Last week we made the point that the Biggest Investing Opportunity Of This Decade is the commodities that are required to enable renewable energy. Some call it ‘green metals’, others call it ‘metals for renewables’ or ‘metals for green energy’. We call them ‘strategic metals’. Our historic study suggested that this sector of strategic metals might morph into the biggest investing opportunity of this new decade, similar to the secular bull runs in gold and crypto in the previous 2 decades.

We said last week that “it makes so much sense that the big booming industry in 2021 and beyond will be commodities that are inputs into renewable energy. Think strategic metals like lithium and cobalt, but also rare earths like titanium and rutile. Think nickel and graphite. Think vanadium.”

We applied a rationale to come to this outcome:

Green batteries for cars, planes, but also homes.

Will this be the next big thing. Will this offer once-in-a-lifetime type of opportunities?

It could be. Probably it will. But specifically the commodities that are inputs into this secular renewable energy wave.

Why?

Simply because of the big rotation that comes with market crashes. We saw this in 2000 and 2010 so we should see it again in 2020 and beyond. It is commodities that came out of a major bear market, so some segments in the commodities space should create a secular trend in 2020 and beyond.

Moreover, this makes sense, fundamentally. Commodities prices typically react on supply/demand dynamics. If renewable energy is going to continue to grow this decade it will be the commodities as inputs into green batteries that will be in high demand, ultimately even potentially in supply deficit. IF this is what’s underway the market will react to this, way before the real deficit hits in the real world.

This post provides some more depth into strategic metals, and we selected a few external sources that can help us with this.

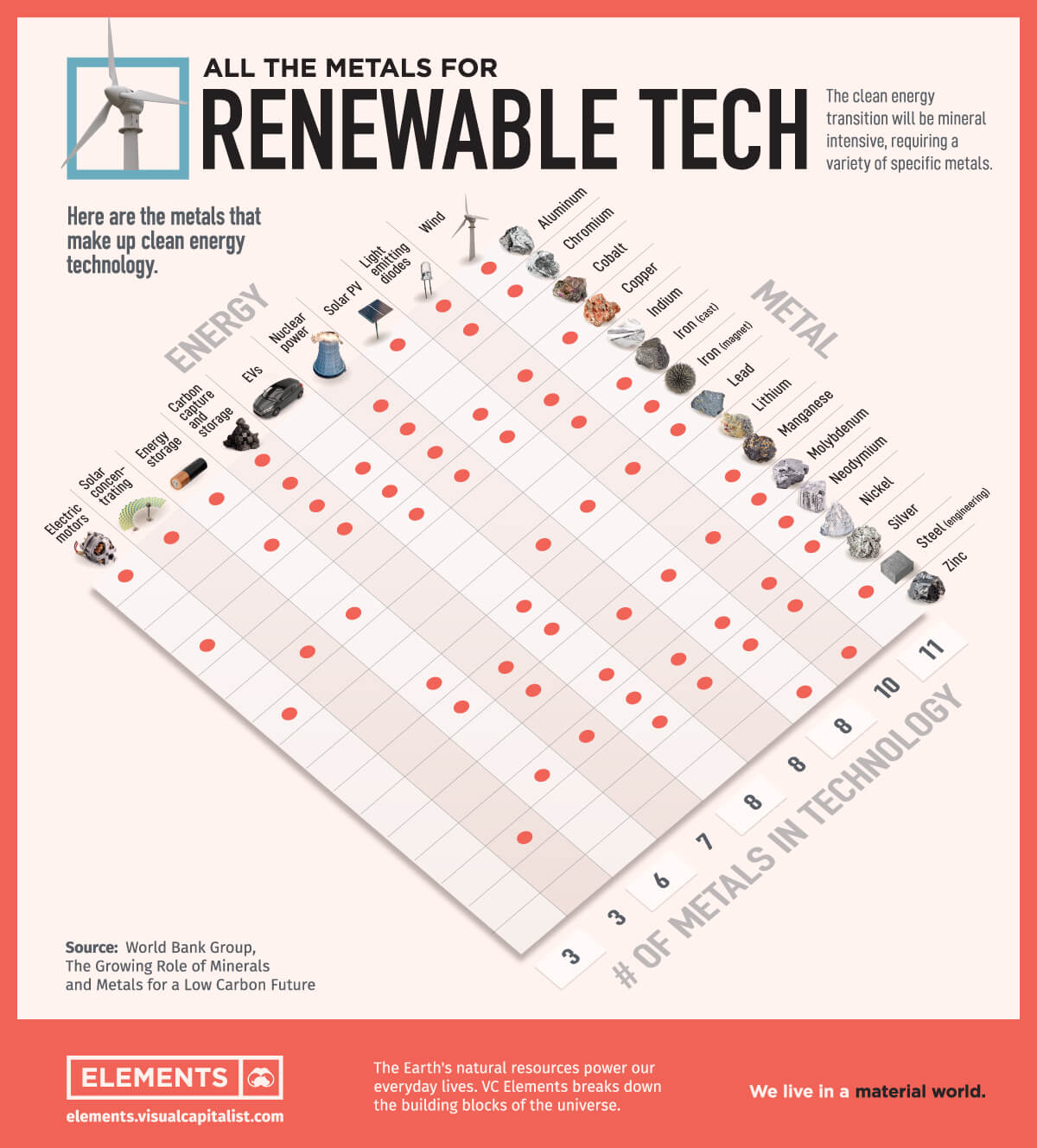

One such source is visualcapitalist.com which has 2 relevant infographics. This first infographic provides a list of different types of metals that are inputs into clean energy. It helps us understand the utility of each.

Visibly, aluminium / copper / molybdenium / silver / nickel are the metals with the widest utility.

As per visualcapitalist.com, the mining industry needs to invest $1.7 trillion over the next 15 years to supply enough metals for renewable tech. “However, the mining industry is not ready to support an accelerated energy transition. While there are a host of projects at varying stages of development, there are many risks that could increase supply constraints and price volatility.”

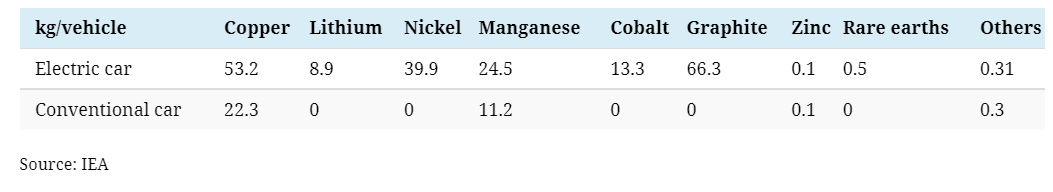

Similarly interesting is the difference in strategic metals that EV require compared to conventional cars:

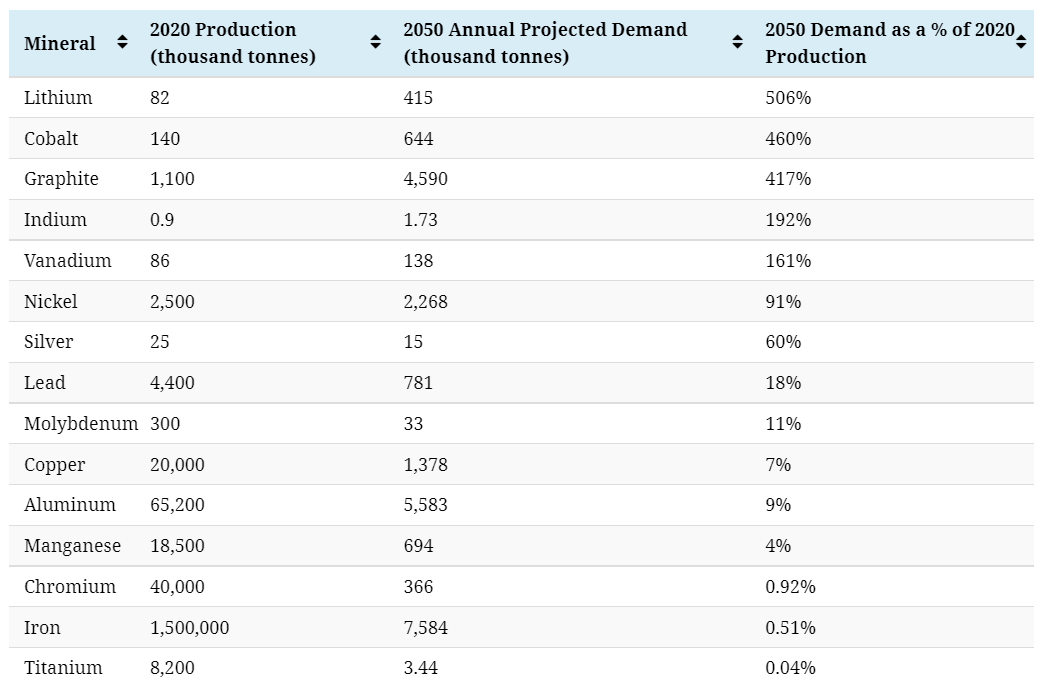

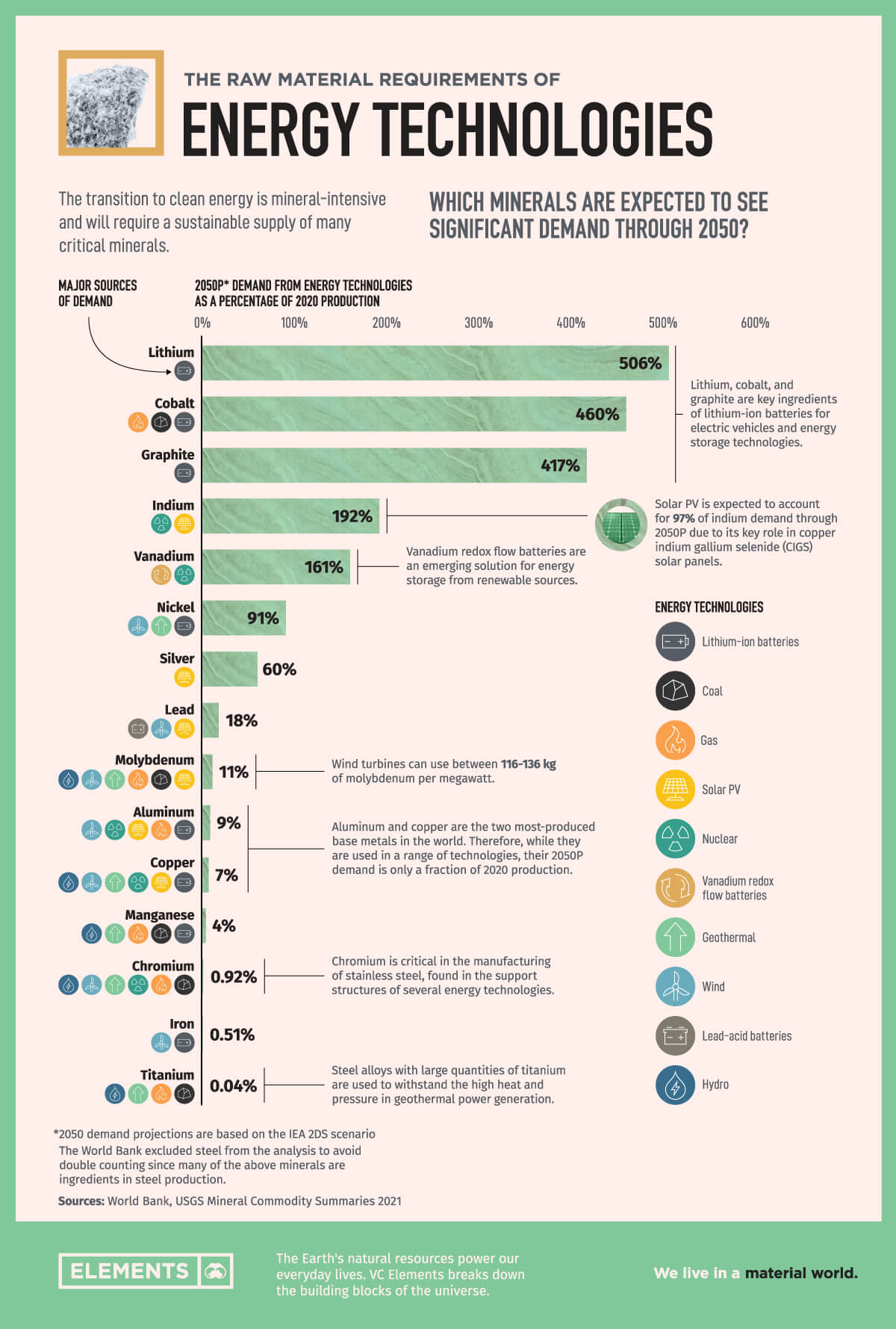

While the previous infographic showed utility it didn’t talk about deficit. That’s why we like the next infographic. It helps understand volumes, particularly the supply deficit over the next few decades as the green energy boom accelerates.

The demand for these energy technologies and minerals will grow alongside our energy needs. Here are some of the minerals that are expected to see increasing demand from energy technologies through 2050, relative to current production levels:

These data points help us understand that we should focus on lithium, cobalt, graphite, indium, vanadium and nickel. All of them are strategic metals.

EV sales data suggest that 2021 is the year which will be a turning point. While many are talking about and expecting the metals boom since many years it is only since 2021 that the demand side is ready to put pressure on the supply side.

The point is this: history shows that bull runs in these metals don’t happen concurrently. They rise one by one. As an investor the trick is to be go overweight, per strategic metal, as each bull run unfolds. It’s ok to keep a one or two smaller allocations for the long term, but we want to have a larger allocation in each bull run. That’s exactly the strategy we will apply in this strategic metals super cycle, particularly in our Momentum Investing strategy and portfolio.

Consequently, these strategic metals are the ones we deeply researched, and they will be the focus of our Momentum Investing portfolio in 2021 and beyond. We expect to hit many multi-baggers in these strategic metals. We are currently fully invested in metals, partly strategic metals and partly silver. It’s not too late to join, as current prices are not far from our entry prices.