The precious metals continues to be in an amazing shape. Rightfully so, because Gold Entered A New Bull Market Right Before Its 8th Bear Market Anniversary (as said 2 months ago). A few weeks ago, in our exclusive series of 16 episodes in which we identify and play top investing opportunities we wrote about the top play in precious metals: Investing Opportunities #3: Gold Market Heating Up, Get In Or Too Late. Our strategy to play the precious metals market is 100% accurate, and our top pick is still the best positioned precious metals stock out there, outperforming almost any other financial instrument in the precious metals market. But is there still lots of upside potential in this market? According to our gold forecast the answer is “no”, according to our silver forecast the answer is “yes”, but what about precious metals miners? We believe short to medium term precious metals miners will rise another 50%, and investors should not get excited during this rally. Investors should plan their exit strategy now, to take profits on the way up. That’s how ‘buy low sell high’ works.

One of the biggest mistakes investors tend to make is sell way too early during a powerful uptrend.

There is a psychological reason for this. And it’s again a perfect illustration of this saying that the biggest enemy of an investor’s profits is his own thinking and emotions.

As said in our 100 investing tips:

Consolidations are very frustrating for traders and investors. This is the type of situation in which the vast majority of investors show no patience. They then sell with a loss, only to find themselves chasing prices higher after a certain time period.

The precious metals is a perfect example of a consolidation in the last 4 years. Essentially, price has gone nowhere, it has been trading in a wide range with a bearish bias.

What happens during such a time period is very simple: the power of repetition feeds to the brain, and ensures the brain takes this bearish perception as the one and only reality.

If you repeat something sufficiently the brain accepts it as a reality!

That’s why most investors tend to sell way too early in powerful bull markets.

That’s why we keep on repeating, with the risk of sounding like a broken record, that investors must stay focused on the charts. Especially the monthly charts help understand the big picture.

Big picture charts are the perfect antidote against the destructive power of the brain and emotions on the profit potential of investors.

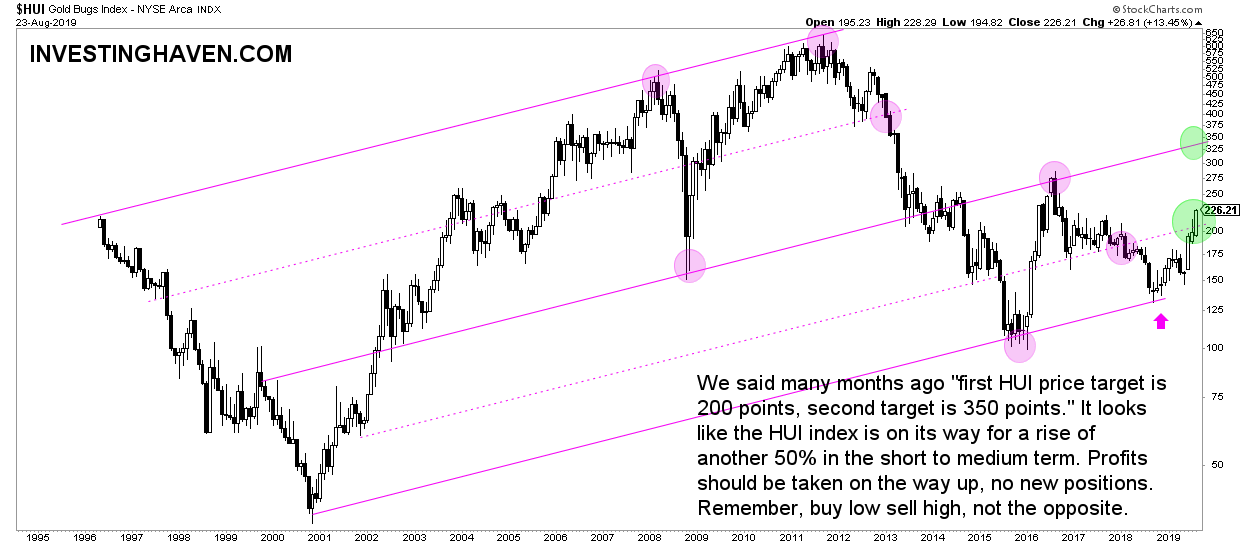

That said, what we see on the long term precious metals mining chart is this beautiful upleg which broken through the median line (dotted). It is now pointing to the next trendline which comes in around 340 points. In other words the rise from 226 to 340 points looks the next big thing before this sector will retrace.

No coincide we did spot this sector as one of the few top investing opportunities of 2019. No coincidence we gave this sector an above average coverage since the beginning of this year!

[Ed. note: As of August of 2019 we provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific investing tips on a weekly basis, mid-week, free of charge. We do this for 4 months. Subscribe to our free newsletter and get premium investing insights in 2019 for free.]