Our bullish stance on silver never changed. Our bullish silver prediction never changed. The market simply postponed achieving our target(s). In writing our 2023 forecasts we noticed a recurring theme, we explained it in great detail in our gold forecast: the impact of the U.S. Dollar on markets and metals. Yes, we believe that the USD will set an epic top, it might already have peaked at 114.4 points which, if true, will put the silver market on fire in the not too distant future. This is the investing thesis behind our preference for silver as the precious metal to buy for 2023.

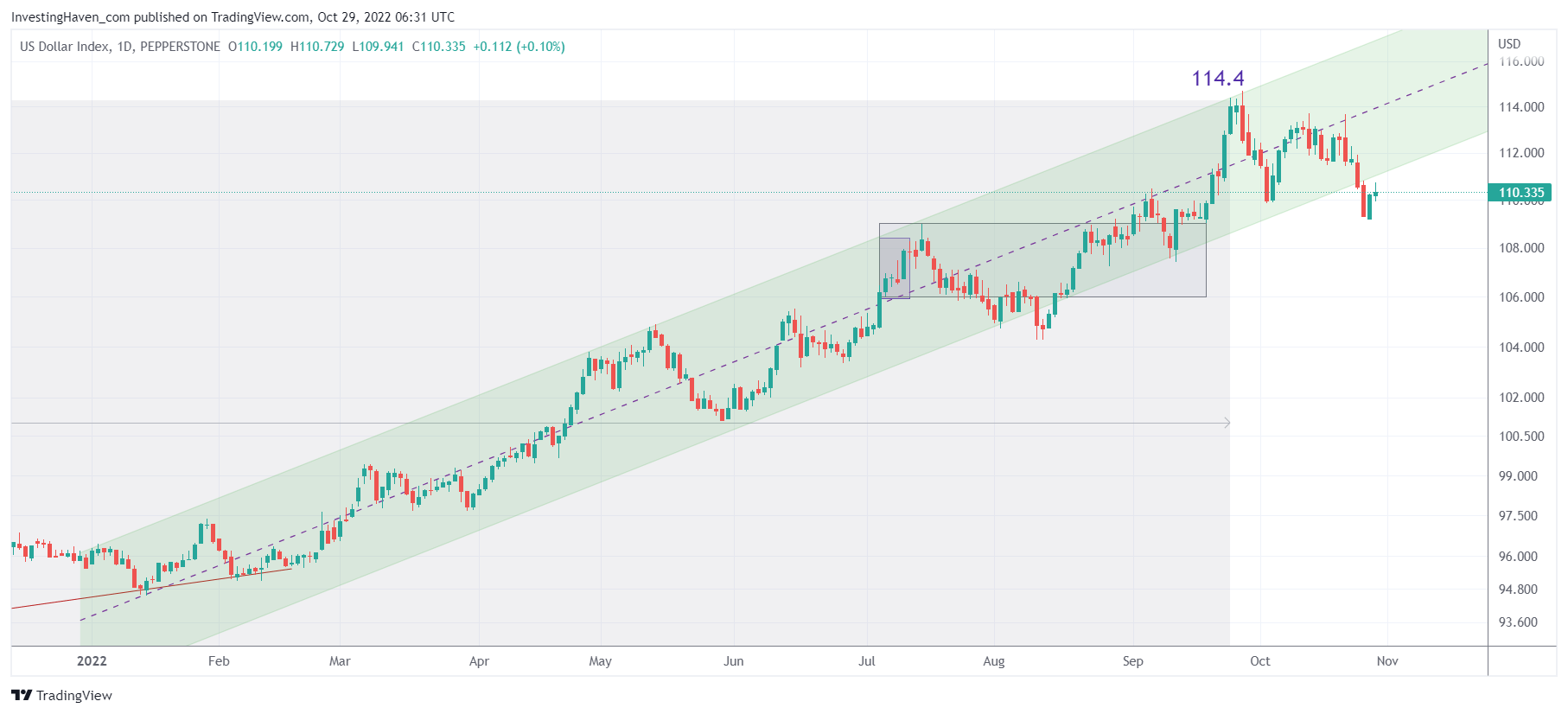

Let’s first look at the USD chart.

The chart says it all: the 2022 channel is at risk. If confirmed, it would be outstanding news for investors in stocks and metals.

The USD has been the driver of weakness markets and metals, it was the driver for epic volatility that characterized 2022.

This is how we explained it in our Momentum Investing alert “10 hidden gems with a buy signal” which we sent premium members earlier today and is available in the restricted area:

The USD fell below its 2022 channel but it’s not confirmed, not yet. Imagine what happens once all Dollars that were accumulated in 2022 will find their way to the market. What a powerful catalyst, it’s a ticking time bomb in favor of markets.

A tiny decline of the USD can put a massive amount of capital in motion.

In the meantime, we see that the price of silver is stabilizing, see first pane on below chart.

More importantly, the CoT report is bullish, by all standards, by any historic measure. The CoT report is not a timing indicator, it is a stretch indicator. It is an indicator that suggests whether there is more upside vs. downside potential in the price of silver.

If the market is going to realize that the USD has peaked around 114 points it will confirm an epic bottom in the price of silver. The upside potential in silver is epic, on a timeframe of 18 months!