Precious metals stocks are simply gorgeous. Talking about a beautiful textbook-alike breakout in 2019, this is one of the few ones out there. Admittedly, in recent weeks it looks like we only talk about our gold forecast and silver forecast as well as precious metals stocks. But there are very solid reasons for this, and the chart in this article makes that point. As money making opportunities have been scarce in 2019, with Bitcoin being one of the few exceptions, there is really a point about getting super excited about potential of precious metals stocks. Note that we tipped especially silver stocks already many months ago as one of the 3 TOP investing opportunities of 2019, along with crypto, and it looks like our net result is already 2 out of 3 winners half way the year!

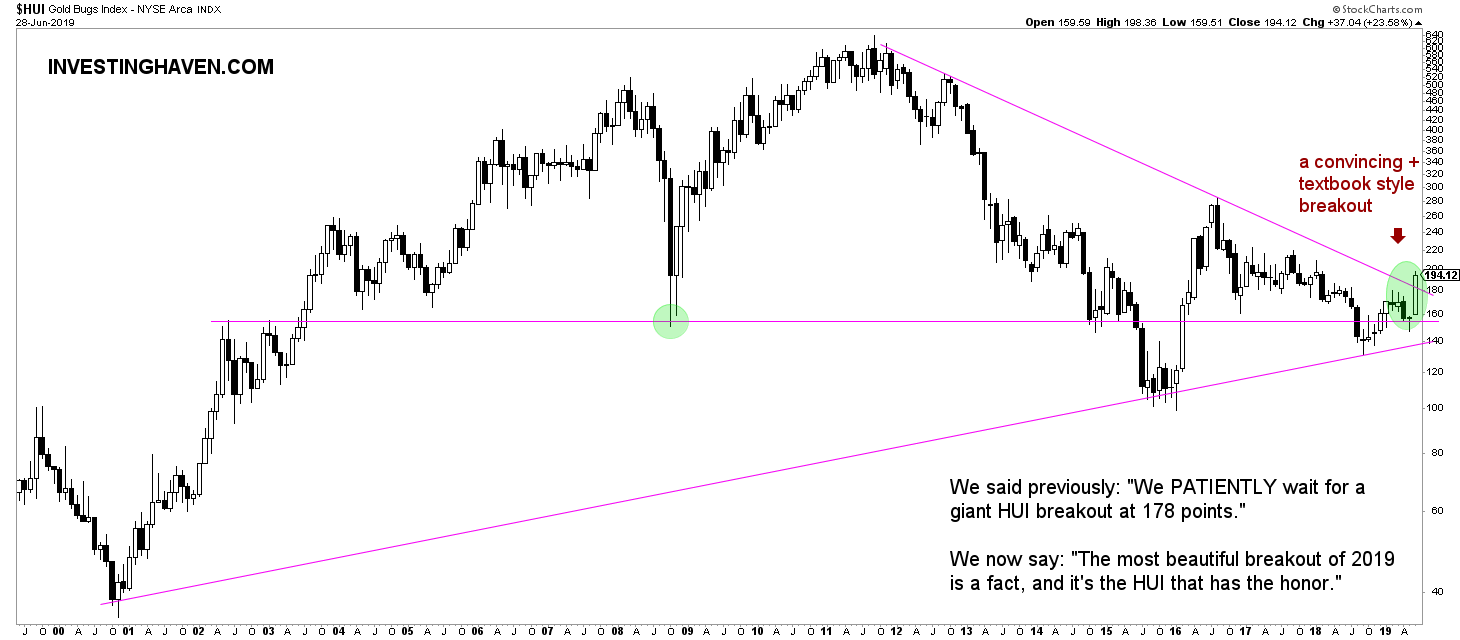

We can and will be brief about this chart which represents the monthly HUI gold bugs index.

- We see a massive triangle pattern that is in the making for 18 (!) full years. This is huge, pretty unusual.

- The recent touch of support at 160 points in the HUI gold bugs index happened at the same level as the 2008 lows. Again, pretty unusual for a stock market segment to trade today at the same levels as the lows of the Financial Crisis of 2008.

- Pay special attention to the momentum (energy) that was built up in recent years as this index was moving to its apex. The subsequent outside of this chart pattern is loaded with lots of energy, in this case visibly bullish energy.

- The monthly closes are what matter most. June 2019 closed on a strong note, clearly above the pattern. This is very, very bullish!

- We want to see 3 consecutive weekly closes above 180 points combined with 3 consecutive monthly closes above 180 points, for a final confirmation of a new trend.

Will this market go ballistic right away? It may be, yes, especially because of the bullish energy that is built up in the last 4 years.

This does not imply though that the HUI gold bugs index will instantly move to previous all-time highs. We rather expect a very strong move in the short to medium term after which a consolidation will follow.

As per Tsaklanos his 1/99 Investing Principles fast moves take a long time to materialize. However, a market can run very fast if and when once “it” starts. That’s because markets run fast just 1% of the time, as per our principles. Anecdotal evidence of this in the precious metals stock market is there on below chart: the number of months in which there was a very strong run up is limited, less than 10 months in 20 years, which comes very close to our 1% rule.

Patience is of the highest importance. You better are in too early, and wait for those few exceptionally strong months to happen, as opposed to waiting until great moves are happening.

Precious metals stocks are a great illustration of many principles. Investors better pay attention to this market and play it right!