One of the standout moves in the recent week in global markets is the ongoing breakdown of the Euro. No surprise we sold our gold mining position 2 weeks ago, we saw this threat coming and it looked for real. This does not mean it invalidates our gold forecast nor our bullish silver forecast. It just means ‘the time is not right’ for a momentum play (a momentum trade). Last week we wrote Euro Chart Raises Red Flag, and added that we need to closely watch which ‘ripple effects’ this might create. One thing is for sure: you don’t take a breakdown or a breakout too light when it happens in currency markets nor in credit markets!

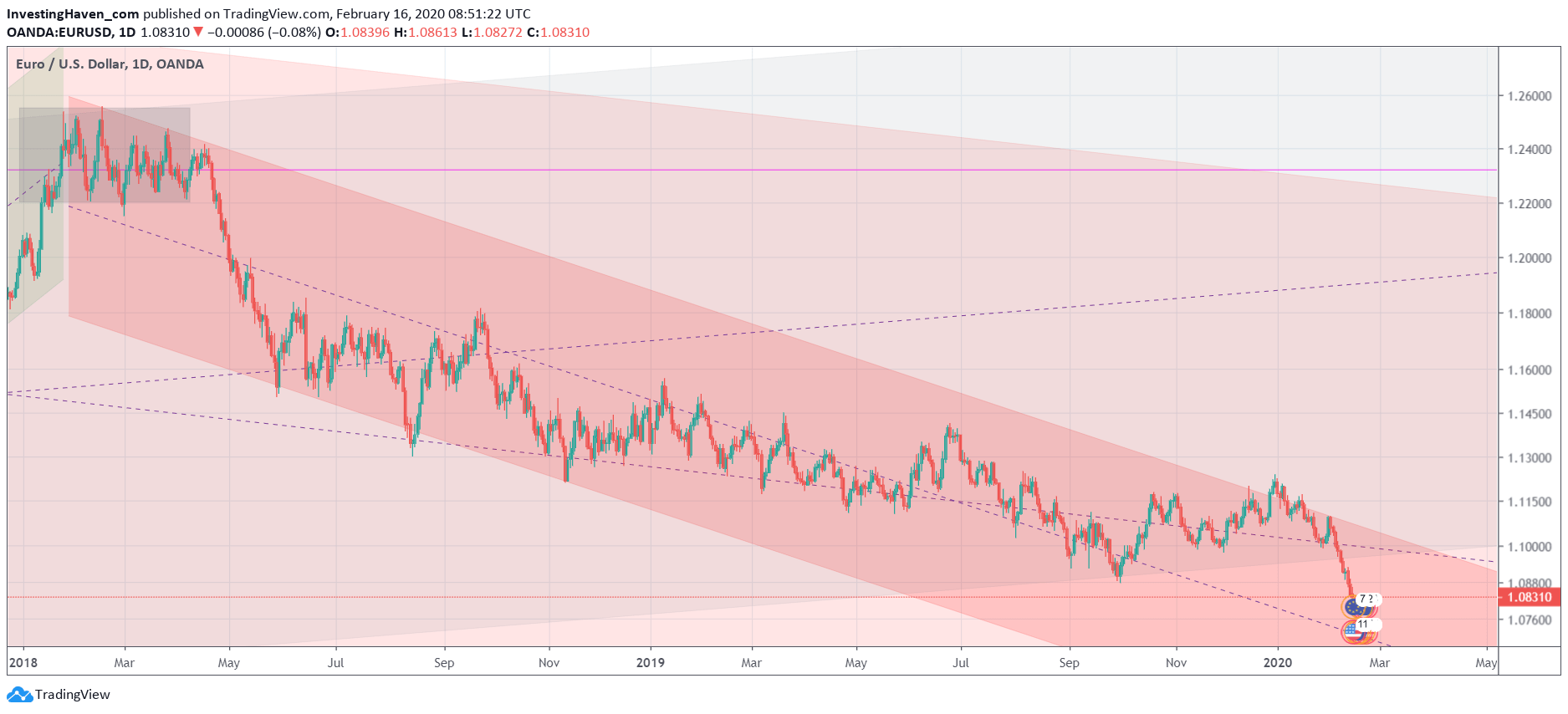

The Euro breakdown is a horizontal breakdown: the October lows are taken out now.

Because of this, and because of the failed breakout in the first week of January, the Euro is now back in its 2 year falling channel as shown on below chart.

Technically the Euro is now eyeing 2 important price levels: first the median line of this falling channel which is 1.065 approx. This is important 2015/2016 support, so pretty powerful.

If, and that’s a big IF, that support level would break as well, the Euro would fall below 1.00. Let’s be crystal clear here: this would introduce an emergency scenario. We don’t know exactly what is going to happen, but rest reassured it will be painful in one or several markets.

We are closely tracking these intermarket dynamics. We wrote a more detailed analysis this weekend in our weekly digest, and we also identified 2 potential winners as a result of a weakening Euro (next to one market that might suffer).

That’s how we prepare our next winner; once we get confirmations of our investing thesis we will take positions.