Gold is one of our hottest topics in recent months. That’s because we closely monitored the gold market as it started to show bullish momentum. The more we write about a topic the higher the probability of hitting a major investing opportunity. As it stands now the gold market confirmed its breakout, and is on its way to meet our first target of $1550 as per our gold forecast 2019 published a year ago! Top gold stocks which we tipped early this year are outperforming. This brings up the question whether it is too late to buy gold and silver stocks? Stated differently is it still worth buying gold and silver stocks at this point in time?

As said the gold price is the one and only leading indicator for the whole precious metals market in this stage of the evolution of that market. We wrote about this extensively, especially in Gold Has A Bullish Bias With Its 2nd Consecutive Weekly Close Above 1400 USD.

Even gold and silver stocks may be bullish, but they need green light from the gold price. That’s what we covered in Are Gold Mining Stocks Now Finally Bullish?

As gold’s price closed for 3 consecutive weeks above $1400 we have a confirmed breakout now. Read our detailed analysis here: Is The Bullish Gold Price Breakout Now Confirmed? This gives green light to gold and silver stocks.

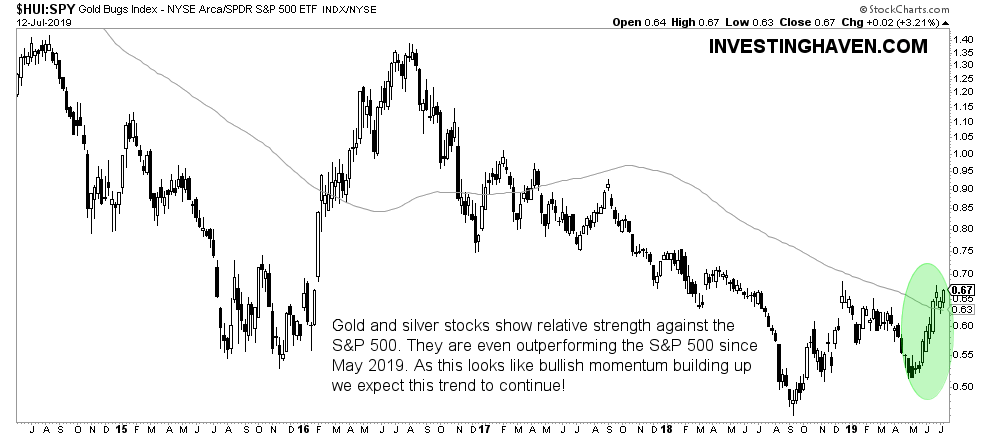

All indicators are supportive for higher gold and silver stock prices. One that we pick out here is the HUI index (gold bug index) relative to the S&P 500. This relative strength chart is an important one because it shows gold and silver stocks relative to a baseline (the leading broad index).

What we see on the relative strength chart of gold and silver stocks is exceptional strength. Starting May 2019 gold and silver stocks strongly outperformed the S&P 500.

Will this continue though is the question, and does it imply that it is worth buying gold and silver stocks now?

We see a few ‘reasons’ why the answer is: yes, it is worth buying gold and silver stocks now. First, not only is the trend up on the relative strength chart of gold and silver stocks relative to the S&P 500, but also is the long term moving average about to turn up. This only happens when there is bullish momentum, and this typically lasts for a while. Second, the price of gold has a confirmed breakout, as said before. Third, a trend is a trend. One might argue that gold is a fear asset, which it is as well … but it’s not only rising on fear.

The point is this: once a trend is in place it is likely to continue. If the set of circumstances did create bullish momentum in the gold market then it is what it is. Counter arguments like the fear asset story, and gold fundamentals, and so on are … useless.

Note that gold and silver stocks are very volatile. We would not exclude some sharp sell offs as they continue to rise in the next 6 to 12 months. It is only time to sell gold and silver stocks when gold goes structurally below $1400.

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific (gold and silver) investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 to 6 months. Subscribe to our free newsletter and get premium (gold and silver) investing insights in 2019 for free. Sign up >> ]