The Euro is weakening, and that’s mostly not good for the gold market. This week was horrible for the Euro but not that bad for the gold price. However, gold stocks were not that great. There is no momentum in the gold stock market, that’s a given. Still there is one specific segment in the precious metals complex that we keep a very close eye on: junior gold miners. The chart below makes the point, and it is a point we also made in our latest gold forecast as well as our silver forecast.

The gold chart we pay attention to currently is the junior gold mining chart, GDXJ ETF.

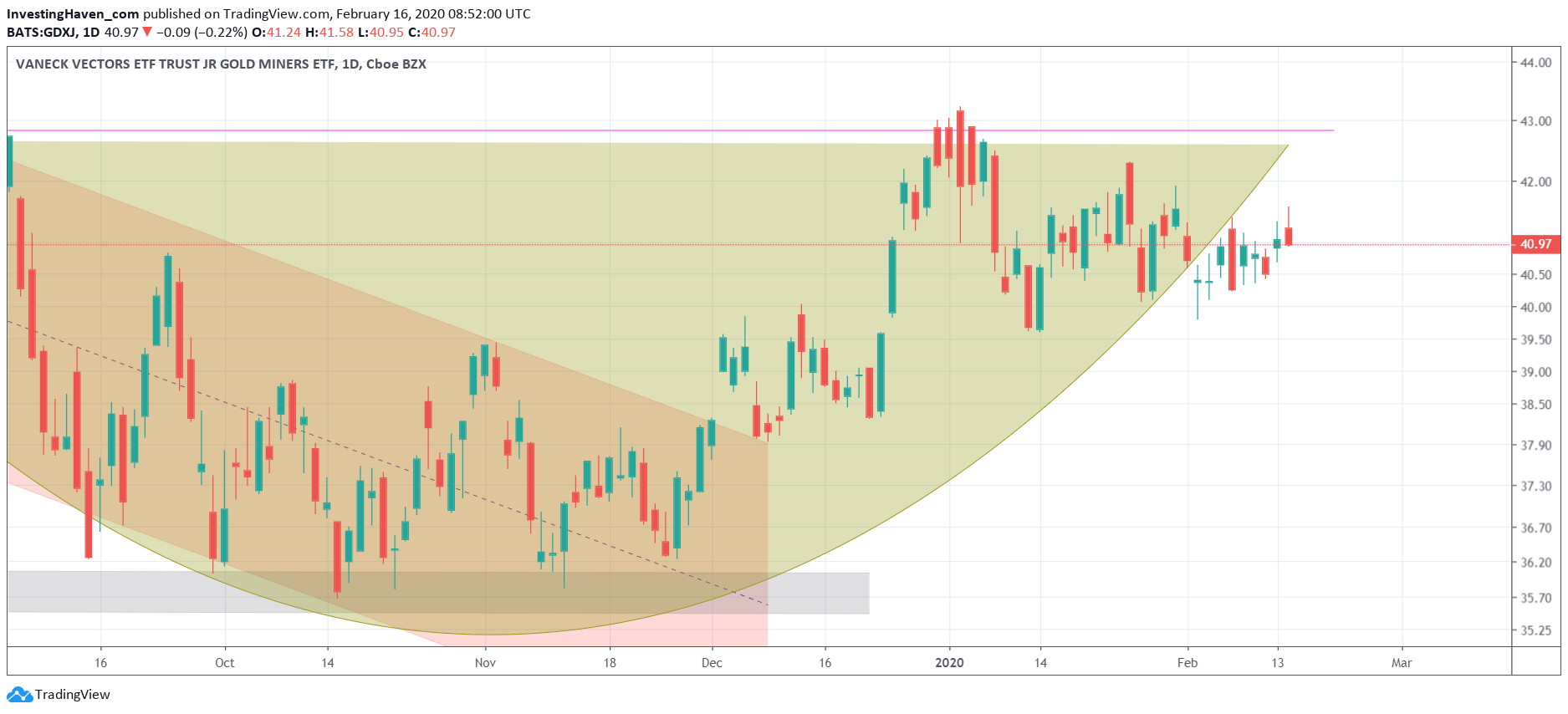

As seen below there was a huge reversal pattern visible on its daily chart. Last week this pattern was violated. This could mean many things, but what exactly can it mean?

One outcome might be that this is the start of a breakdown, and a bear market could result from it. However with the gold price showing a solid pattern (no momentum, just solid) we don’t think there is such a bad outcome coming out of the gold mining space.

The other outcome might be a consolidation before a major breakout. We give this scenario the benefit of the doubt.

The way this could play out is either some sort of cup-and-handle, or a ‘boxed’ consolidation between 36 and 43 points for another x number of months.

Whatever the outcome we keep a very close eye on the GDXJ because it is a gauge for risk in the gold market. Especially if there is relative strength of junior gold miners against senior gold miners we know for sure there is an increased risk appetite among gold investors.