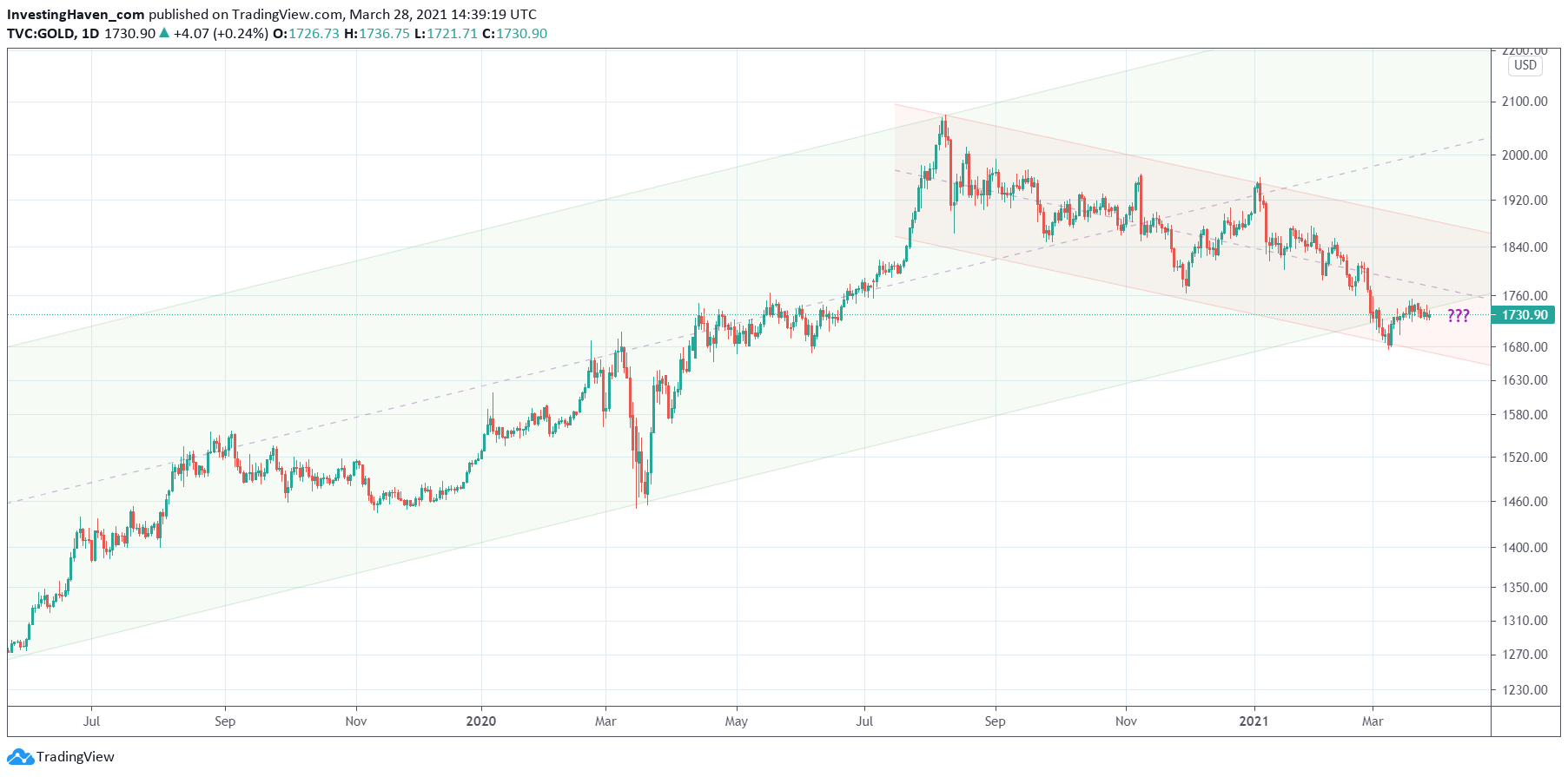

Gold is testing the edges, and it is in a twilight zone right now: It may start a cataclysmic decline, or it will start a recovery (bullish reversal). This is how to read the gold market based on the daily gold price chart. Note that we said in our gold forecast that gold would not be bullish in the first half of the year, so far an accurate prediction.

The daily gold price chart is the one we feature in this article, and it is a pretty interesting one to say the least.

In the summer of 2019 we flashed a strong buy on gold, and we documented this in the public domain: Gold and Silver Stocks Breakout: Why This Time In 2019 Is Different.

Our forecast back then was spot-on: gold started a strong uptrend, and it did last more than a year.

Since August of 2020 though the bull trend turned into a bear trend. We said so, also in the public domain, in this post Gold Price Chart Becoming Very Complex as well as Gold Falling In Love With Former All Time Highs.

Since then it went downhill, with a few short lived recoveries.

And this created a downtrend on the daily chart, as seen below (red falling channel).

There are 2 ways to think of gold, going forward:

- The downtrend that started in August of 2020 is a tactical downtrend in the context of a rising longer term uptrend. This suggests that gold’s decline came to an end, and gold will soon start rising again.

- The price of gold fell below its rising green channel, and is now ready to continue this downtrend. The green rising channel is failing, the red falling channel will become dominant. Gold moves lower OR will consolidate for an extended period of time.

Which scenario do we expect to play out?

Frankly, we believe that gold will not continue its move lower. That’s because of intermarket dynamics as explained here This Leading Indicator Says Market Trends Will Be Challenging To Identify In 2021. If Treasuries consolidate it might be good for gold, is what we believe.

This does not mean that gold will be wildly bullish. It means that gold will probably not be bearish, and depending the structure and nature of the consolidation it *might* set the stage for a bullish investing cycle later in 2021.

That’s our best guess forecast at this point in time with the data at hand.