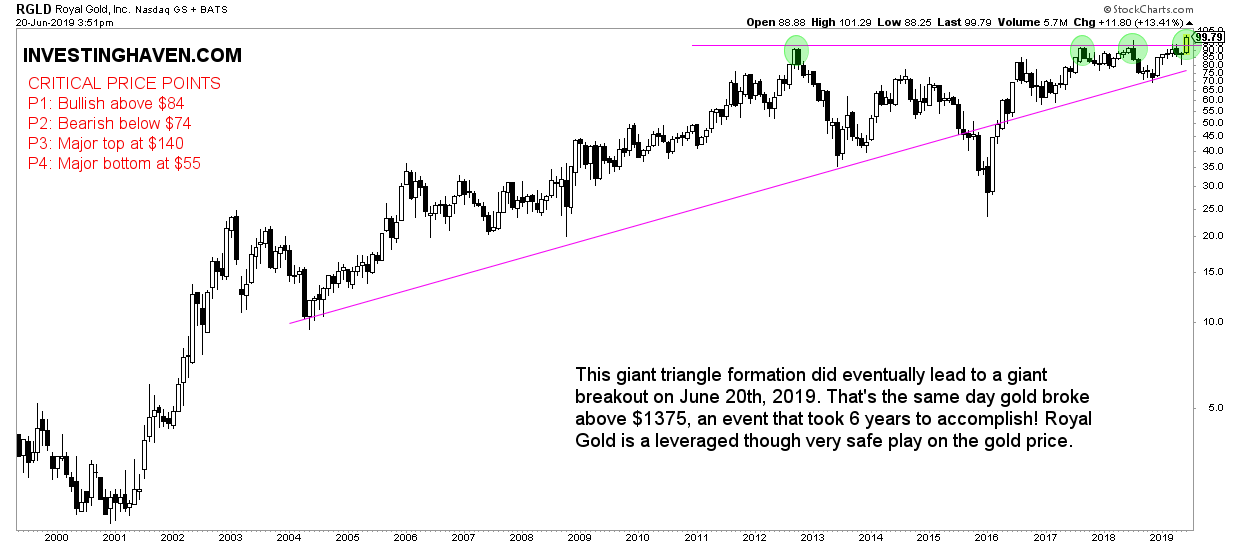

We identified 4 months ago the 3 best gold stocks for 2019. One of them was Royal Gold (RGLD). With today’s gold price breakout we have confirmation that Royal Gold is a top gold stock to own. Moreover, and certainly on coincidence, Royal Gold breaks out today. This is a breakout out of a 15 year triangle pattern which is bullish in nature. One thing is sure: this will unleash massive bullish energy.

In our ‘best gold stocks 2019’ article we concluded with this finding:

One thing is clear, if and when gold surges above $1300, and ultimately above $1375, we will see wild moves higher in top gold stocks as this really is an oversold stock market segment. That said, we believe that gold stocks are near a once-in-a-decade buy opportunity, and it is worth considering top gold stocks for 2019.

We also referred to keep a close eye on the prices and leading indicators identified in our gold forecast. It is clear that all conditions were favorable for a gold market breakout, we simply expected this to happen in the September to November timeframe.

That said, the question is how to play the gold and silver market now?

For aggressive investors it is clear that the silver market will provide massive leverage. At the risk of sounding like a broken record we have been providing coverage on First Majestic Silver (AG) since we published our bullish First Majestic Silver forecast.

For more defensive investors that do not prefer to handle the high leve of volatility of the silver market we believe Royal Gold (RGLD) is a great alternative. Likely it is the best alternative.

Royal Gold is a safe investment. It is a streaming company, one that is around for several decades. It has proven to be less volatile that most other precious metals stocks with the only exception of October – December of 2015.

Right now, Royal Gold goes through a giant breakout process.

Note that the 3 previous attempts failed, see the green circles on the chart. It is clear that this time is different because this breakout attempt comes with a breakout in the gold price which is the leading indicator.

As said in our investing method do not underestimate the power of leading indicators, they are crucial.

We expect a steady rise in Royal Gold, certainly it will have leverage on the gold price. So if a gold price investment (like the GLD ETF) is not ‘juicy’ enough, but the violence of the silver market is too much of it, then Royal Gold is one of the best alternatives.