The price of palladium (PALLADIUM) rose again last week. It gained some 4 pct on Monday Feb 25th, and closed the week almost at the same price level as Monday’s close. Our 2019 palladium forecast is being crushed, and our most bullish price target of $2720 may be underway, as explained in Palladium Investors: Prepare Your Exit Plan. But what about this March 1st date that we spotted in Palladium’s most important event On March 1st, 2019? The good news is that palladium could not have done any better, check out why.

Before looking into the details we want to reiterate why we are covering palladium, one of the least known and appreciated precious metals, so extensively lately? That’s because we tipped palladium as one of the TOP 3 investing opportunities of 2019 that could deliver mega returns. As said, mega returns are 2 to 3 fold rises in one year. This justifies extensive coverage, right, for sure if our followers can benefit from it?

Regarding this March 1st, 2019 date, what we said a month ago is this:

The 4-hour chart below has some crucial insights:

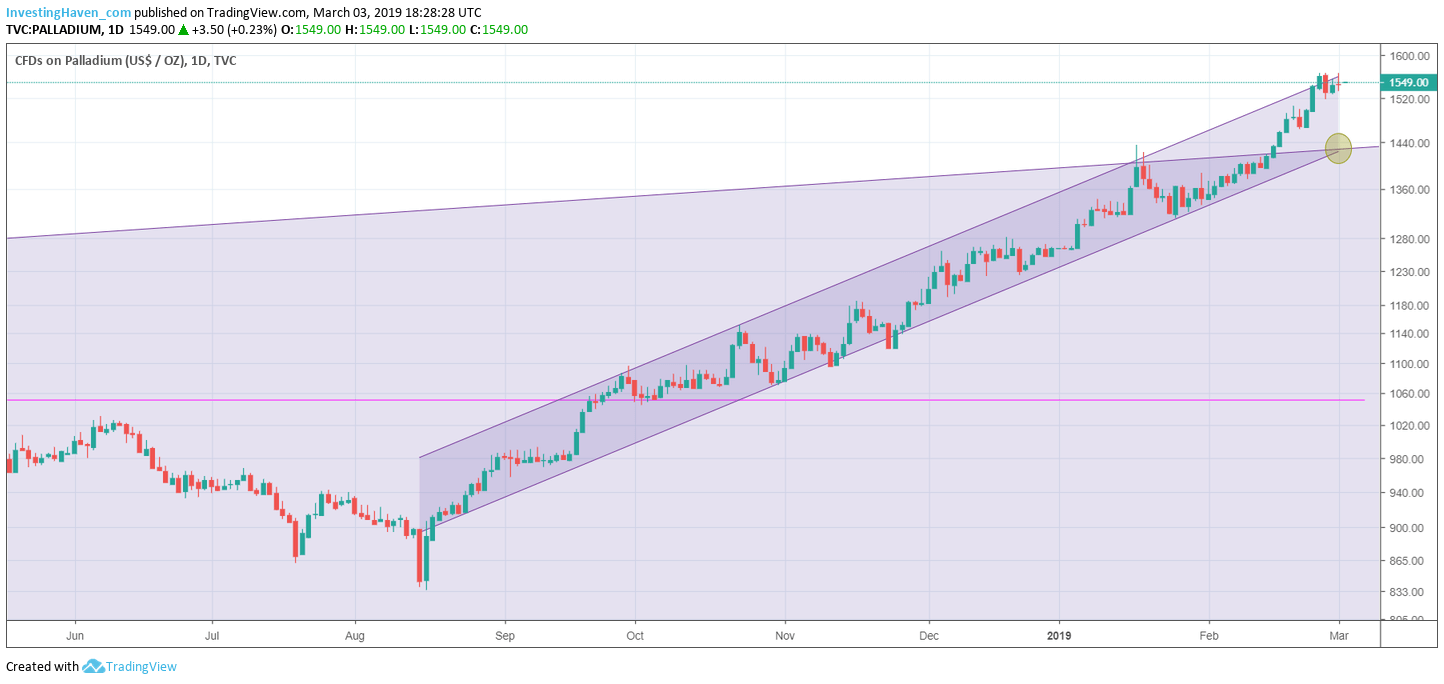

- By far the most important price point is $1420. It is where the tactical uptrend channel crosses the upper band.

- Moreover, on March 1st, 2019, support of the tactical channel crosses support of the upper band.

What this means is this: if the price of palladium continues to trade above $1,420 at a minimum 5 days after March 1st, 2019 it will likely confirm its breakout and its willingness to move to $2,700 in 12 months.

This is interesting.

Palladium closed March 1st, 2019 at $1549. Even if it would retrace heavily the coming week chances are high that it will continue to trade above $1440. It would need to retrace more than 8 pct to fall below this important $1420 level.

As seen on below chart palladium’s price is now strongly at the top of its rising tactical channel (fast rising channel), and the tactical channel is now fully in its secular channel (slower rising channel).

The odds of palladium exceeding $2,000 this year, maybe even in a blow-off top fashion reaching the $2,500 to $2,700 area is very high.

How to play the palladium uptrend? Very simple, there are 2 options to get expsoure to palladium: one solution is to buy PALL ETF (easy but not always the liquidity you need so high risk), the other solution is to open an account with GoldMoney and buy/store physical palladium for you in a couple of simple steps. GoldMoney is one of the few online precious metals services that offers palladium.