It is going to get volatile in the silver market. We expect to either see a long term bottom which eventually will push silver to our long standing silver price forecast (higher 30ies) or continued/ prolonged struggles in the lower 20ies.

Silver has been an important topic for us in 2021. We keep on covering silver not only because we continue to believe that the long term setup is really bullish but also because we believe we owe our readers coverage on this (one of the favorite topic among many of our followers).

We look at 2 silver price leading indicators in this article. Interestingly, both are pretty extreme.

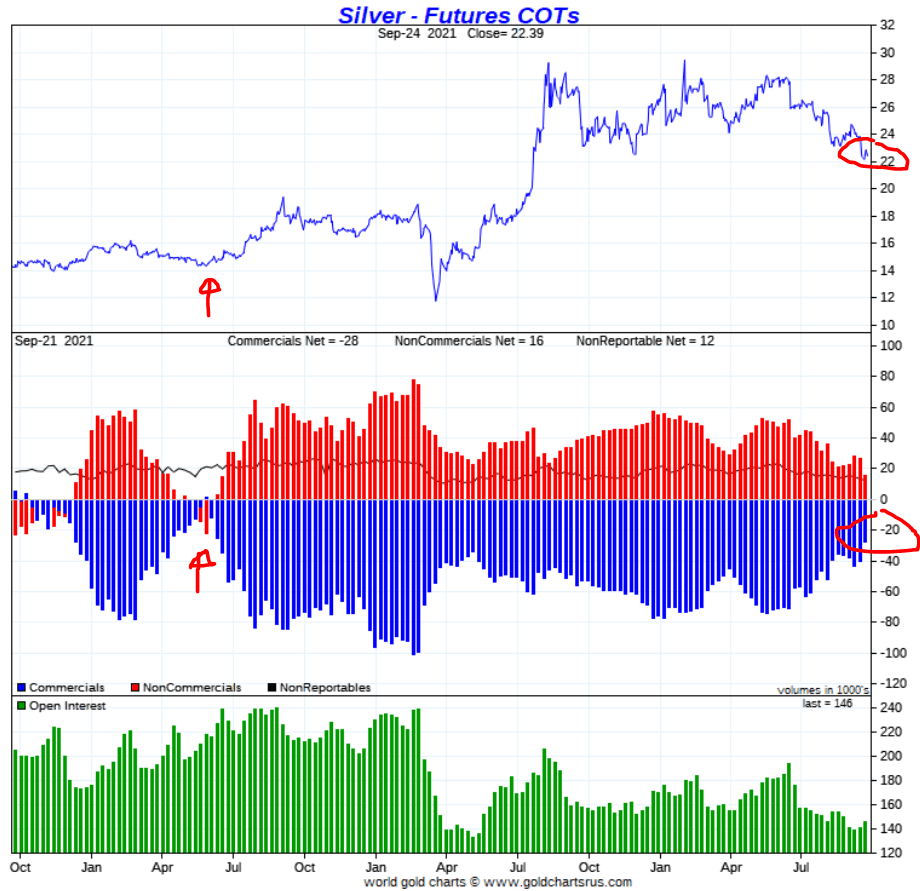

On the one hand the silver CoT report is turning really bullish. As said, you should think of the CoT report as a ‘stretch indicator’.

The blue bars representing net short positions of commercial traders in the futures market (think some large banks) now have the lowest net short position:

- The higher their net short position the more the silver price is capped.

- The lower their net short position the more support the silver price will find around current levels.

The last time the net short position of commercial traders was as low as today was back at the start of the summer of 2019 right before silver went up 50% and silver miners 100%. Not saying a silver explosion is about to start tomorrow, just putting things into perspective.

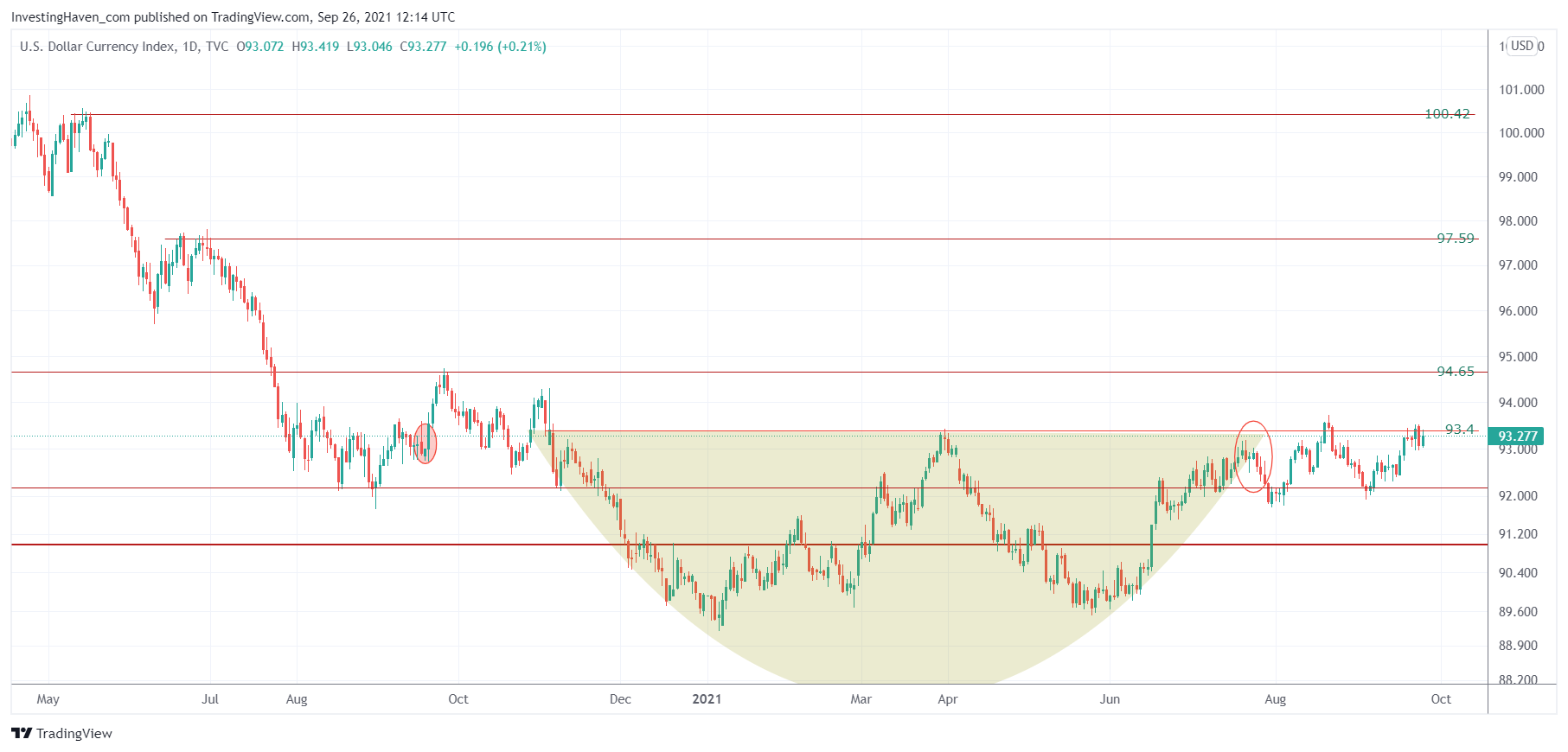

On the other hand the USD is still not giving up. It has an aggressive setup. A move above 94.65 will be really ugly for commodities. The opposite is true as well: if the USD fails to move above 93.4 and next 94.65 it might drop back to 91 or lower which would be great news for gold and silver.