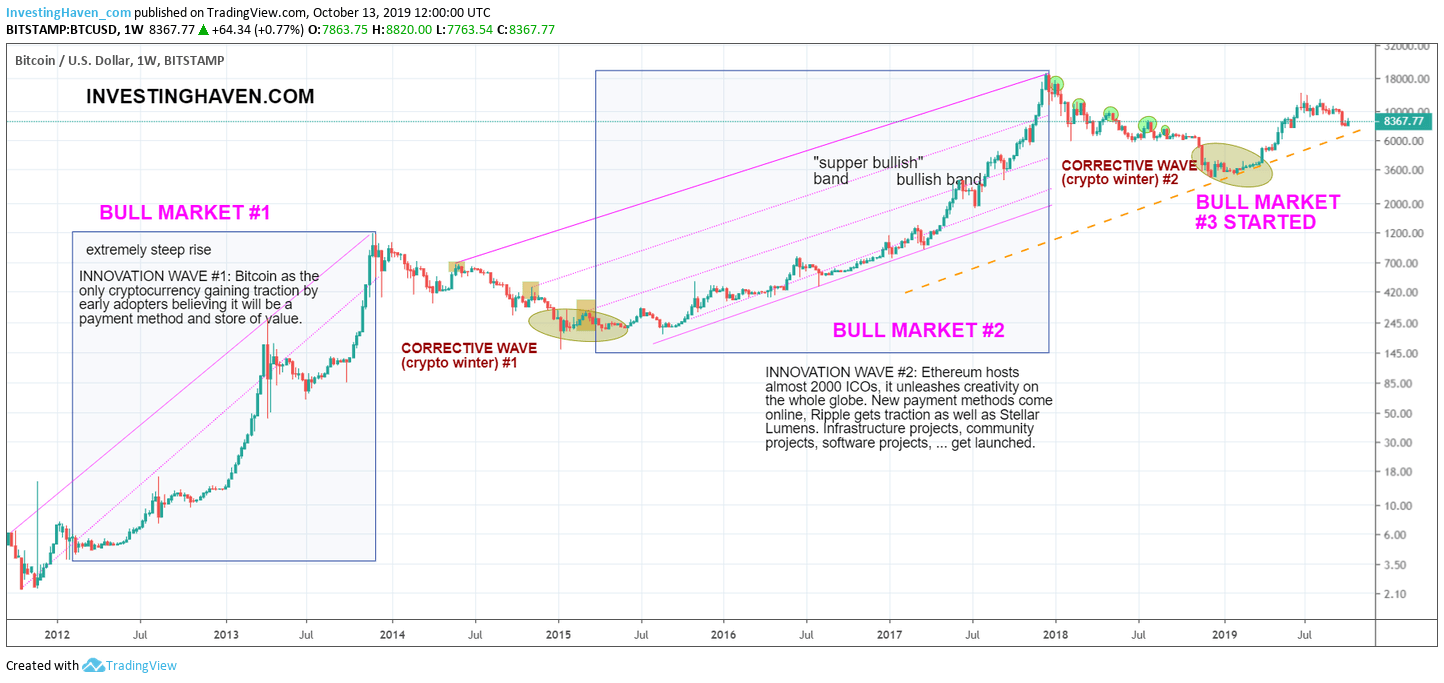

It is no secret. We expect the crypto and blockchain bull market to accelerate in 2020 and 2021. We have used the term ‘crypto bull market #3’ throughout the year. It indicates a secular move higher which typically starts slowly with rough sell offs, but then morphs into a strong long term rally. We were among the lonely voices in the world to signal the start of the new crypto bull market in February of this year, when 99% of people was convinced that crypto was done for once and forever. We even said this in the public domain, and confirmed the start of crypto bull market #3 on April 2nd in this article Bitcoin & Crypto: Bear Market Officially Ends Today, Bull Market Officially Starts Today. Today we see sufficient signs of our prediction to come true. More importantly, we learnt a lot this year on what is and isn’t working well for blockchain and crypto investors. These are the 10 most important things to remember going into 2020.

The chart embedded below illustrates what we mean with our ‘crypto bull market #3’ statement.

As the crypto and blockchain bull market is going to accelerate any time soon as per our 2020 forecasts we want to share 10 important learnings from the crypto bear market as well as the early phases of the new bull market this

Note that all these insights come from our crypto & blockchain investing research service, but they are somehow generalized. That’s out of courtesy for premium members. Anyone who wants to know all the details should just sign up for the service as there is instant access to all the detailed materials. You can make our materials actionable as of the first second after signing up.

- The number of cryptocurrencies that add real value is really limited. Out of the 2000 cryptocurrencies in existence is less than 1% that will create value in the real world. Many are scams or just geeky (too much focused on technology specs and not on solving a problem in the real world). Per our 1/99 Investing Principles we expect maximum 20 cryptocurrencies to get to the stage of adoption.

- It is adoption in the real world that will drive cryptocurrencies prices in the longer term. We updated our top cryptocurrencies list. It is clear that a handful shows signs of adoption going into 2020. Those are the cryptocurrencies to hold for the long term.

- Libra, the cryptocurrency project of Facebook and its network of partners, is failing miserably, according to this WSJ article. No surprise, but what do we really learn from this? There is one learning: creating a successfuly cryptocurrency is really, really a complex undertaking. It is no coincidence that some of the most successful cryptos have been growing at what many tend to call a ‘disappointingly slow pace’. The key message is this: you need to focus on growing an ecosystem with real life use cases if you want to have a successful cryptocurrency. Again, the majority will fail, only a handful did find the recipe to success.

- Ripple as a company and XRP remains the most promising crypto project and cryptocurrency out there, period. Look at the accomplishments in the last 18 months, especially the acceleration of use cases in the last few months. Not any other crypto is able to replicate this success.

- Statistics on usage of crypto based applications remains surprisingly low, especially looking at the most known blockchain networks like Ethereum, EOS, and the likes. We believe the holy grail is elsewhere, not in consumer oriented apps.

- We expect a lot from the Trusted Compute Framework. This is a framework in which trust based apps can be developed on the blockchain. Intel is driving this with many partners, even other tech giants. We keep a very close eye on this trend in 2020.

- We did identify one cryptocurrency that looks extremely promising, and can play in the same league as Ripple and XRP. We talked about this in our Investing Opportunities #11: A Crypto Multi-Bagger In The Making Going Into 2020.

- Most pure play blockchain stocks did not prove they can be viable businesses. Most of them are even today still ‘under narcosis’ from the 2017 hype. Financial results and growth evidence from blockchain stocks are a disaster. Our top 10 list in the meantime became a top 6 list. In there we identify 3 blockchain stocks that are worth buying.

- Even in 2019 after such a strong rally and confirmed breakout in cryptocurrencies we still see crypto investors being greedy. They ask: “how comes your 50-fold price rises did not materialize yet.” Even though we stand very strong and 100% back up our forecasts and long standing price targets we see crypto investors are way out of synch with reality. A 50-fold increase in a price is something hardly any investor has experienced to date, with the exception of a select number of crypto investors. Locking in 50-baggers requires hard work, patience and being smart. Lots of crypto investors simply don’t get it.

- Should we give up on crypto and blockchain in 2020 and beyond? No on the contrary we should learn a lot from the last 12 to 24 months! As an investor we know that a handful of cryptocurrencies should do extremely well. For stock investors there is less than a handful of blockchain stocks to hold, and their returns will be much smaller than those of cryptocurrencies. We expect an acceleration to take place in 2020, you don’t to miss this like 99% of investors who got into crypto in 2017 near the peak.

From a fundamental and technological perspective we want to conclude with this classic phenomenon which we also see now in the blockchain sector:

We tend to overestimate the impact of a new technology in the short run, but we underestimate it in the long run.

It’s an observation from Roy Amara, and spot-on for blockchain according to us.

We firmly believe in our price targets and forecasts, and invite people to get all our detailed and actionable insights on a weekly basis. Sign up here >>