As per our gold price forecast 2019 published 4 months ago we forecasted that the first part of 2019 would be mildly bullish for gold. We now start seeing a bullish to potentially wildly bullish development in the gold market for 2019. Risk sentiment is about to break out according to our gold risk indicator. If and when this occurs it would introduce risk taking into the gold market which would be awesome especially for silver, gold stocks and silver stocks. The same conclusion is derived from our top 3 long term gold charts.

Let’s go back for a minute to our gold (GOLD) market 2019 price points. This is what we wrote in our forecast for the gold market in 2019:

Below $1200 the gold market in 2019 will be bearish. we can hardly believe gold will stay below $1200. Between $1200 and $1275 is more or less neutral. Above $1275 is mildly bullish. Above $1375 is wildly bullish.

That said we also pointed out which price targets we have for the gold market in 2019:

That’s why our most bullish gold price forecast for 2019 is that gold will hit $1550 in 2019 (20% probability), but only if it succeeds breaking through the $1375. The $1375 test is a base case scenario (75% probability).

On the flipside, any failed attempt to stay above $1200 will be the bearish scenario, and it might gold to $1050, though the least likely in our opinion (less than 5% probability).

Note that we also identified the price target of $1650 on the historic 40 year gold chart. Let’s consider this our most bullish target for now.

Gold market 2019 bullish development

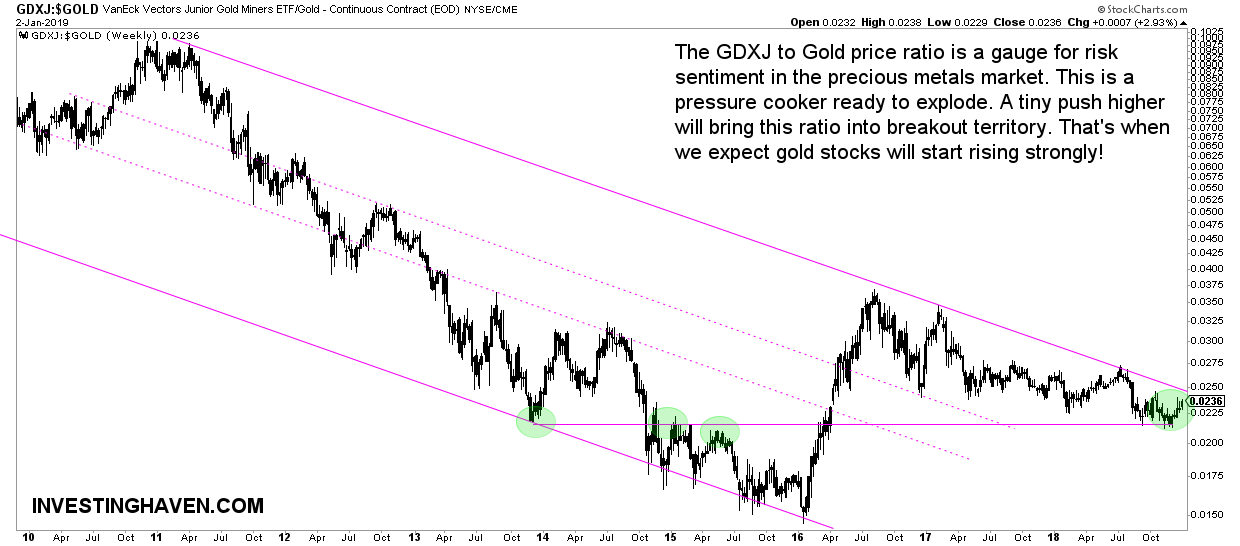

There is this one gold indicator which we rarely feature which is now starting to look extremely juicy. We are talking about the junior gold stocks to gold price ratio.

This is an important indicator because it tells us something about risk sentiment in the gold market.

The point is this: junior gold stocks is the highest risk segment in the gold and silver market. Only if there is a high appetite for risk will junior gold stocks rise. The opposite is true as well: junior gold stocks are the primary target to decline if and once there is no risk, and they can decline very hard and very fast.

Now if the junior gold stocks to gold price ratio rises it points to risk sentiment dominating the gold market, also in 2019.

Now if the junior gold stocks to gold price ratio breaks out from a consolidation or a falling trend it means risk sentiment entering the gold market.

And that’s what we may start seeing soon. As seen below this indicator is about to break out from a 7-year falling trend. This is major, make no mistake, and it will largely determine what happens in the gold market in 2019!

A tiny push higher in the gold stocks sector compared to the gold price will create a breakout on this indicator, which, as said, will lead to a strong appetite for risk in the gold market in 2019. If and once this happens we will know for sure that our gold price target will be met. We may also consider our target from our 40 year gold chart.

Here is the point: nobody is talking about this. Nothing to identify about this in the gold news feed. InvestingHaven is the only blog bringing this up.