One standard practice in our research is to evaluate the bullish but also the bearish case of investing opportunities we assess. When it comes to commodities it is best practice to always check any opportunity against the USD trend(s), and look for correlations between individual commodities markets and the USD. What does the USD tell us about our commodities outlook for 2021?

As said many times in the past we believe 2021 and possibly 2022 will be big for commodities.

They also tend to move in cycles/ sectors, so you don’t get a one-size-fits-all answer when assessing the USD against commodities. It’s a case by case assessment you’ll have to do.

As commodities bulls we don’t want to see a strong Dollar: a very strong Dollar particularly, as it will push commodities down.

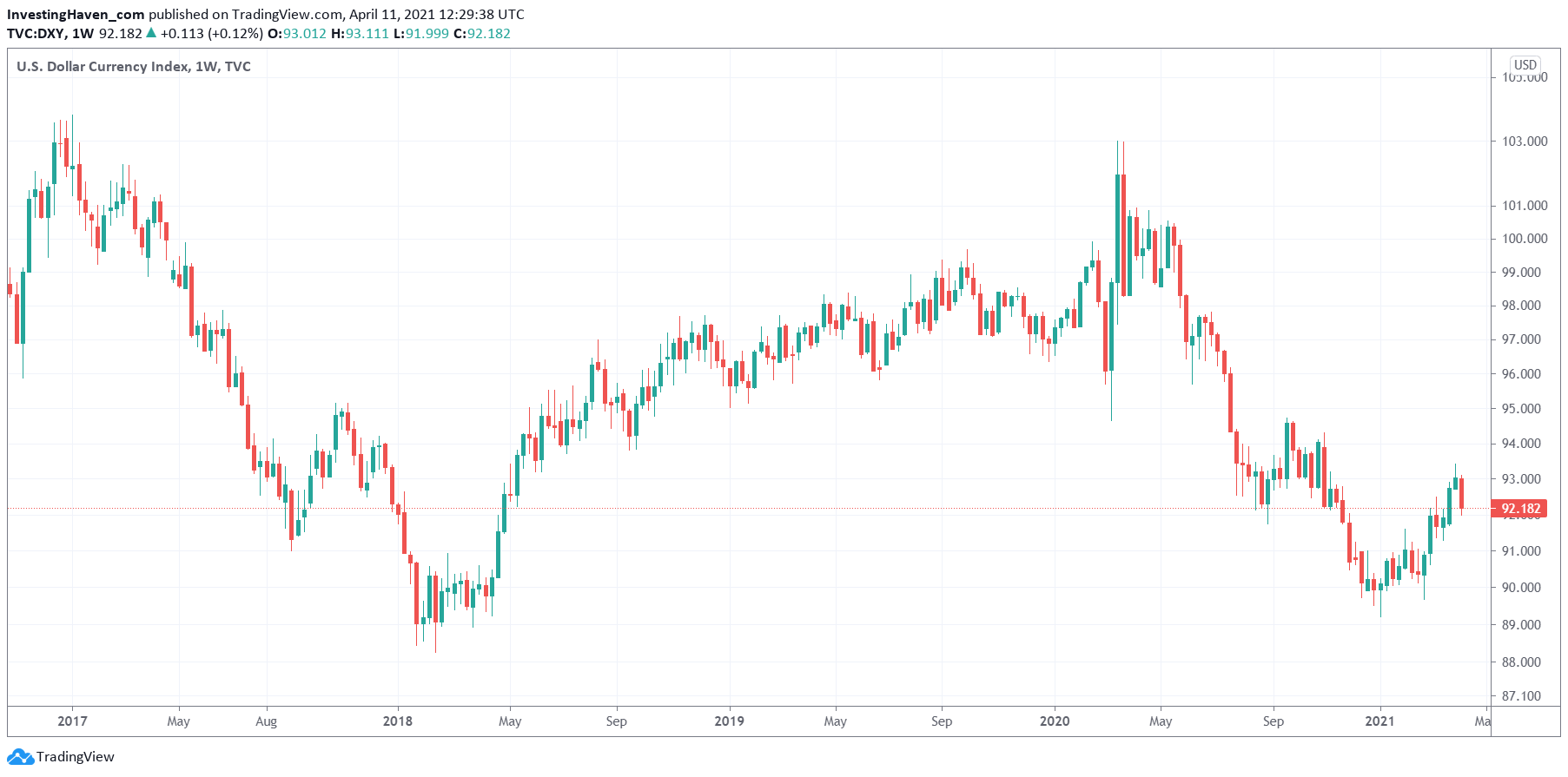

Is there any finding that comes out of the USD chart, with the USD being the ultimate bearish driver against commodities?

We need the weekly USD chart in order to answer this question, and the answer is surprisingly short. From our detailed weekend update in our Momentum Investing research sent to members today:

The weekly USD chart does not suggest strength in the USD is here, on the contrary. The recent attempt of the USD to move higher was not impressive. It did create some damage, but nothing big. More importantly, the USD is hitting resistance now. A break above 94 points would be big, but that’s not likely in the short to medium term.

Is it that possible? It’s that simple to understand a bearish case, or lack thereof.

This does imply that individual commodities are set to shine in 2021 and 2022, for as long as the USD remains below 94 points.

So the one and only thing that commodities bulls have to do is assess each commodities market to find the one(s) that is (are) ready to trend.