Silver’s moment of truth is here. After a bullish reversal that is about is ongoing for 11 full months now, close to one full year, silver is printing a setup that will either confirm the bullish reversal or invalidate it. This will happen the coming week: August 9th till 13th. Yes, it is our 2021 silver forecast that is going to be validated next week… or invalidated. This is why.

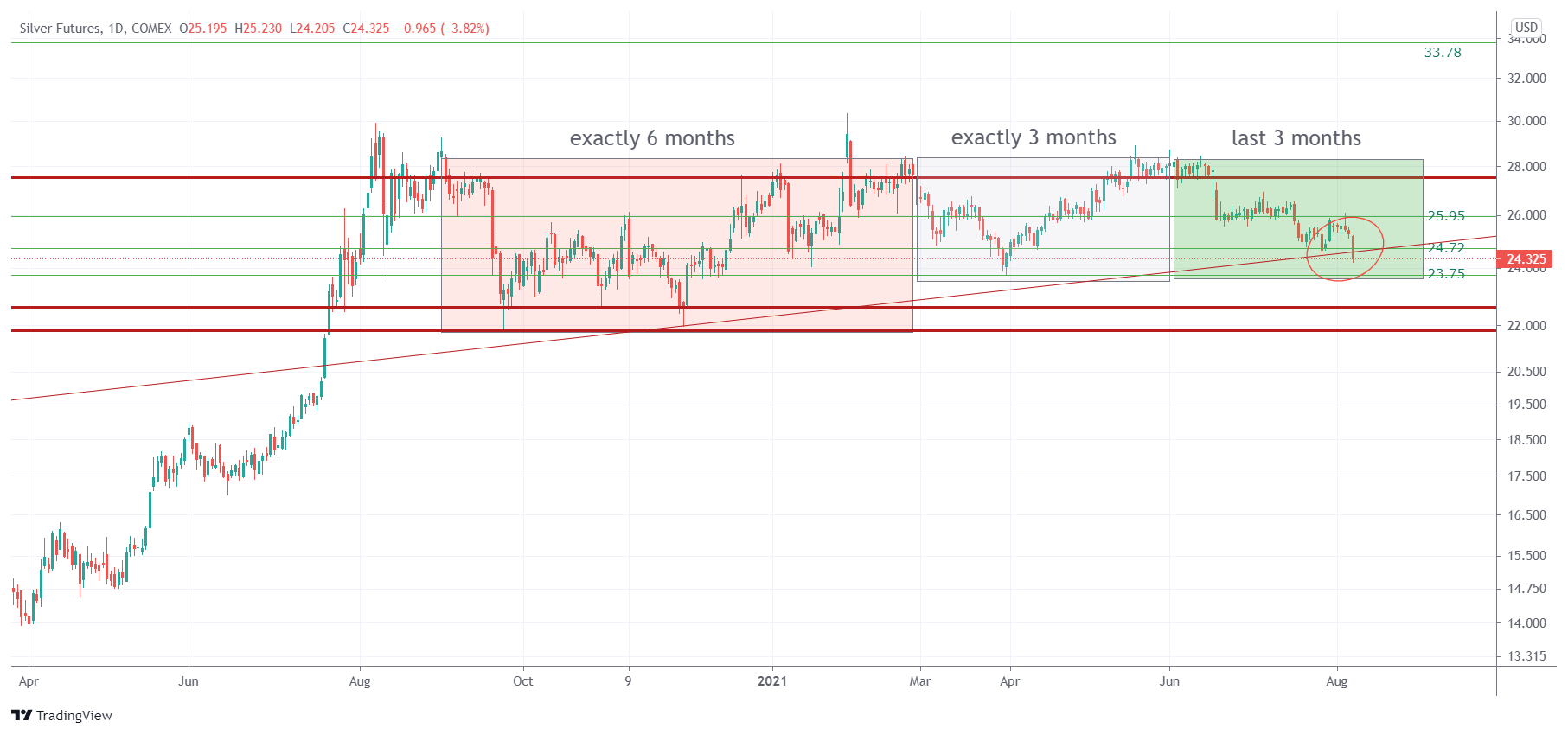

The 3 month cycles dominate volatile markets like silver and crypto, just to name a few.

The silver price chart with the 3 month cycles is the one featured below. We can see how the 6 months (2x 3 months) between September last year and February of 2021 were pretty violent, with a very high level of volatility.

The next 3 month cycle was more orderly, with a bullish micro-pattern right around the end of March / first days of April. The lows of that micro-patterns were 23.75 USD.

Right now, silver is in the 3d month of this current cycle. Silver was looking extremely solid, but Friday’s red candle marks the start of a 3 day decision window that will either resolve as a bullish micro-pattern (similar to the first week of April) or will bring silver below the multi-year trendline. The former scenario would result in a higher low against the previous cycle, the latter would imply that silver’s bullish reversal is weakening (a secular breakout above 28.50 USD is probably delayed with at least 3 months).

The monthly is still very constructive but it’s clear that it has improve quickly now. Silver simply can’t move lower from here. The opposite is true as well: if it moves higher, next week, it will be a very bullish setup that has the ability to blast through 28.50 USD (secular trendline, in green).

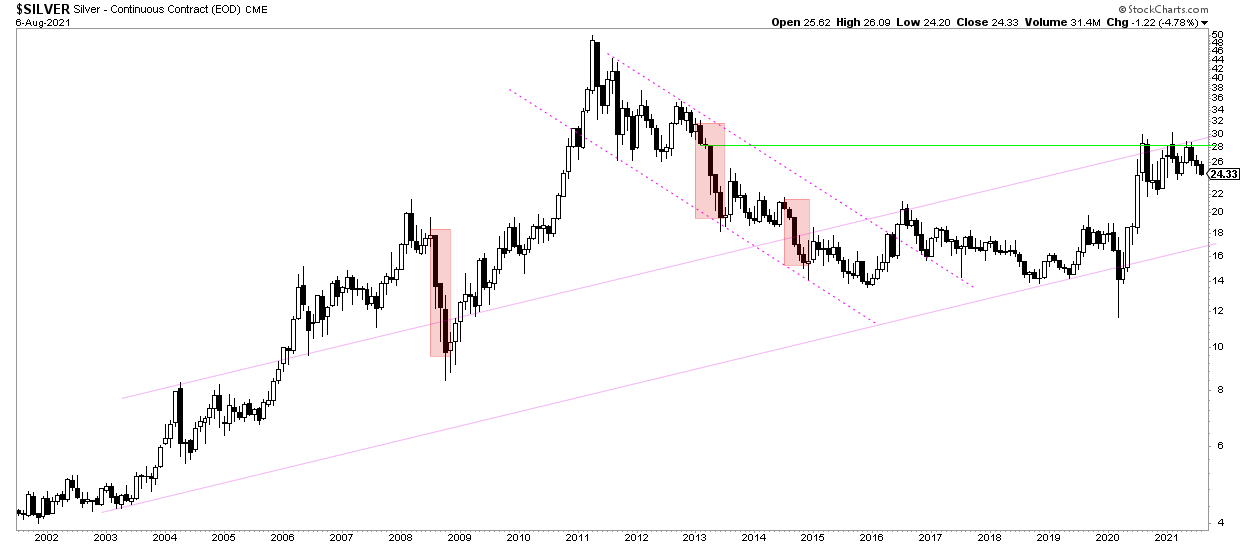

If there is one ‘good thing’ about this monthly silver price chart is that we have had only 3 instances in the last 20 years in which the silver price declined for 3 or more months in a row (red shaded areas): 2008, 2013, 2015. The probability of silver to close this month lower than its opening price is by historic standards not very high. However, this doesn’t mean it can’t happen. We are open minded, we stay unbiased, we simply work with the facts at hand and determine decision windows. The upcoming week is a decision moment for silver (and gold), simple as that.

In our Momentum Investing service we are about to publish a very detailed analysis of the silver market. Moreover, we have a plan ready in case silver would invalidate its wildly bullish setup: a shortlist with 6 stocks that have phenomenal reversal setups.