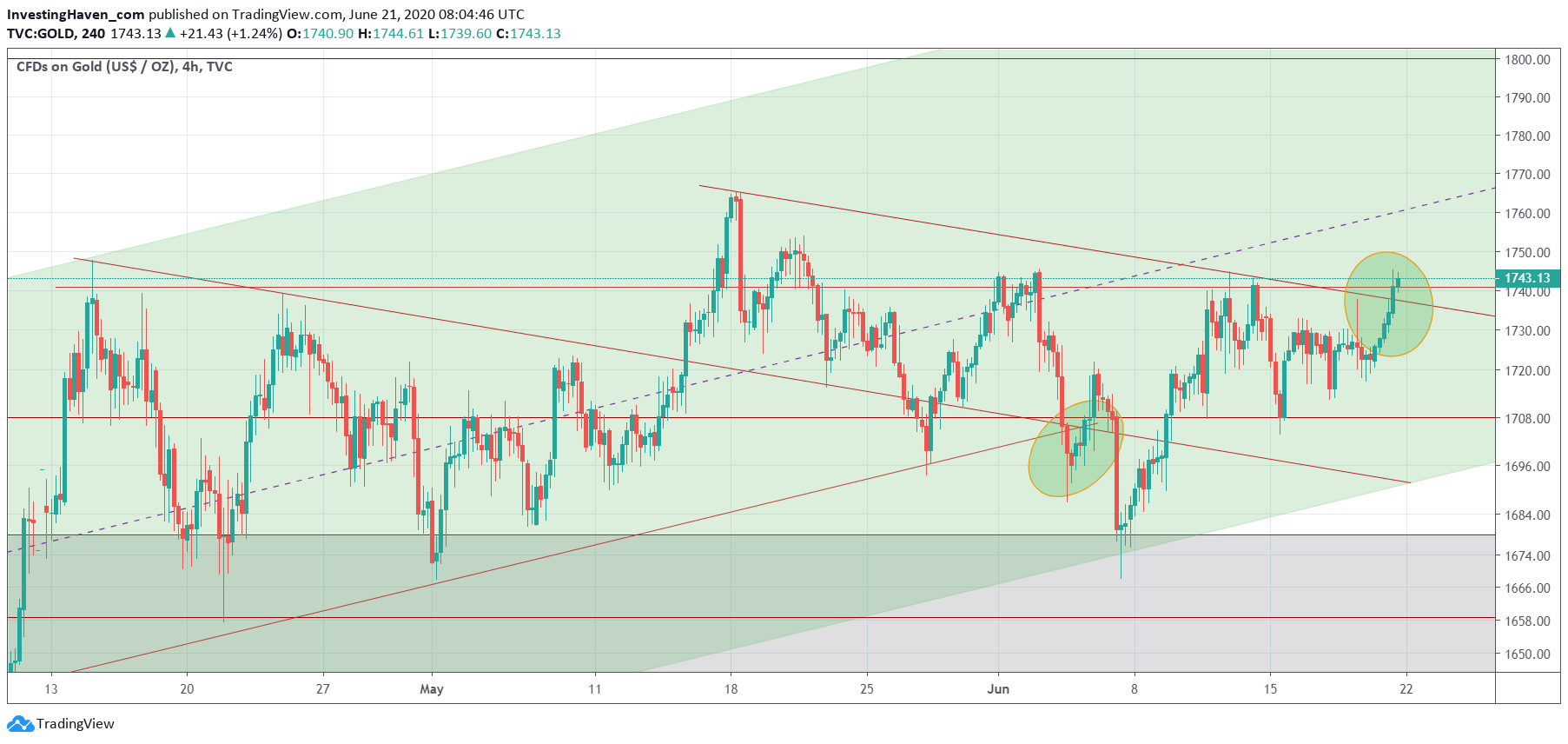

When gold breaks out, it mostly does so at unexpected price points. On Friday, gold broke out on our chart(s). This was for us the trigger to flash a buy signal on the strongest mid cap gold miner. We took a position in the most promising gold miner among mid and large caps, on Friday, in our Momentum Investing portfolio.

Gold’s price chart since mid-April must have resulted in major frustration for investors.

As said many times, and as per our 100 Investing Tips For Long Term Investors consolidations are nerve wracking for investors.

- Investing tip: Consolidations are very frustrating for traders and investors. This is the type of situation in which the vast majority of investors show no patience. They then sell with a loss, only to find themselves chasing prices higher after a certain time period.

- Investing tip: Consolidations create a very bullish long term outlook for any asset or market. Essentially, during sideways trading, sellers tend to leave the market every time the price peaks. If a consolidation goes on long enough all sellers leave this market. That’s the ideal market condition for a new bullish trend.

Many gold investors have sold positions in the last 8 weeks, which is the prerequisite for this market to move higher. If bulls and bears leave the market, there is sufficient space for the bulls to do their magic.

The 8 week gold price chart shows the double breakout: both the falling trendline as well as the horizontal trendline was broken to the upside.

More importantly this happened at the lower side of the rising channel (green). In other words there is plenty of upside potential after Friday’s breakout.

Note as well that a breakout may be a process. Technically, this breakout is confirmed once above 1760 USD/oz. We can reasonably expect some hesitation around 1760.

We believe gold is moving to all time highs though.

Why do we believe so?

Because of the leading indicator in the gold market: the gold futures market.

We are not going to explain the details on how to read the next chart, because we wrote about this countless times in the last 7 years.

All we can conclude after reading the next leading indicator chart is this: there is plenty of upside potential in the gold price.

Do you like our analysis? You can follow our work with our look-over-the-shoulder investing method and strategy as per our Momentum Investing service. We tend to take one gold position next to one technology position.