With the explosion in commodities prices, back in the first quarter of 2022, the ‘commodities super cycle’ narrative was created. Investors continue to believe that all commodities will move higher. While it is true that some commodities will do well in 2024 and 2025, we hasten to add that it’s a select few that will do well. Here is our viewpoint on which commodity will outperform in 2024.

We are writing our 2024 forecasts. One of the key conclusions is that markets should do well in the first 2 quarters of the year after which we want to assess market conditions in May/June of 2024.

How To Know If Stocks Will Tank In 2024?

A Stock Market Crash In 2024? Here Is A Surprising Answer.

As it relates to commodities in 2024, we share a few high level thoughts in this short post. We leave members with an invitation to join our Momentum Investing service in which we tipped, today, one specific commodity that might stage a secular breakout either on Nov 27th, 2023 (tomorrow) or on Dec 6th, 2023. Hint: it’s not silver.

Commodities in 2024

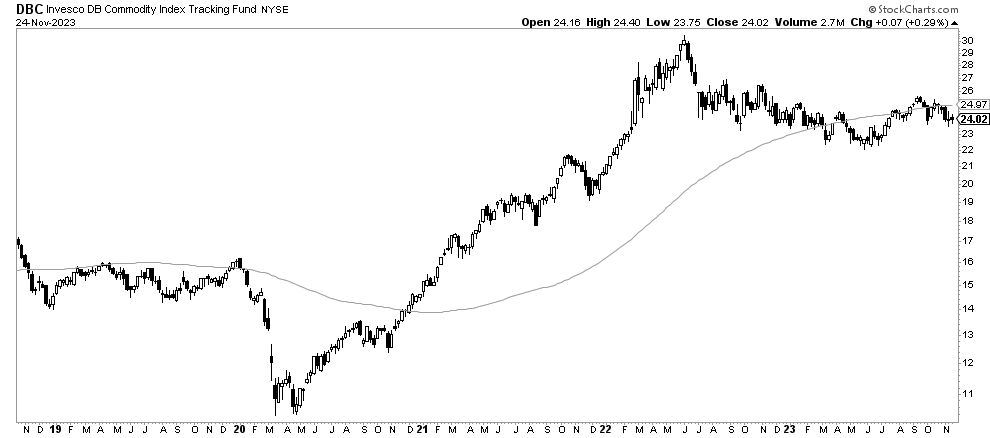

Visibly, the commodities index chart is consolidating. There is no excitement on this chart, nor does this look like a reversal that is ready to explode in 2024.

Admittedly, the consolidation is taking the shape of a bullish reversal. However, if we look at the uptrend between mid-2020 and mid-2022, it is clear that this big uptrend requires a big consolidation before an uptrend continuation can take place.

That’s why we believe that commodities in 2024 will be neutral, except for one or two commodities that might do very well in 2024.

For 2025, the picture will likely change. The commodities that will do well will differ, the overall commodities trend might change as well. Much will depend on how the consolidation that is visible on the next chart will develop.

Copper in 2024

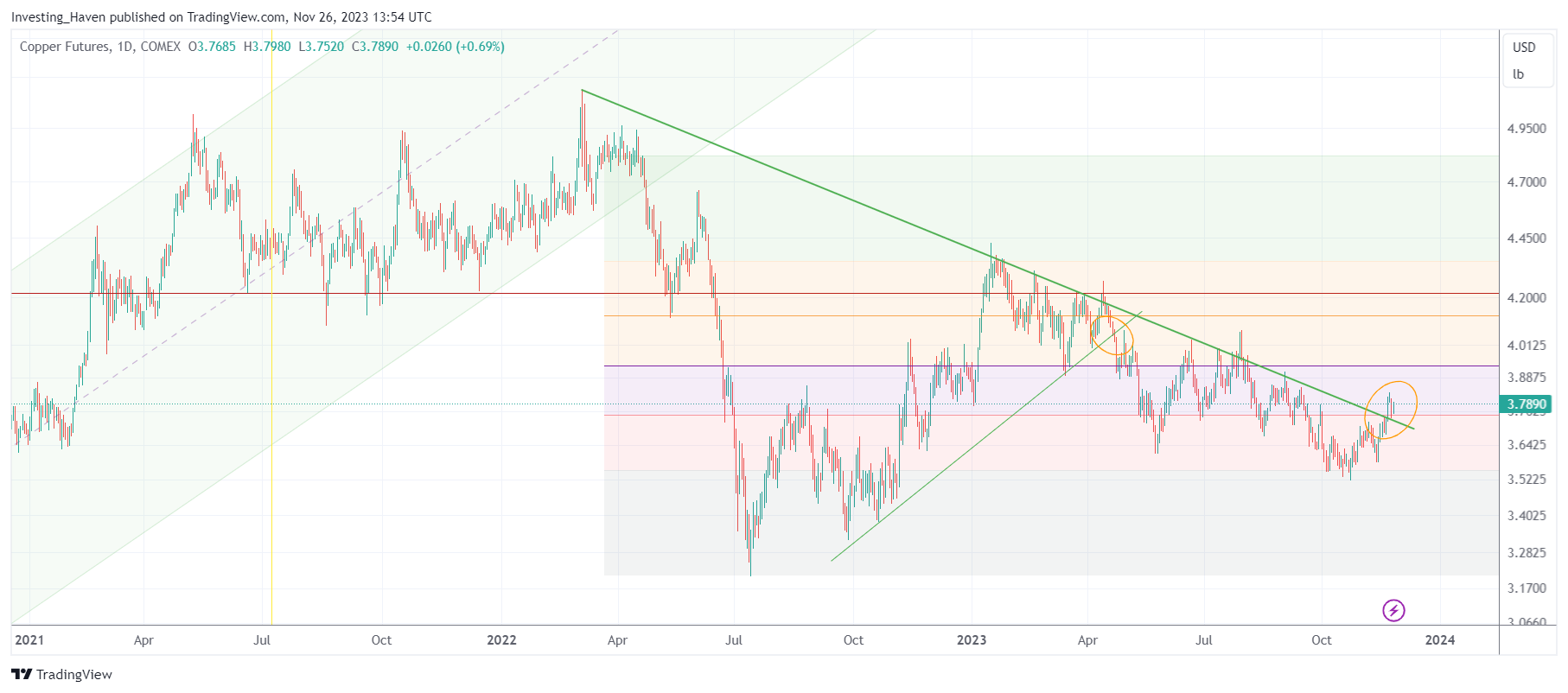

If anything, copper is one of the most important commodities, paving the way for the overall commodities trend in 2024, 2025 and beyond.

In a way, copper has leading indicator characteristics in the commodities universe.

The copper chart, since 2021, shows an uptrend followed by a decline and consolidation, somehow similar to the commodities index chart shown above.

What’s more, copper in 2024 will face a serious challenge – while the price of copper is above the multi-year falling trendline (support), it is also below the 50% retracement level (resistance). We believe that copper might do well in case it gets past 4 USD. In doing so, it will be printing a W-reversal with its 2022 highs as a first target. We are not saying it will happen, we are saying it might happen.

Silver in 2024

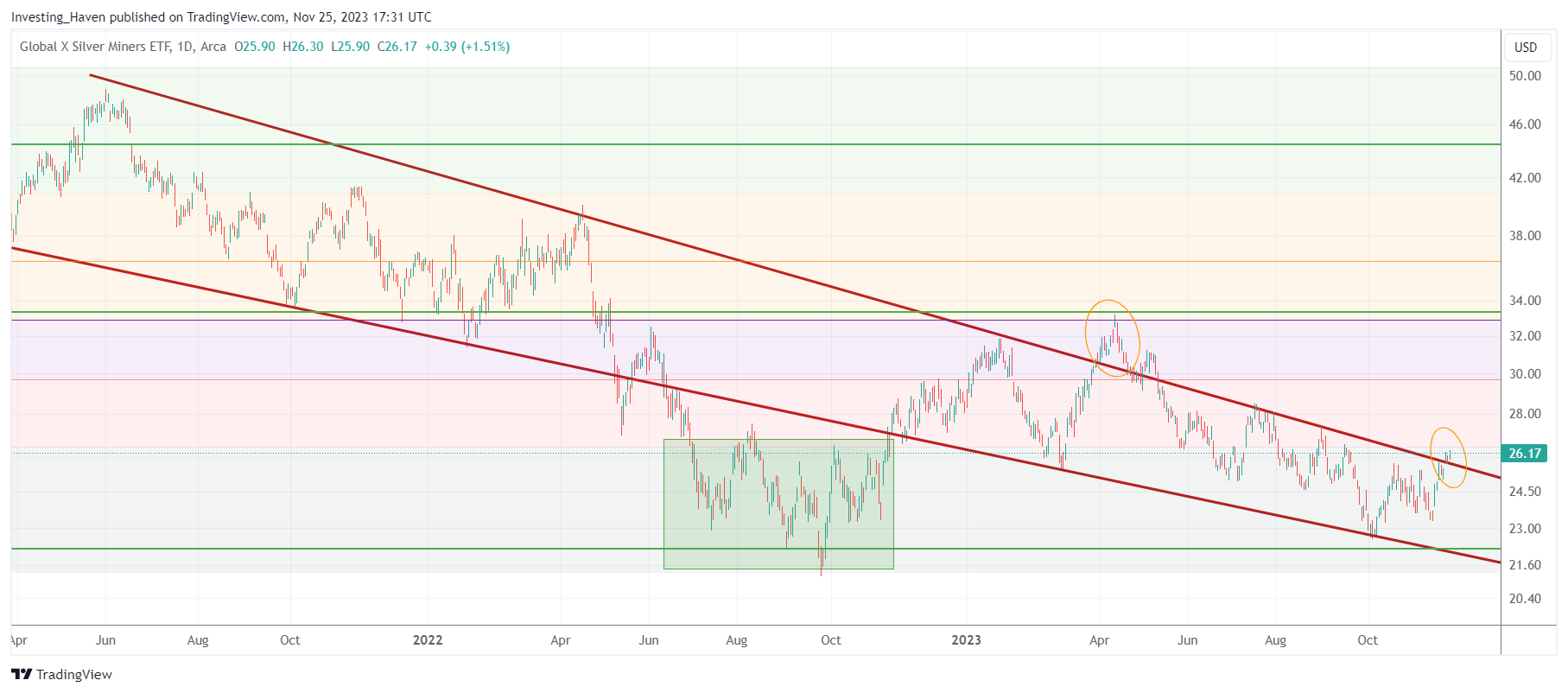

As per our Silver Price Forecast 2024, we continue to believe that silver will be the outlier in 2024. Why? Because it’s a very rate sensitive asset, and as explained in Investor Wisdom: Be Very Careful With Consensus As Illustrated By The ‘Higher Rates’ Narrative the probability of rates having peaked and silver have bottomed is unusually high now.

The silver mining chart is now breaking out from a falling wedge which is a bullish pattern.

Which other commodity might outperform in 2024?

The is one more commodity that might do really well, not just in 2024 but starting in December of 2023. What’s more, tomorrow, November 27th, might be a secular breakout day for this commodity. Hint: it’s not silver.

We covered this commodity in more detail in today’s Momentum Investing alert Sector Rotation Will Remain Dominant, available in the restricted research area.

We need to respect our premium members. That’s why we prefer to invite readers from the public space to sign up and read our research note to unlock the details. We not only discussed the commodity that might be ready for a secular breakout, we also gave guidance, very specific guidance, on how to know when (on the day) it will confirm a secular breakout.

We offer detailed gold & silver price analysis, as a premium service, covering every week leading indicators of the gold price and silver price. Premium Service: Gold & Silver Price Analysis >>

In case you prefer to let us do the hard work while you focus on other challenges in your life, you might want to consider our unique passive income service >>