It’s pretty simple in gold: a make-or-break level is being tested ‘as we speak’. The month of May will be decisive for the precious metals market. In order for the market to realize our bullish gold forecast in the 2nd half of 2021 we need to see a stabilization and a bullish reversal in May.

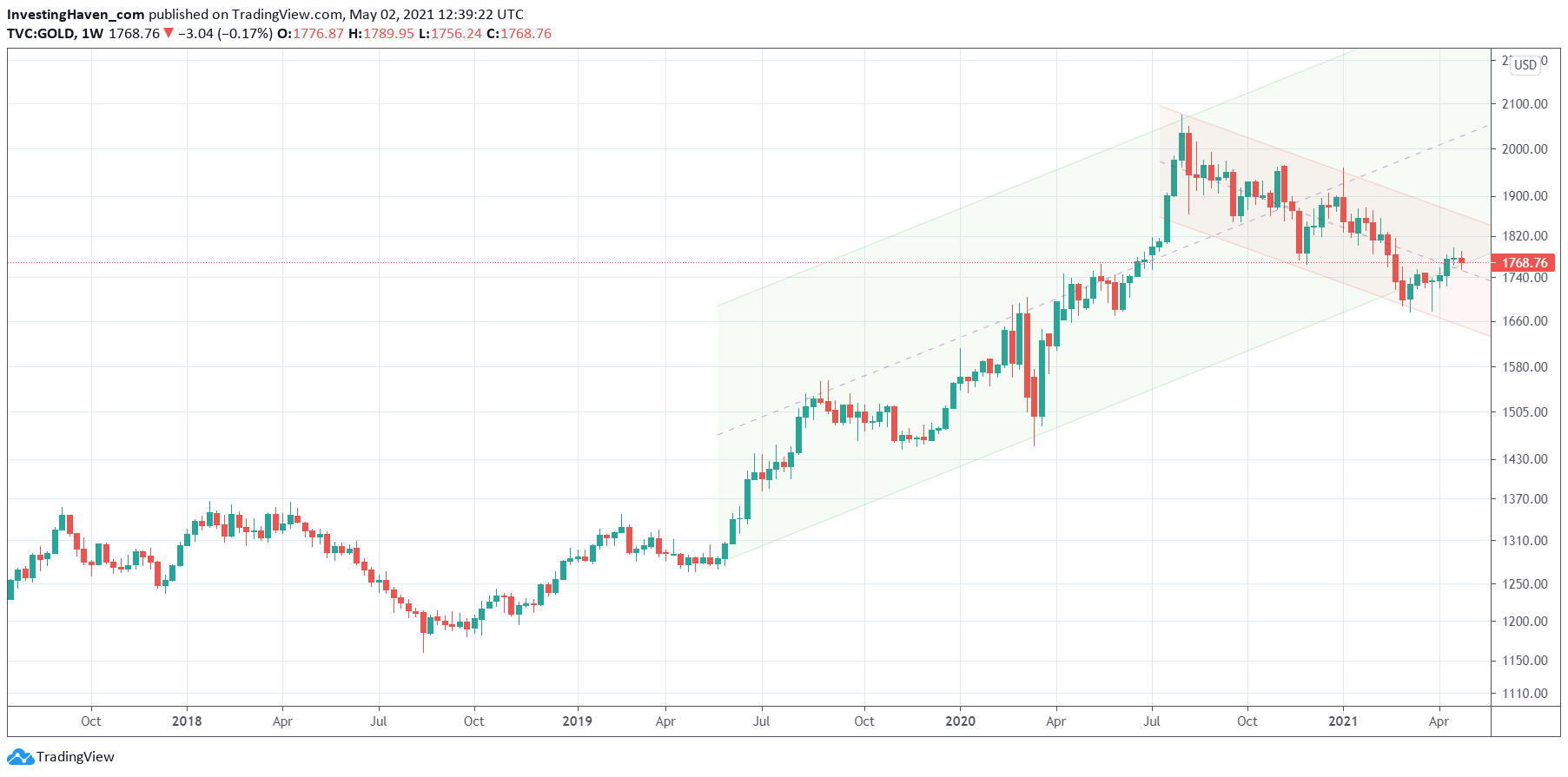

Here is one of the most ‘extreme’ charts we currently see, among the hundreds we track: gold’s weekly chart.

Interestingly we have been featuring this chart for a while now, we mostly included the daily chart in our posts. Today we look at the weekly.

As a refresher on the daily we wrote about the 2 trends on this chart, in Gold: Will The Tactical Bear Win Or The Secular Bull Market

First, the secular bull market that started in June of 2019. That’s the trend represented with the green rising channel. A powerful uptrend that started 2 years ago, saw a big drop during the epic Corona crash sell off, and continued its rise only to set a major top in the summer of 2020.

Second, the tactical bear market that started after gold set a major top in the summer of 2020. See the red falling channel on the chart.

The weekly chart shows weekly candles right at this rising channel. Since February we have seen a few candles partially below the channel, but opening prices have always been in the rising channel.

What all this tells us is very simple and straightforward: bulls are fighting to keep this bull market alive. So far, they seem to be succeeding in it, but it’s a ‘deadly’ fight.

The month of May will be telling: 3 weeks below this channel will be the end of the gold bull market that started in June of 2019, a two year bull market so far.

The opposite is true as well: if bulls succeed in keeping gold in this rising channel, for 4 consecutive weeks, it will be clear that gold will be moving towards the 1800-1820 USD/oz level. That’s the setup this market needs to invalidate the red falling channel, and continue to move in its longer term green rising channel.

If anything, leading indicators are supportive of higher gold prices. The Euro, as said in Leading Risk Indicator EURO Eager To Confirm A New Secular Bull Market, should not move lower, which is what gold needs. Similarly, bond yields look to be losing momentum, and flat or falling bond yields is what gold needs to move higher. The combination of a rising Euro and flat/falling bond yields is what will push gold above 1800-1820 USD/oz to confirm the continuation of its 2 year bull run.