October is an important month for the gold and silver market. Most often seasonal strength starts in October, and lasts until April. This year as well we see the first signs of strength returning the gold and silver market as October 2018 kicks off. This really is an early confirmation of our gold price forecast 2019, as well as silver price forecast 2019 and bullish setup from our long term gold charts. Consequently our silver miners forecast 2019 should be taken very seriously, as well as our top gold stocks 2019 insights.

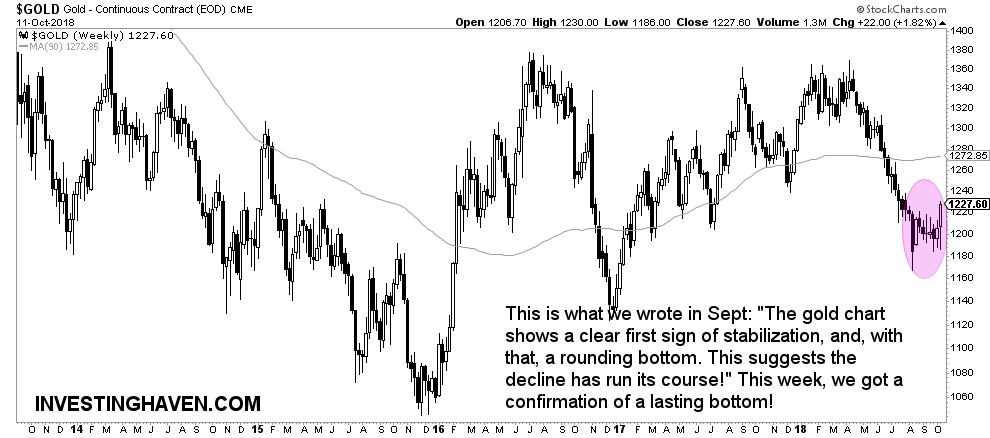

Gold market: a powerful rounding bottom

Everything we wrote in our gold (GOLD) price forecast 2019 is absolutely still accurate.

There is one thing in particular that we want to stress today:

As part of our gold price forecast for 2019 we believe that gold is setting a major cup-and-handle on its chart. The recent breakdown marked the start of the handle. We believe that gold, in this formation, will go back up in 2019 to test the $1300 to $1375 area. As that will be the 3d attempt for gold to break out of its strong resistance (red line on the chart) there is a fair chance gold will succeed.

Yes, there is a very encouraging sign for gold bulls which was confirmed last week. It is the rounding bottom.

A rounding bottom is a very powerful bullish signal. It suggests selling is exhausted, and buyers take control in a market.

For gold it seems clear that all selling was exhausted in the 1165 to 1200 area. If no sellers are in the market then only buyers are left. We believe that’s what we are witnessing right now, and the rounding bottom pattern is signaling it.

It may be an easy ride to the 1280-1300 area.

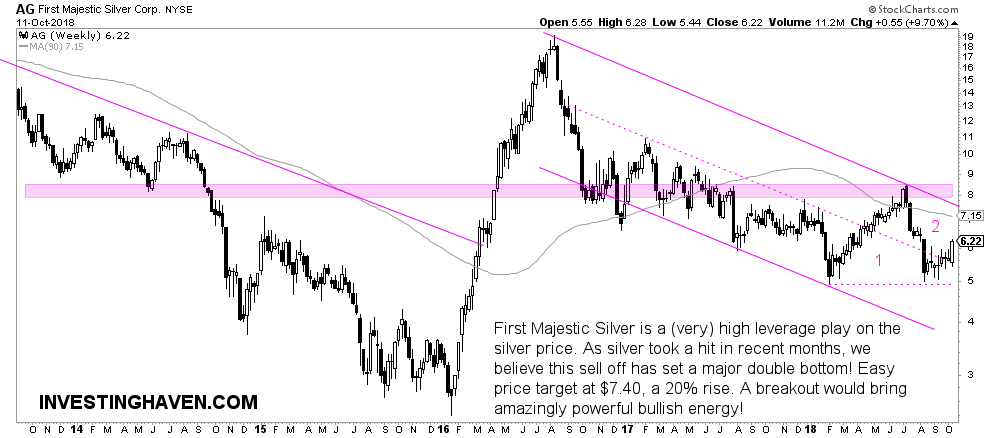

Silver market: leading silver miner sets double bottom

Needless to say, silver (SILVER) will be rising once gold goes higher. That’s a no-brainer.

There is more to silver though.

The bellwether pure play silver stock shows a very bullish setup, similar to the price of gold shown above. First Majestic Silver, the largest silver pure play miner, sets a major double bottom against January of this year.

SIL ETF now trades at 24 points. Note that we said in our silver stocks forecast for 2019:

Combined with the silver price forecast which is mildly bullish, we believe the bottom in silver stocks is in, and our silver stocks forecast for 2019 is also mildly bullish. We expect silver stocks (SIL ETF) to rise to 32.5 points, at a minimum, and potentially even to 42.50.

The chart of First Majestic Silver suggests an easy ride to the $7.40 area, a 20 pct rise against today’s price point.

If, and that’s a big IF, it would manage to break above $7.40, with conviction, we see a test of the 17-19 area in the next 6 months!