Apple, Tesla, Bitcoin, Ethereum, silver, and gold offer strong growth, innovation, and protection in a diversified 2025 portfolio.

Building a diversified portfolio that spans growth stocks, top-performing cryptos, and inflation-resistant assets is a powerful way to balance risk and reward.

With mid-2025 trends shaping the market – AI innovations, shifting EV dynamics, and macroeconomic uncertainty – most investors are keen on building a diversified portfolio. To help you, we have identified 2 stocks, 2 cryptos and 2 precious metals you should be focusing on right now.

Best Stocks to Buy

Apple Inc. (AAPL)

Trading around $215 and sporting an attractive forward price-to-earnings P/E of about 30, Apple continues to show relative stability despite recent volatility.

While shares have pulled back about 1.3% ahead of its July 31 earnings release, analysts expect modest revenue and earnings growth; consensus estimates point to 3.7% revenue growth and earnings around $1.42 per share.

Down 13% year-to-date, Apple stock is particularly exciting to own as an upgraded AI roadmap, hopefully at its upcoming earnings call, could push growth beyond hardware sales.

A 0.49% dividend yield adds to the list of reasons to stick with AAPL shares.

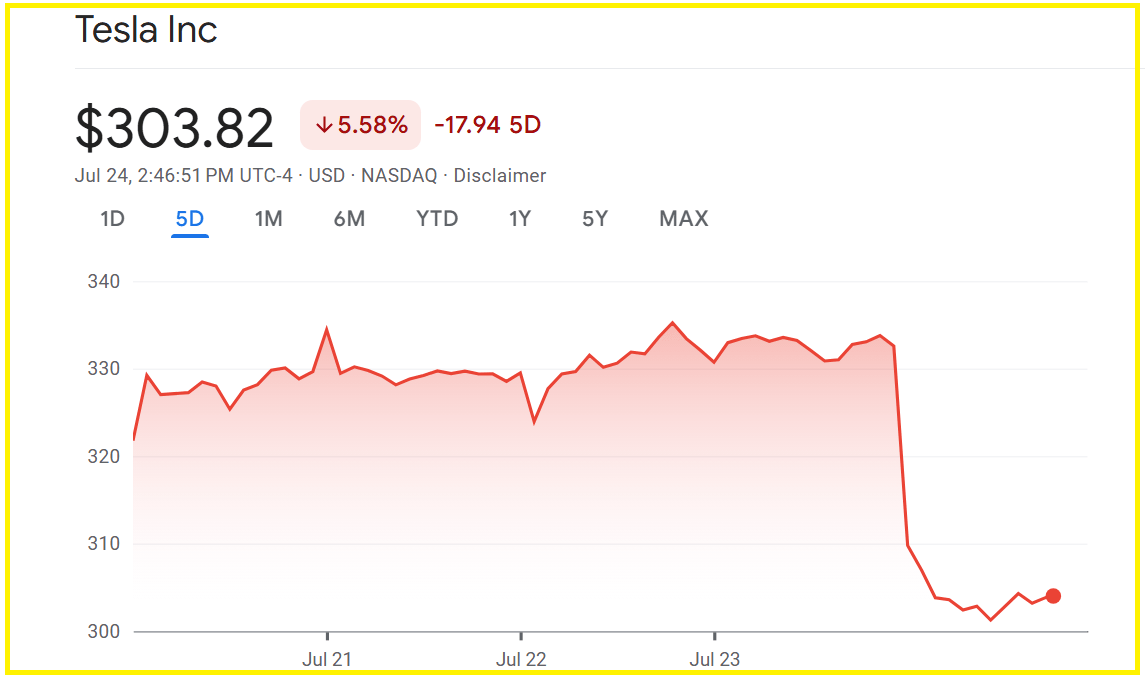

Tesla Inc. (TSLA)

Tesla shares trade near $304, dipping over 9% this week amid a rough Q2 report showing a 12% revenue drop and vehicle deliveries down 13.5%, the worst slump in a decade. CEO Elon Musk warns of “a few rough quarters” while pivoting focus toward robotaxis, AI, and energy services.

Despite near-term headwinds, like tax credit expiration and stiff competition from BYD, analysts like Wedbush see a “golden age of autonomous” unfolding, potentially lifting shares 40% if Tesla executes on volumetric robo‑taxi rollout.

With Dojo beefing up its machine‑learning edge and robotaxi pilots underway, TSLA remains a high‑risk, high‑upside play on auto innovation.

Best Cryptos to Buy

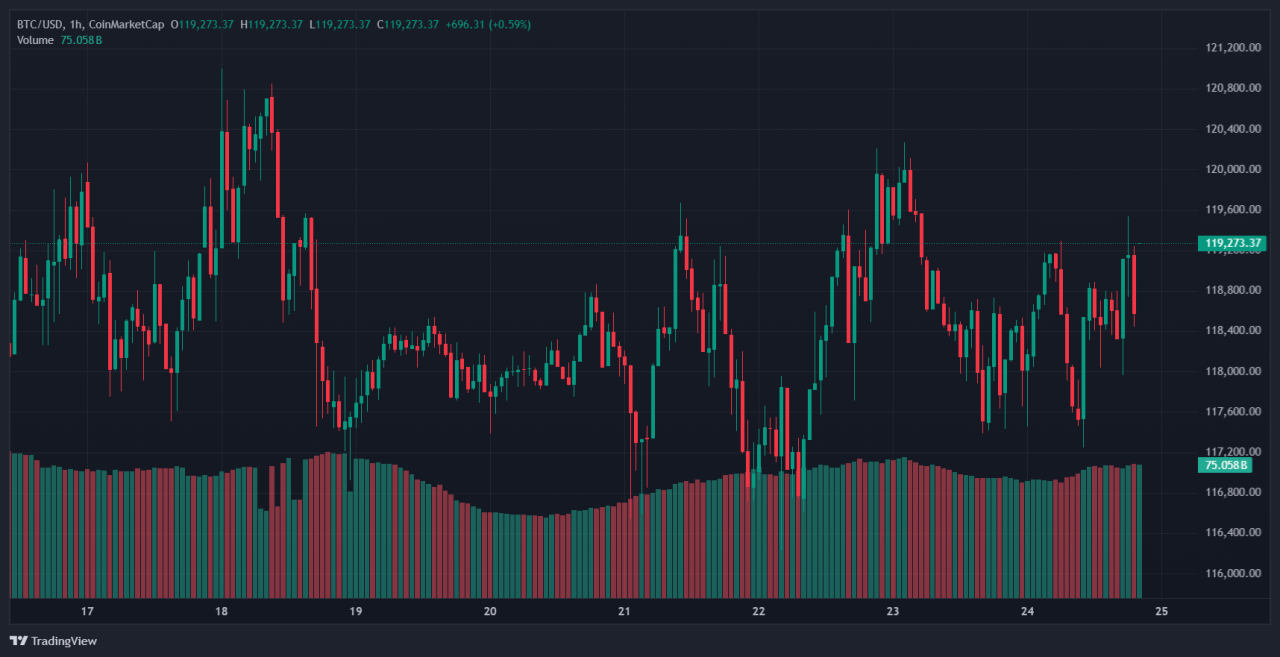

Bitcoin (BTC)

Bitcoin is hovering just above $119,000, and remains the top asset in the digital currency world. Its surge past $123,000 was driven by inflows into new spot Bitcoin ETFs as well as renewed institutional interest.

ETFs now hold over $125 billion in Bitcoin assets, accounting for more than 6% of total circulating supply. Corporations like Strategy (formerly MicroStrategy) continue to buy aggressively, adding another 4,980 BTC recently to reach nearly 600,000 BTC on their balance sheet.

Analysts forecast Bitcoin could reach between $160,000 and $200,000 by the end of 2025. Standard Chartered sees a target of $200,000 based on institutional ETF demand and constrained supply after the April 2024 halving.

Its role as an inflation hedge, response to geopolitical tensions, and growing treasury allocations by institutions makes it a rich part of any diversified portfolio.

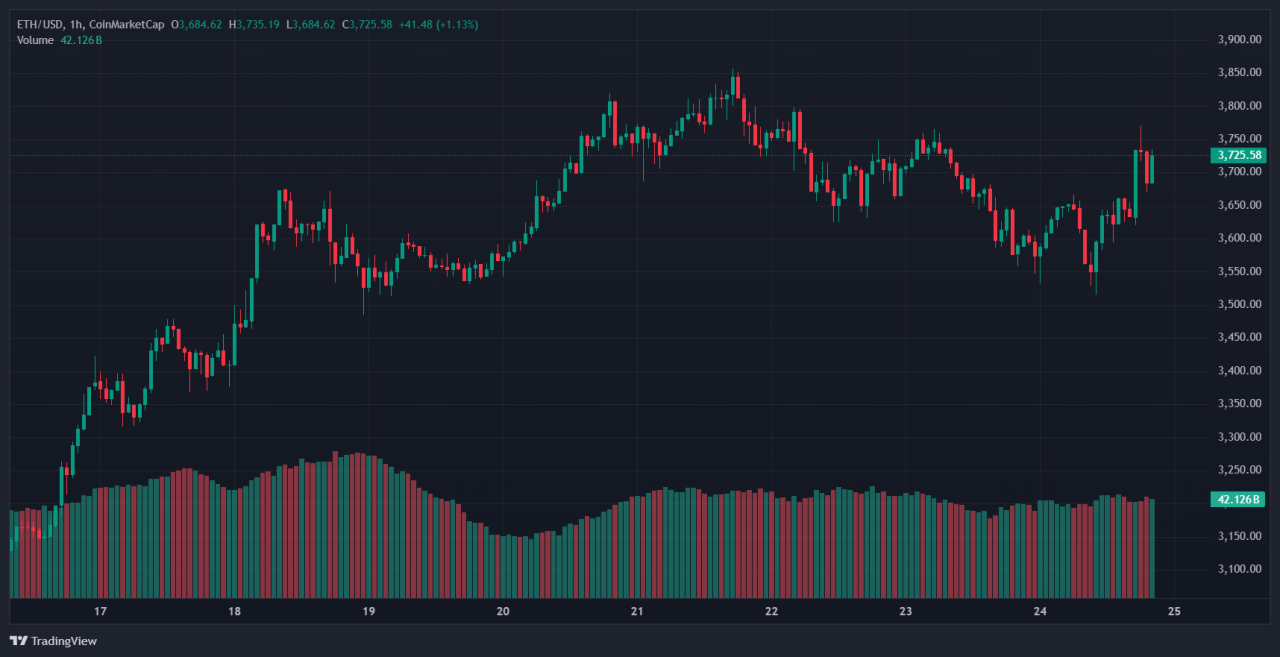

Ethereum (ETH)

Ethereum is trading near $3,740, underpinning the backbone of decentralized finance, smart contracts, and NFTs.

Despite modest price gains, ETH generated approximately $2.48 billion in on-chain fees in 2024, up marginally from the year before. This shows resilience amid reduced transaction costs after the Dencun upgrade.

Meanwhile, staking continues to grow; roughly 29% of the ETH supply, over 37 million tokens, is locked in staking contracts, providing steady passive income and securing network consensus.

Ethereum’s utility remains unmatched in building DeFi applications and issuing tokens, positioning ETH as more than just a speculative asset.

Under potential regulatory frameworks like staked ETH ETFs, investor access is likely to expand further. That demand driver could fuel renewed appreciation in ETH over the coming months.

Best Precious Metals to Buy

Silver

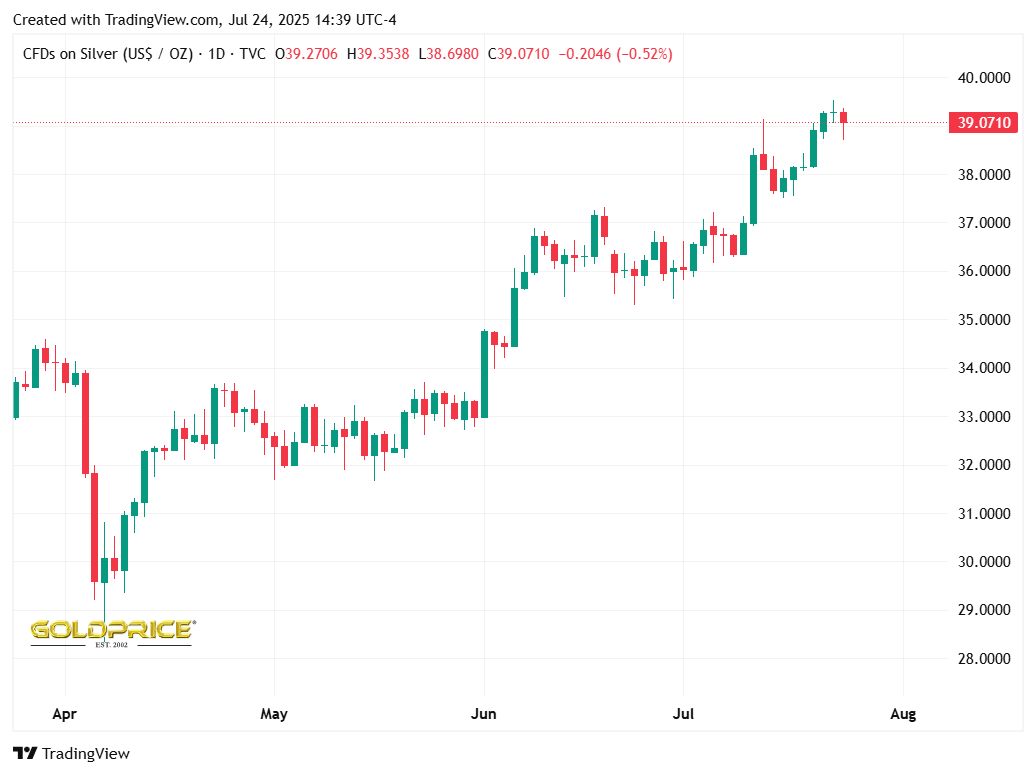

Silver has rallied over 36 percent year-to-date in 2025, reaching roughly $39.40 per ounce, the strongest level since 2011. Industrial demand remains key, thanks to renewable energy, electronics, AI and defense sectors, while supply deficits persist into a fifth consecutive year.

ETFs also have surged, rising around 31 percent YTD, signaling growing investor interest.

Silver’s dual role as both a safe-haven and industrial commodity makes it a compelling addition for those looking to invest in silver now, especially given upside potential toward $42–45 on supportive macro dynamics.

Gold

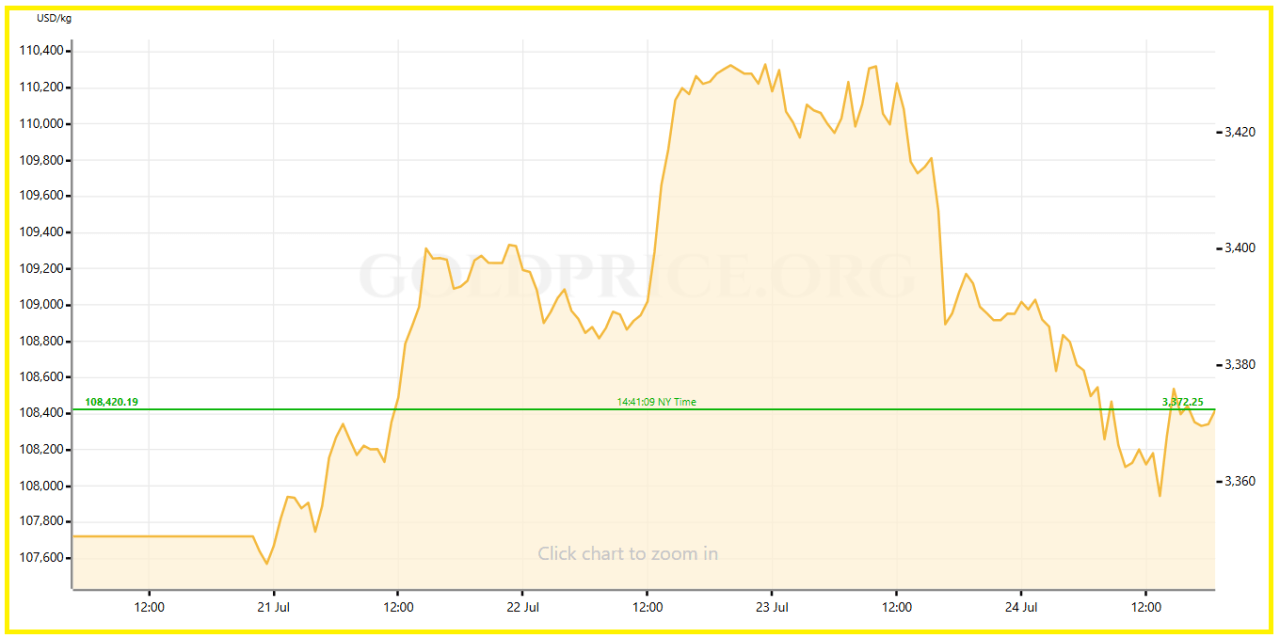

Gold is trading near $3,400 per ounce mid-2025, up about 29 percent YTD. Central banks and ETFs have fueled demand, with Q1 demand hitting the highest level since 2016.

Analysts project further gains: Goldman Sachs forecasts $3,100 by year-end, while JP Morgan sees $3,675 and even $4,000 by mid-2026 in a bull scenario.

Ongoing inflation, global debt concerns, geopolitical tension, and dollar weakness all support gold’s case as an inflation hedge in 2025.

Conclusion: Allocation Framework

Balancing this mix – Apple and Tesla for growth, Bitcoin and Ethereum for innovation, and silver and gold for stability – creates a well-rounded portfolio that covers both upside potential and downside protection.

A suggested allocation: 30 percent equities, 10 percent crypto, 10 percent metals, with adjustments based on individual risk tolerance. Rebalancing quarterly and aligning each allocation with financial goals ensures portfolios stay on track.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)