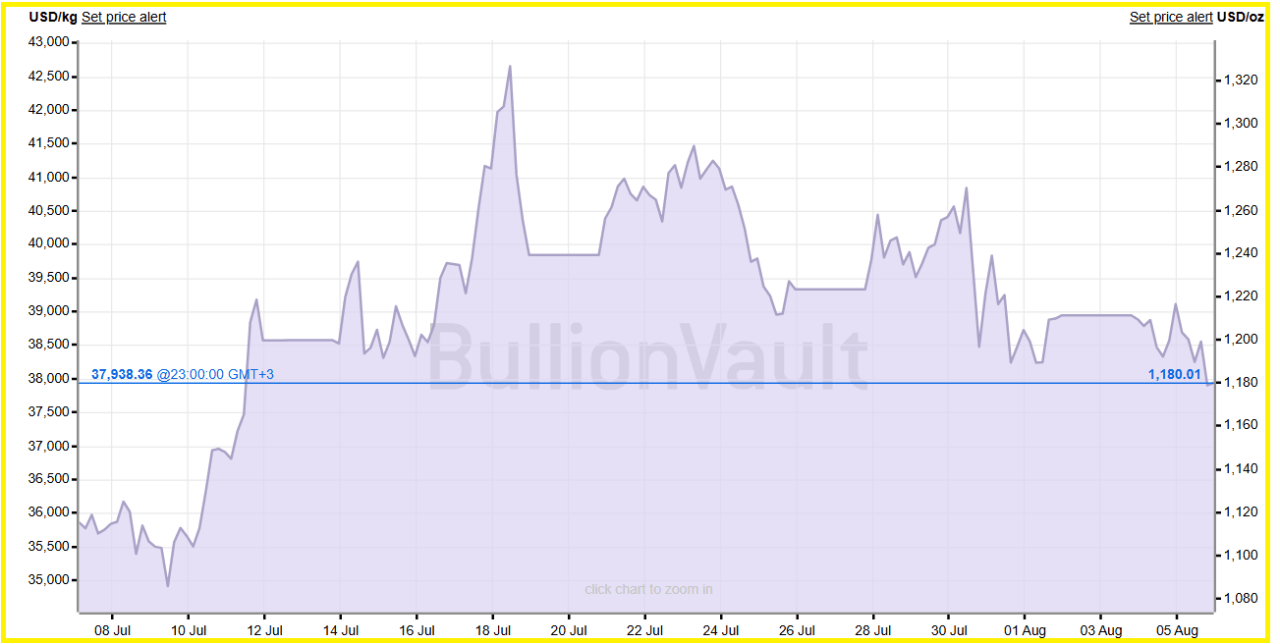

Palladium prices rose 31% in 2025 while a U.S. tariff petition on Russian imports adds uncertainty. Supply risks and speculative trades intensify volatility.

Palladium climbed 31% year‑to‑date amid tight supply and low liquidity. Sibanye‑Stillwater has filed a U.S. petition for tariffs on Russian palladium imports, setting the stage for intensified volatility and trade disruptions.

Tariffs and Trade Risk

Sibanye‑Stillwater formally requested that U.S. authorities impose tariffs on Russian palladium imports, citing below‑market pricing and alleged dumping by Nornickel. Russia supplies roughly 40 % of global mined palladium, and its exports to the U.S. rose 42 % year‑on‑year in early 2025.

Analysts warn that even if tariffs do not change supply fundamentals, they could reroute physical flows and fuel speculative trading, increasing palladium price volatility.

Palladium Supply Shocks and Speculation

Auto industry demand remains the key driver: China and the U.S. consume most palladium through catalytic converters. UBS forecasts a market undersupply near 300,000 ounces in 2025, around 3 % of demand.

Johnson Matthey sees a smaller deficit of about 17,000 ounces, near balance. That said, market liquidity remains thin. A single day’s news of possible sanctions triggered a nearly 9 % price rally above $1,150 per ounce, illustrating sharp speculative moves.

Palladium Price Speculation versus Long-Term Risks

Short‑term momentum remains the key risk. Futures traders have responded to trade headlines with sharp, rapid swings. In contrast, long‑term fundamentals are less clear. If U.S. tariffs on vehicle imports take effect, auto-sector demand for palladium could decline.

MarketPulse projects a potential 4% drop in palladium demand, equal to roughly 364,000 ounces, while platinum demand may fall by about 1%.

Over time, increased recycling and the use of platinum as a substitute may help offset some of the pressure on palladium demand.

Conclusion

Three forces continue to shape the palladium market: tariff uncertainty, structural supply tightness, and speculative momentum. If the proposed tariffs are approved, trade flows may shift and prices could spike.

If they are rejected, elevated prices may still persist, but volatility is likely to remain high. Over the next 12 to 18 months, you should closely monitor automotive demand, recycling activity, and policy decisions to gauge where palladium is headed.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service — delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)

- The Two Only Silver Charts That Matter In 2025 (July 6)

- Quarterly Gold & Silver Charts Are In, Here’s the Big Picture (June 29)