 2024. This one visual, shown below, makes the point. The price of gold in world currencies other than the U.S. Dollar is touching all-time highs, the only exception being the Swiss Franc (probably 3 to 4 pct below ATH). If anything, this one visual suggests massive interest in gold as an investment in 2024.

Chart courtesy: Goldchartsurs.com.

Silver Is Gold’s Leveraged Bet

While the price of gold in world currencies is setting all-time highs, suggesting a gold mania in 2024, we believe that there is a better alternative than gold for investors.

This gold mania in 2024 is likely going to result in an even stronger silver mania. The big topic among metals in 2024, in our view, is SILVER.

We mentioned in several articles, recently that silver is the precious metal to buy for 2024. In one of the most recent writings we tipped silver as the commodity to outperform in 2024.

However, note that silver is not a metal that fits every investor’s profile. Silver is volatile, restless, often trendless. Silver, whenever it starts rising, can move up fast and high. Until it gets explosive, it can take a while, not every investor can live with this.

Gold & Silver Price Analysis

Our gold & silver price analysis service informs members about gold and silver price trends, upside potential in price, downside potential in precious metals prices. We also cover gold and silver mining indexes in our analysis.

Every Saturday, we send out a detailed analysis which is useful for investors with a long term and medium term horizon. Our service is not a fit for options traders nor for short term oriented traders.