Aptos is gaining momentum in 2025 with high scalability, ecosystem growth, and strong institutional adoption driving bullish investor interest.

Aptos (APT) is a next‑generation Layer‑1 blockchain built by former Meta engineers using the Move programming language.

With a growing ecosystem, major partnerships, and improved infrastructure, Aptos is positioning itself for mainstream adoption. As demand for scalable, secure, and developer‑friendly chains rises, 2025 becomes a pivotal year for many investors and builders.

Here are five compelling reasons to consider buying Aptos in 2025.

1. Lightning‑fast Scalability & Low Fees

Aptos delivers high throughput and low transaction costs, thanks to sophisticated engineering like dynamic parallelism and speculative execution.

Lab tests have shown transaction speeds exceeding 100,000 transactions per second under optimal conditions. This positions Aptos well ahead of many competitors that continue to struggle with performance bottlenecks.

Real‑world success stories reinforce that scalability. For example, Aptos powers the EXPO2025 DIGITAL WALLET in Osaka, processing over 558,000 transactions and onboarding 133,000 new accounts since January 2025.

That demonstrates how the network handles a burst of activity across tens of thousands of users with seamless speed and efficiency.

2. Powerful Ecosystem Growth And Adoption Momentum

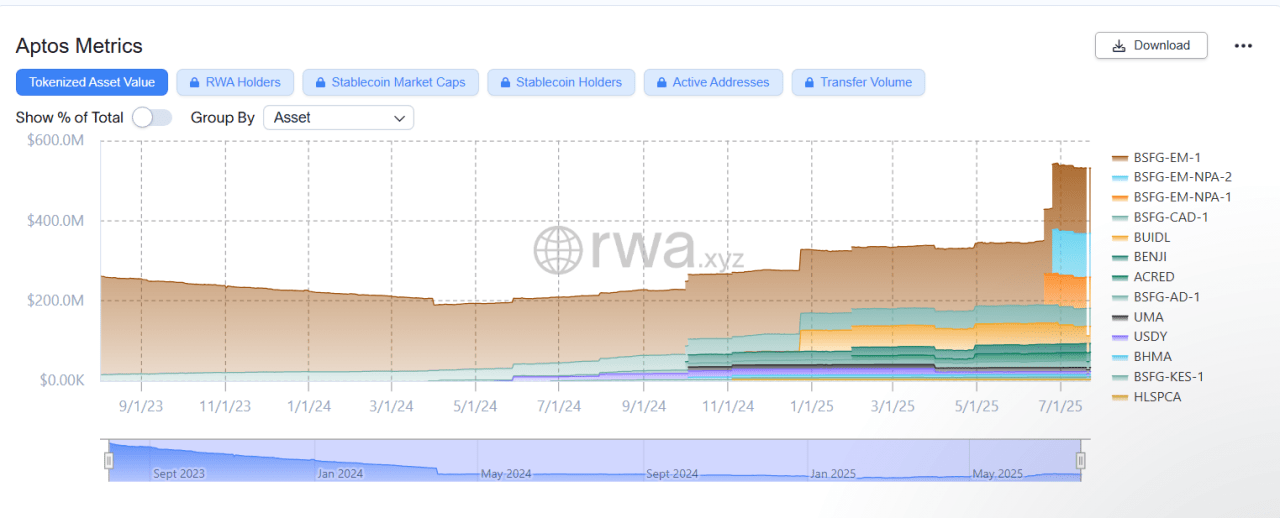

Aptos ecosystem is expanding rapidly; by early 2025 it hosted over 170 projects with more than $1 billion in total value locked (TVL), and exposure to real‑world assets pushing $540 million.

Foundations backing this growth plan more than $200 million in DeFi grants and builder support across 2025, fueling new launches and dApp innovation.

Strategic partnerships also underline adoption momentum. For instance, Aptos Labs joined forces with Stablecoin Standard in May 2025 to bolster stablecoin infrastructure, streamlining developer tooling and promoting real-world payment rails on the chain.

Collaborations with major players like Google Cloud, Microsoft, Mastercard, and Coinbase has also helped boost visibility and institutional reach.

3. Positive Price Outlook And Growing Etf Interest

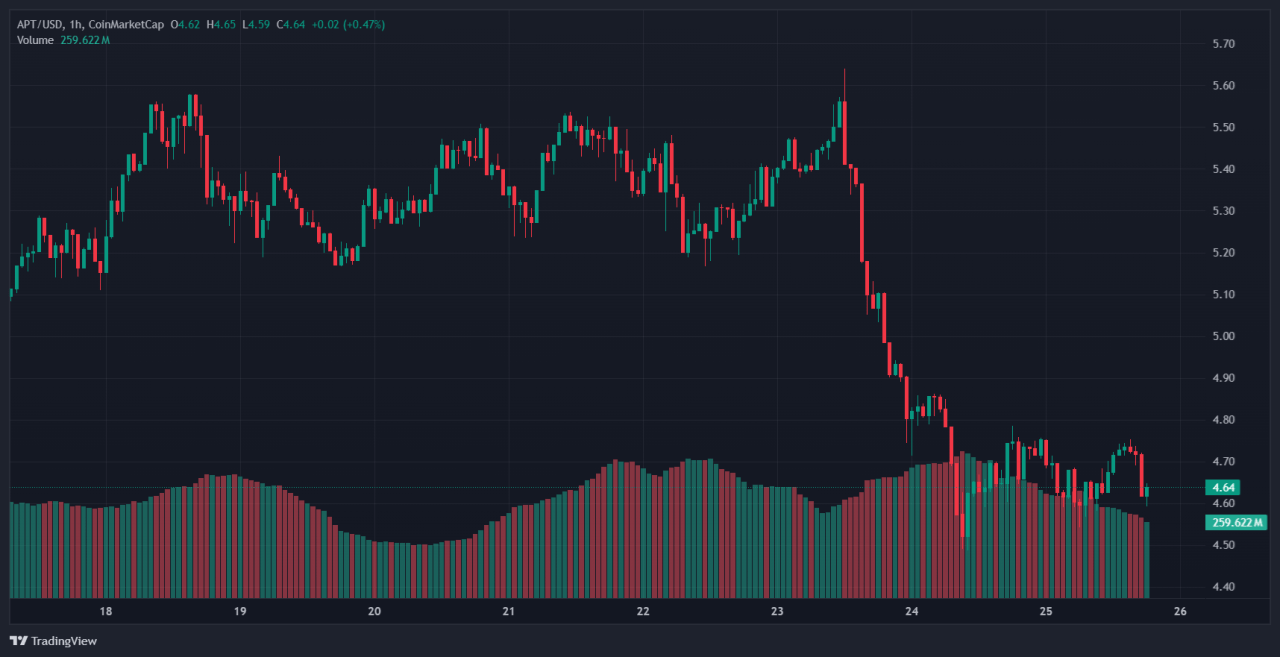

In 2025, Aptos stands out with a broadly bullish price narrative backed by ecosystem expansion and institutional interest. Many analysts forecast price averages ranging from $10 to $12 by year-end under neutral conditions, with bullish targets reaching $20 or more.

For example, TheCurrencyAnalytics projects a range between $5.62 and $20.68, centering around $12.62. Other forecasts estimate a minimum of $7.05, average of $12.56, and potential highs up to $19.08.

Institutional attention is gaining steam too. Bitwise has registered a spot Aptos ETF in Delaware, signaling serious investor appetite and potential regulatory clarity that could accelerate capital inflows.

A breakout above consolidation zones near $6 could pave a path toward $7.20 and beyond, according to technical momentum setups and ETF speculation.

4. Technological Differentiation: Move Language And Security-first Architecture

What sets Aptos apart among Layer‑1s is its foundation on the Move programming language, purpose-built for security and formal verification. Move’s strong type system and resource-based architecture prevent issues like reentrancy attacks, making contracts inherently safer by design.

The Move Prover (MVP) enables automated formal verification of smart contracts in minutes, offering developers high assurance of safety in production code.

Aptos also employs advanced execution engines such as Block‑STM and Shardines, offering speculative parallel execution that enables up to 1 million TPS for non-conflicting transactions – even in heavily congested conditions. These innovations yield sub-second finality and extremely low gas fees, ideal for high-frequency DeFi and AI-integrated dApps.

5. Market Positioning & Growing Institutional Credentials

Aptos has emerged as a blue‑chip Layer‑1 blockchain attracting heavyweight institutional interest.

Major firms like BlackRock selected Aptos as the only non‑EVM chain to host its USD Institutional Digital Liquidity Fund (BUIDL), while Franklin Templeton expanded its OnChain U.S. Government Money Fund (FOBXX) – with over $400 million AUM – onto Aptos, reflecting its capital markets readiness).

That said, institutional adoption isn’t just about finance. BitGo now supports Aptos custody in both hot and qualified wallets, securing not only APT but on‑chain assets like USDT and USDC with high compliance standards.

Additionally, protocols like PACT Protocol recently launched with over $1 billion in on‑chain assets and licensed lending infrastructure, showcasing Aptos as a backbone for transparent, scalable credit markets in emerging economies.

These integrations reflect how institutional-grade products and tokenized real‑world assets (RWAs) are woven into the Aptos chain. Total value locked has surged past $1 billion and grew over 700% year‑to‑date, supported by nearly 8 million monthly users and record transactions daily.

Conclusion

Across these five compelling factors – scalability, ecosystem momentum, bullish outlook, tech differentiation, and institutional credibility – the Aptos blockchain shines as a Layer‑1 positioned for long-term relevance in 2025.

Investors who believe in high‑performance, secure, and institutionally‑backed crypto infrastructure will find Aptos worthy of attention. Stay alert to on‑chain metrics, roadmap execution, and price behavior as you consider buying Aptos this year.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)