It has been quiet in our crypto auto-trading since 8 months. However, behind the scenes a lot has happened.

In this article, shared with the group of members that expressed interest in auto-trading, we share our thinking and the evolution of our crypto auto-trading service. We explain why we decided to discontinue the service the way it was originally designed, but share 2 alternative options for which members can indicate their interest (through a survey).

Macro-events that exposed risks of crypto auto-trading

- It started with the SBF drama and FTX implosion, on November 9th, 2022. While the crypto market was prime for a breakout, we got a mini-crash that sent all tokens significantly lower. On November 8th, we had an open position in crypto auto-trading, because of our long term focus our stop loss kicked in a few hours too late and we closed the position with a double digit loss, a scenario we wanted to avoid at all cost.

=> Our response to this ‘black swan’ type of event: we finetuned our algorithm on a lower timeframe, this optimization allows for quicker response times in case of an accelerated move lower. Our work was complete by December 2022, it has proven to be successful as evidenced by the signals we got in 2023 (see BTC + ETH charts embedded below). - In March, when we were ready to re-open crypto auto-trading for our members, the Silicon Valley Bank imploded. It was the fastest bank run in history of the U.S. The problem is that Circle, issuer of what was considered the safest stablecoin, USDC, got funds locked into the Silicon Valley Bank. Please read this article to refresh your mind USDC depegs as Circle confirms $3.3B stuck with Silicon Valley Bank. Over the weekend of March 11th, the USDC lost its peg. A drama similar to FTX and a softer version of the Luna/Terra disaster was looming. A few days later, our algorithm flashed a buy signal on BTC.

=> Our response to this ‘black swan’ type of event: puzzled, completely puzzled, is how we felt back then. In no way would we have allowed a buy signal to be sent to our auto-trading members, we would have blocked the signal. In hindsight, it was the best entry point.

=> We worked out a solution. We started thinking in the direction of having members keep their funds in USD. Our tech team started solutioning how to convert USD in USDC or USDT exactly the moment a buy signal comes in. When selling, we would convert the cryptocurrency into a stablecoin and right after into USD. This would come with higher transaction fees, but we would circumvent the stablecoin risk. Our team prepared developments to implement this feature. - In June, when we were developing the solution outlined above, we were once again caught by surprise. This time around, Binance was sued by the SEC. It ultimately resulted in (a) signs that Binance US would need to shut down (b) no bank transfers nor credit card transfers allowed anymore towards and from Binance.

=> Our thinking after this event: This was the proverbial ‘breakpoint’ for us.

Note that these risks might have destructive effects in volatile times. When the market goes up, these risks remain hidden. It is the sudden way in which these risks can hit our members that is not acceptable for us.

The risk is too high for crypto auto-trading members

After so many attempts to get crypto auto-trading right for our members, finetuning the algorithm to deal with black swan events, handling threats of stablecoin implosions, unstable exchanges and the risk of not sending/retrieving fiat currency from the largest crypto exchange in the world (Binance), it was clearly getting impossible to re-assure decent risk management for members. External factors, not in our control, would hit our members, sooner or later, which is a thought that we cannot live with.

We had to look into a different direction. As a team, we had to accept that all the hard work and our investment in time / effort / capital to establish the auto-trading technology and service would turn out to be a ‘sunk cost.’ No fun, but the reality is clear: the macro environment is too risky to justify offering auto-trading on the largest centralized exchanges based on stablecoins/BTC and stablecoins/ETH trading pairs.

It is what it is.

What’s next? A pivot – similar end results but in a different way.

We certainly don’t feel paralyzed, on the contrary. We feel encouraged because we did undertake action and understood what is not a good solution for members.

All our efforts brought us closer to understanding what would be a much better solution for members.

There are always solutions, also in financial markets. We are solution-minded and result-oriented. Nothing is going to stop us from creating successes from members, on the long run, for members with a long term vision and mindset, similar to ours.

After a lot of thinking, we came up with an exciting option which is outlined below as option #2. There is of course the no-brainer option #1 as well.

We are asking you to complete the survey, which will take you exactly two minutes so you can express your thoughts about the solutions we are bringing to the table. Take the survey here >>

Option #1: crypto buy/sell signals by email, for manual execution

We send you the buy and sell signals by email. We focus on the optimized BTC and ETH strategies which were finetuned to protect from sudden drops by black swan events (like the FTX implosion).

Below is the chart with the results of the BTC buy and sell signals, after optimization, in 2023. In blue you can see the trades we got, as seen we got two trades of which one is still open.

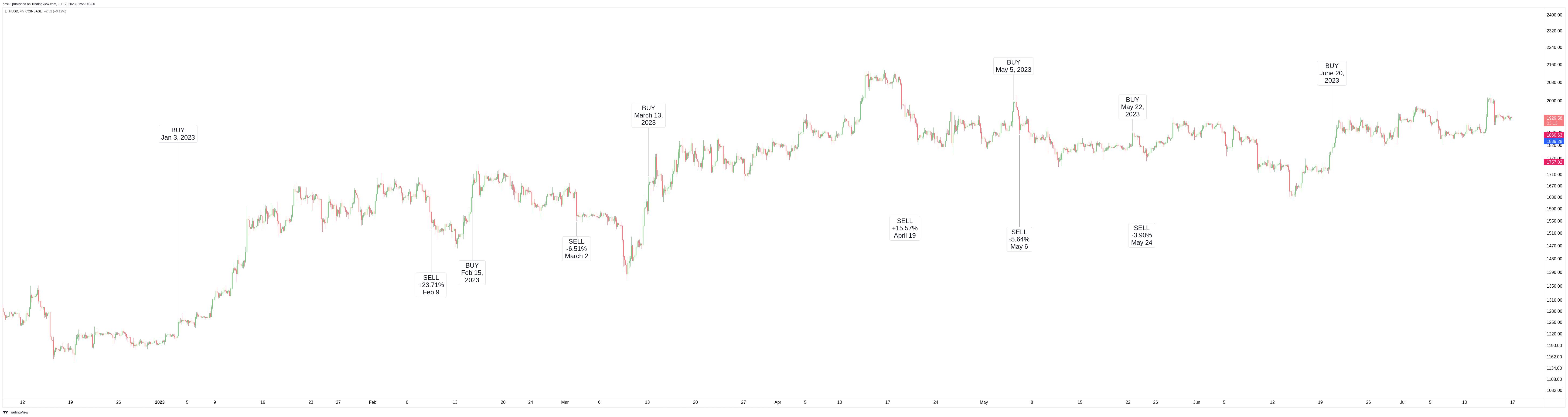

Next is the chart with the results of the ETH buy and sell signals, after optimization, in 2023. There are plenty of them, as you can see, we trade much more often which implies we close the position faster once it becomes clear ETH is not able to rise (protective measure).

Note that this option entails that you receive the buy and sell signals, from both BTC and ETH, which you can use at your own discretion. More importantly, you have to execute the trade manually.

Note: we can also explain how you can receive the signals not only by email but also with a push notification on your smartphone, for free, although a small initial effort will be required to set up a Gmail account.

So, this option is ideal for members that are close to their mailbox and smartphone, able to act fast. It’s not the most convenient solution, but it certainly is an accurate solution which also gives enough flexibility. You can choose in which base currency (fiat, stablecoin) to hold your funds, on which exchange, etc. The risk assessment of stablecoins and exchanges is carried by members.

Option #2: create long term compound effects by combining the free tokens strategy with staking free tokens

As a member of our crypto service, you are already familiar with our strategy to hit the ‘golden weeks’ and combine it with hitting winning tokens with the intention to keep ‘free tokens’.

Thinking long term, three years out, when we expect the top of the crypto bull market to occur, there is opportunity to stake the free tokens in order to sell them at the next market top. This is the concept:

- Wait for the ‘golden weeks’ to initiate a position in a token that has double digit staking rewards.

- Aim to keep free tokens at the end of the ‘golden weeks’: sell the amount of your principal once the token doubles. This requires carefully timed entries.

- Start staking the free tokens. While staking comes with risk, it is happening on free tokens.

- If we are able to do this, successfully, between three and five times in the next 18 months, we will have a compound and leveraged effect at the next bull market top.

Here is a calculation which we do based on TheGraph (chart below):

- Principal amount is $5,000, the token trades at 0.118. We buy 42,372 tokens.

- TheGraph doubles, we sell $5,000 and keep 21,186 tokens. This is a ‘happy day’ scenario.

- We start staking those 21,186 tokens at a reward of 10% per year. The compound effect after 3 years is 28,199 tokens.

- Assume that TheGraph goes back to 1 USD, which is a conservative price target, you will have created $28,199 with free tokens while you got your principal back.

As you can see, TheGraph is very close to a breakout. We can time the breakout for members and send a buy signal when we see it come up. We sell after a 100% rise, no questions asked, start staking the free tokens.

This option #2 requires a long term vision, lots of patience and no ‘get-quick-rich’ mindset… nor a ‘to-the-moon’ expectation. We try to hit between 3 and 5 success stories, in a risk managed way we let the market work for us and let time create value.

This option #2 also requires that you take the entries and exits, as well as initiate the staking process on trusted exchanges.

In the worst case scenario, the price of the token does not move higher (you end up with tokens with a low value). In relative terms, the risk and potential damage (worst case) is contained because the holdings should be ‘free tokens’.

Please complete the survey

We are asking you to complete the survey, which will take you exactly two minutes so you can express your thoughts about the solutions we are bringing to the table. Take the survey here >>