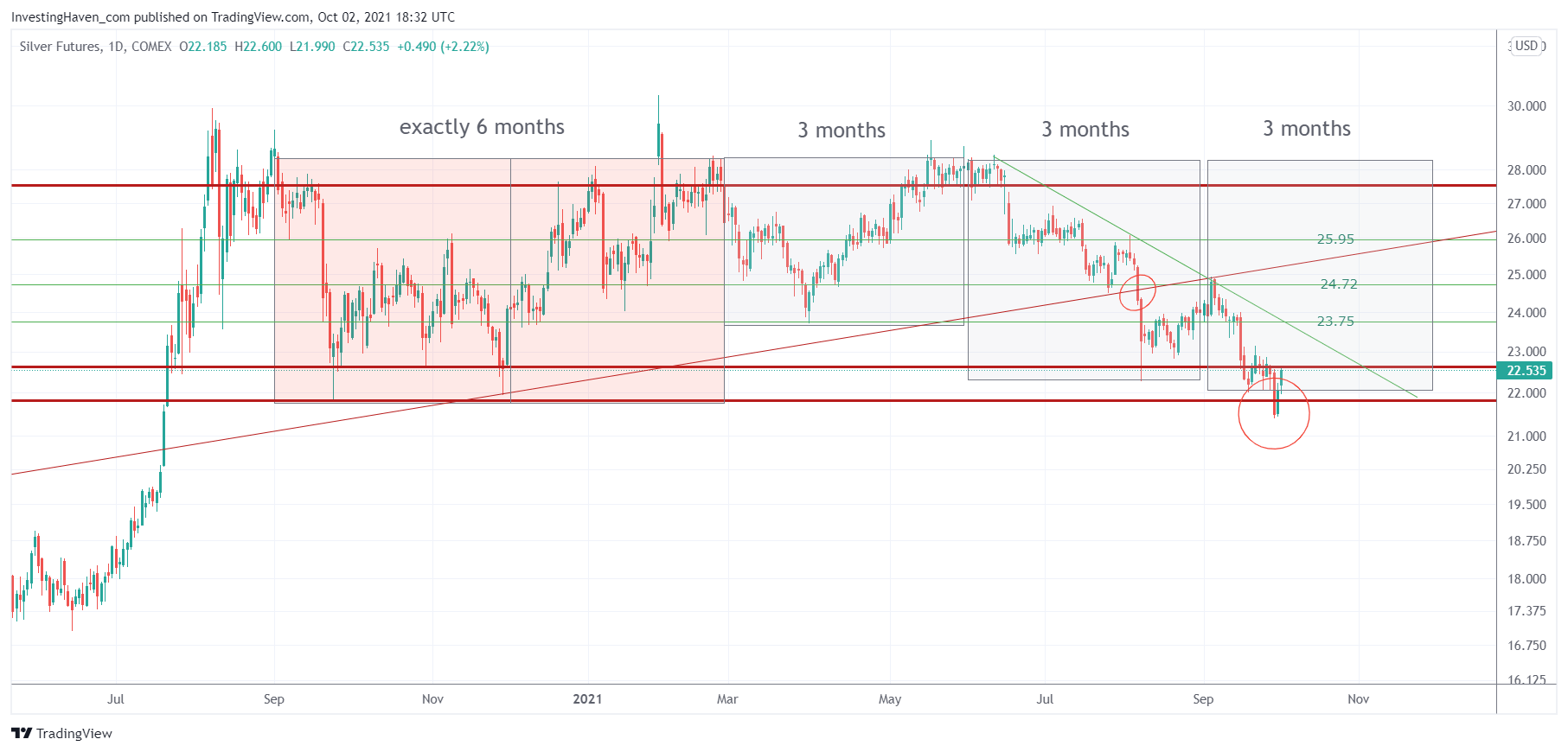

Last week we wrote about the extreme situation in which silver found itself: Silver Reaching Extremes: Silver Futures Market Positioning vs. USD. The point was very simple: silver has conflicting leading indicators. The USD is clearly not letting silver do its thing while the futures market setup was (still is) considerably improving. Which leading indicator will win on which timeframes (short vs long term)?

The market spoke this week, and on the short term timeframe it is clear that the USD has the last word.

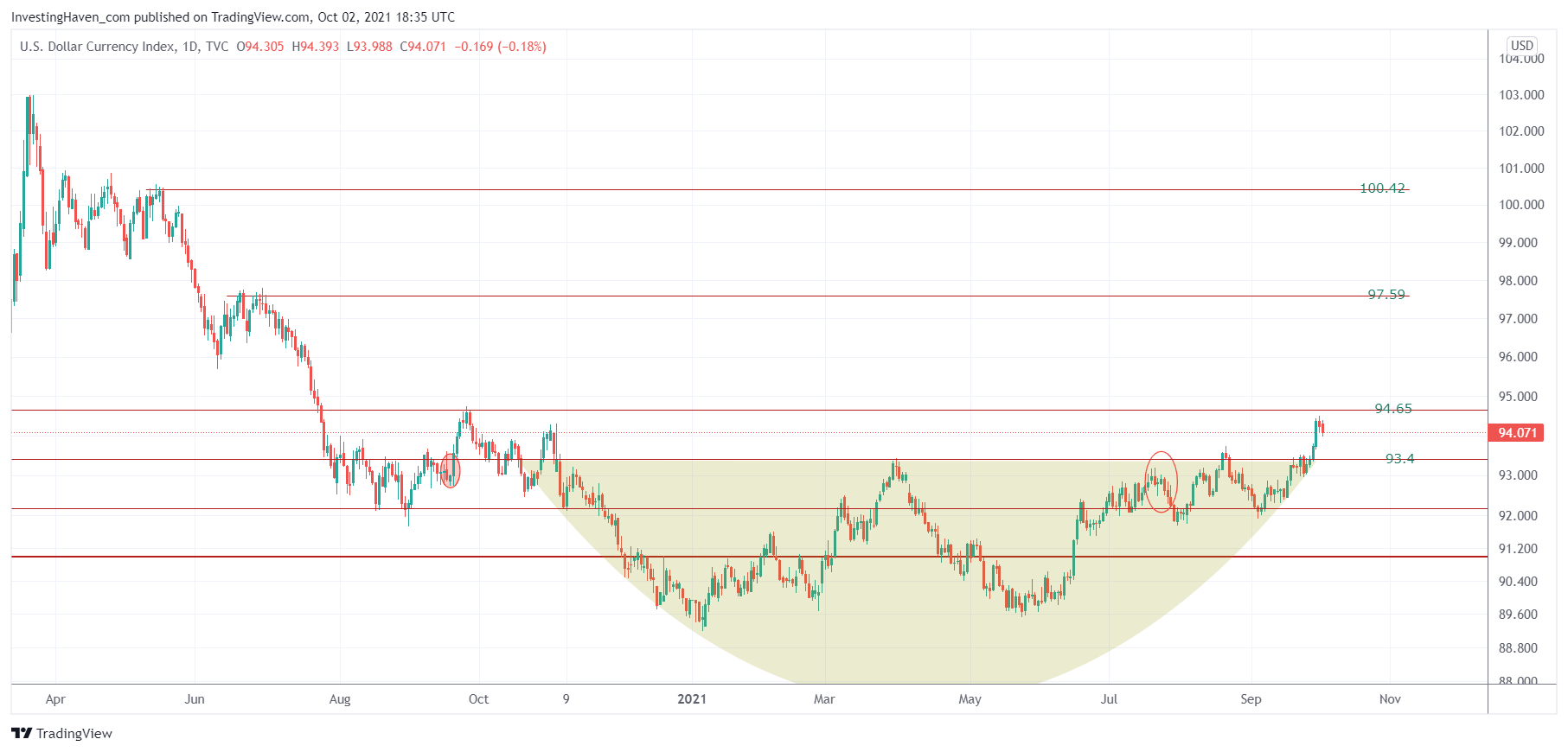

The USD broke above the level which we have for a year on this chart: 93.4 points. We also mentioned that 94.65 is the last resistance level before things get ugly, not only for silver but for all markets globally.

So far it looks like 94.65 is providing resistance. This is subject to change, and the bullish reversal we get on the USD chart might need more time to resolve higher. Regardless, the USD is on a mission, and 97.50 points is the mission unless bigger forces can stop this.

The precious metals market is suffering because of the USD setup. Short term, it is primarily a matter of holding up for silver. Long term the bullish reversal is still there, no structural damage yet but the point is that repair time for silver has gone up significantly.

This really means that investors have to make a choice as per their timeframe, risk tolerance and alternatives:

- High risk tolerance, long term timeframe, not many alternatives: stay long silver, presumably healthy to reduce some exposure on a bounce.

- Low risk tolerance, medium term timeframe, many alternatives available (as per one’s own assessment): reduce silver positions and rotate into other sector(s).

The USD impact on precious metals has been unusual in 2021: an unusual level of intermarket dominance is what we saw. It feels like David vs. Goliath which presumably is not going to change in the short to medium term.

In our Momentum Investing portfolio we see a few very juicy setups which justify reducing silver exposure and rotation into a few select sectors. Note that we don’t see many opportunities, but the ones we see are unusually attractive.