Gold miners had a rough week. We said one week ago that good things could happen in the gold mining space, but we also added that a push higher was mandatory. Our article Gold Miners Alert: Secular Make Or Break Level published one week ago had all price levels right, it was a matter of days for gold miners to confirm their path higher … or too much of resistance to finally break out. This week, the market made clear that it is too early for a final breakout. Note that this is a short to medium term oriented article, complementary to our long term viewpoint from our gold price forecast.

As a refresher this is what we wrote last week:

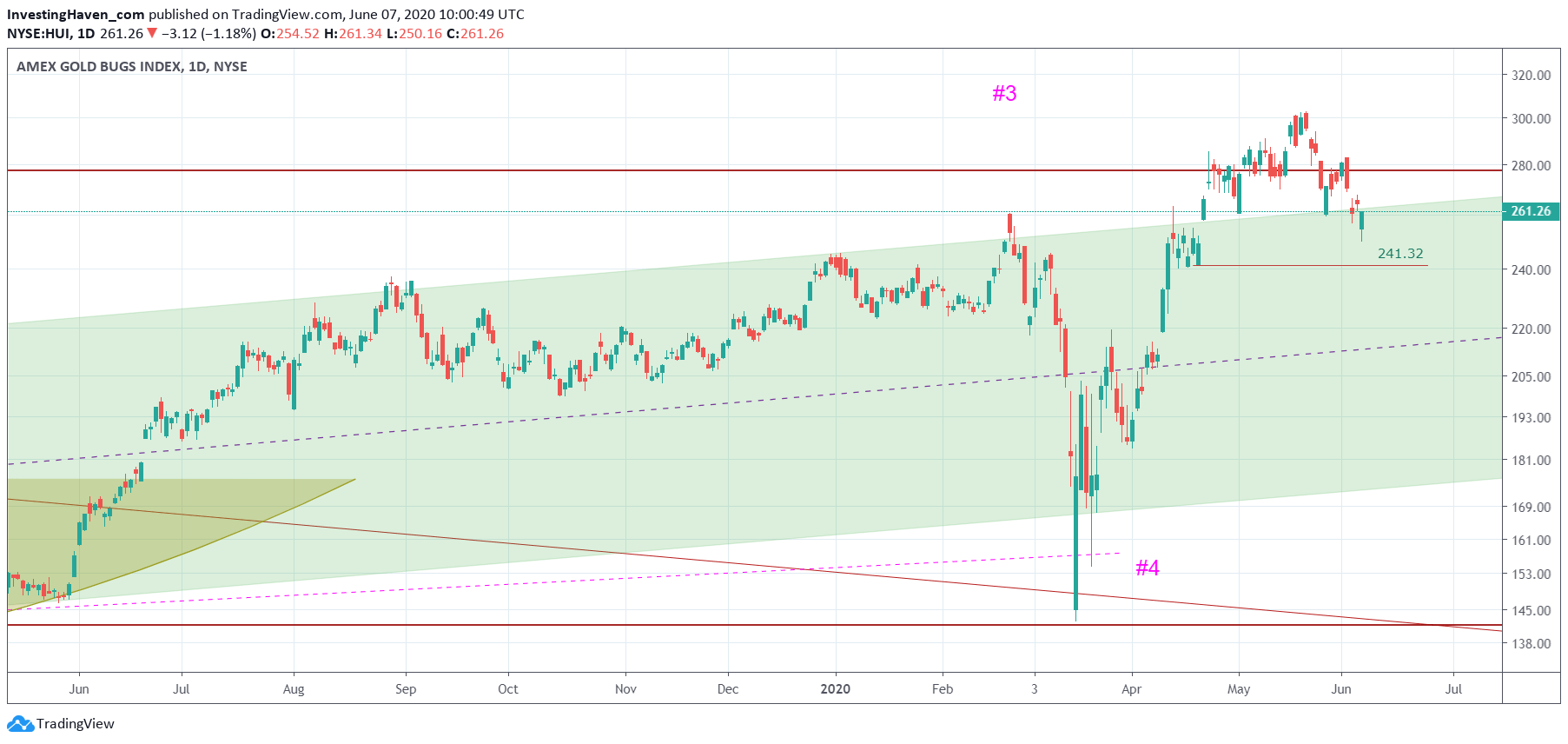

We see that the gold mining space is now testing a giant breakout level. After a breakout attempt earlier in May this HUI index came back down to test the 275 level which we consider the breakout point.

And continue with very precise price points:

If gold miners succeed in staying above 275 points for 3 consecutive weeks we know for sure that 375 points and next 500 points are underway.

Last week appeared to be a week with strongly rising rates, which is by default bad for gold. Mind the word ‘strongly rising’: the faster rates rise, the more gold will struggle.

It is now clear that the HUI gold mining index did set a topping formation around its breakout level at 275 points. There is some sort of head-and-shoulder visible on this chart, not so good for the short and medium term.

Attempt #4 to break out above 275 points in 7 years failed. We’ll look for attempt #5 later this year, either in a few weeks / months / quarters, we don’t know.

One thing is clear: we got a warming up rally in recent months in the gold mining space. We can now identify the strongest gold and silver miners. We are eager to buy those quality gold and silver miners at a discount, at a later point in 2020.

Short term the very important level to watch is 241.32 in HUI. It is a pivot point according to our analysis. Whatever happens around that price level will be telling for the short to (even) medium term.

In our Momentum Investing service we focus extensively on precious metals. We held one precious metals stock with a very promising setup, but when we saw the signs of this topping formation shown on below chart we sold this miner with +2.7% profit. We are very closely watching gold and silver miners to buy quality miners at a discount later in 2020.