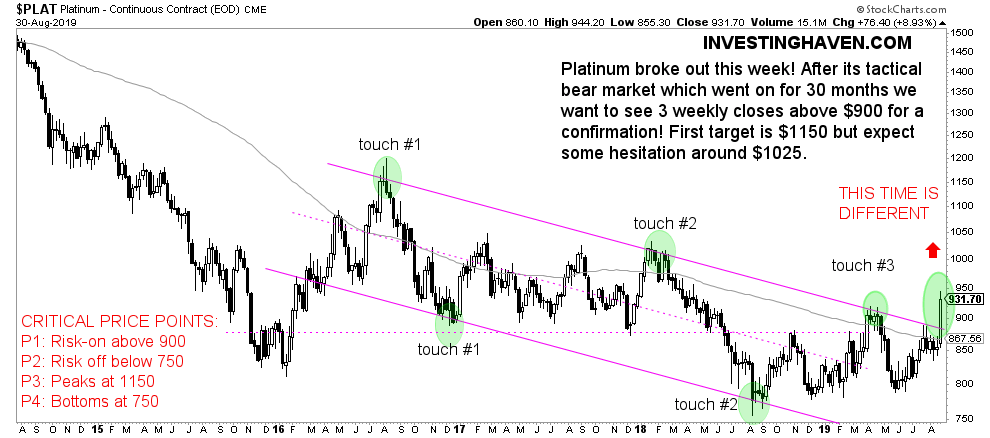

Platinum is the last precious metal to join the bull market. This last week it broke out from its 3 year downtrend. We now start seeing the first signs of evidence for our Platinum Price Forecast 2019 to materialize. For any price target we have to turn our attention to the long term timeframes

Let’s revise what we said in our platinum forecast.

Our #platinum price forecast for 2019 is straightfoward. Once platinum rises above $900 for 3 consecutive months it will rise 32% to the $1190 level. This is our base case forecast for 2019.

Let’s see what start of the breakout suggests on the monthly and weekly charts.

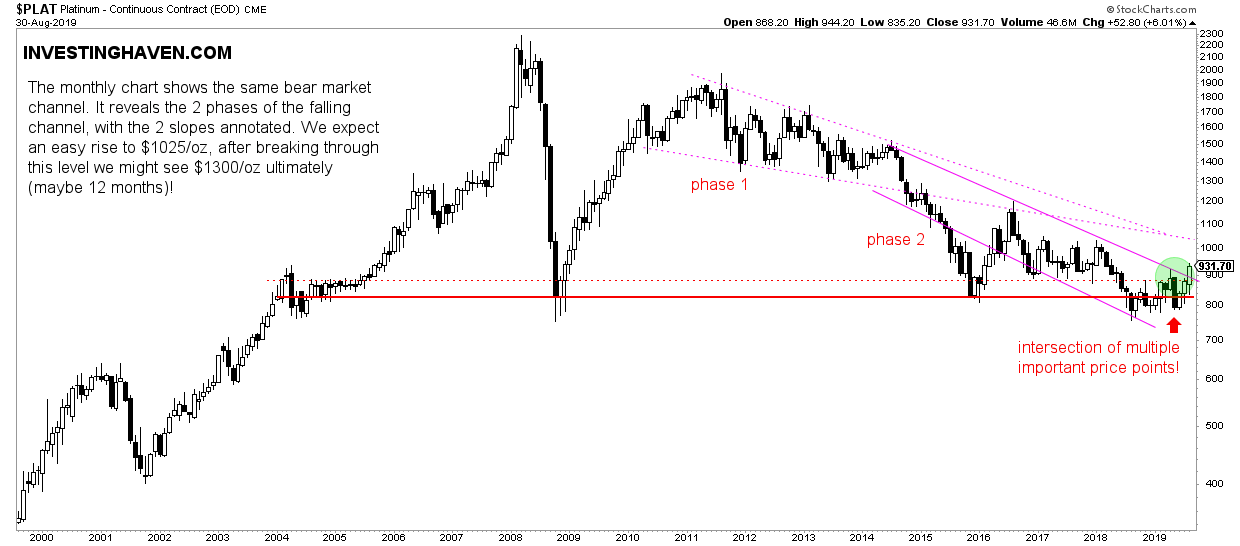

The monthly is not impressive yet, but may become very impressive any time soon. Visibly, platinum is on its way to 1025 USD/oz. Once broken to the upside there is little resistance to 1300 USD/oz.

Interestingly, the weekly timeframe confirms exactly the same conclusions from the monthly chart above.

In our platinum forecast we moved on saying this, based on the monthly price chart:

If and when platinum decides to move out of this triangle, and break out of it to the upside, we will see a monster bull market. This certainly will not happen in 2019 unless exceptional circumstances like acute supply shortages will occur. Not likely, but never say happen.

Beyond 2019 though there is a probability that a platinum bull market will start. The most bullish price target becomes $1800 but that’s certainly not a realistic price target in 2019.

What we are saying is that ultimately in the most bullish scenario platinum may rise to 1800 USD/oz again.

So the question becomes is it worth looking at platinum knowing that silver equally bullish.

Based on our Silver 3 Price Levels To Watch In 2020 piece we see similar upward potential in platinum vs. silver. So the key tip for investors is to pick one precious metal, and stick to it for the long term.

Because the biggest pitfall is to go from one to the other precious metal only to leave profit on the table. In the end it is one and the same asset class.