For a few months we did not look into the uranium market. As per our 2020 forecasts we did not expect this market to do well. However this may be changing now with an explosive breakout that took place this week. Will uranium become the other bullish commodity next to gold? It could make sense because as per our forecast made last week Commodities Are Setting A Major Bottom, Ending A Long Term Downtrend. Some commodities will be the leaders, and the combination of gold and uranium as the outperforms in this early phase of the new commodities trend might make sense.

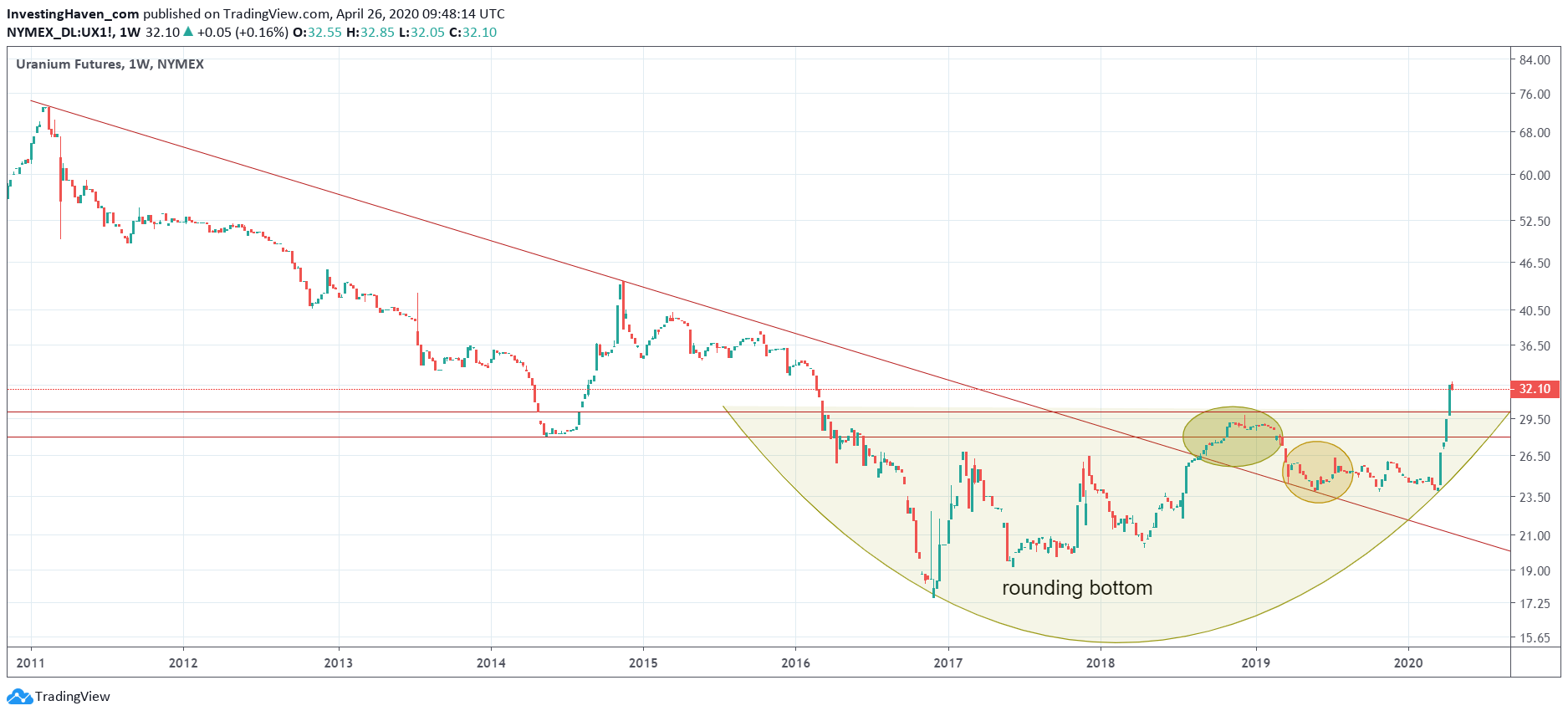

The chart of the uranium spot price is featured below.

Note this giant rounding reversal pattern, a huge W with a higher right leg, combined with a 4 year horizontal breakout. This is according to our research THE most poweful bullish pattern that you can imagine. It has 2 components: a W-reversal with a higher right leg, and a horizontal breakout over a long period of time.

This setup bodes really well for uranium miners. Several of them have doubled in the meantime since the March lows.

There is no need to chase prices. At the start of a new bull market in these commodity segments (gold miners, uranium miners) it is only a handful of investors that can imagine to which levels these miners can rise. So timing a great entry is important, and avoiding chasing prices higher is even more important.

We are not going to chase the uranium market. However we track this market closely. If we are going to take a position it will be in our premium research where we currently hold a gold position and a hedge against the most cataclysmic crude oil crash in history.