KEY TAKEAWAYS

- Curve holds deep, stable liquidity with TVL in the low billions, which supports reliable swaps and steady activity.

- CRV holders who lock into veCRV gain access to recurring protocol fees and boosted rewards.

- The vote-escrow model encourages long-term alignment by rewarding longer lock periods with more influence and benefits.

- Curve sits at the center of many DeFi strategies, and platforms like Convex create ongoing demand for CRV.

- Curve’s multi-year history, active governance, and responses to past exploits give it a clearer risk profile than newer protocols.

Curve gives long-term investors access to stable liquidity, real fee rewards, and a mature DeFi ecosystem.

Its structure creates real value for investors who want clear utility and steady activity.

Curve Finance runs one of the most active platforms for stablecoin and similar asset swaps.

CRV acts as its governance token and gives holders access to rewards through vote-escrow locking.

That said, there are many reasons to buy CRV today. These include Curve’s deep liquidity, steady fee generation, long-term alignment through veCRV, strong integration across DeFi, and a proven operating record.

Solid Reasons To Consider Buying CRV

There are several reasons to invest in CRV today. Below are five of the main ones.

1. Deep, Specialized Liquidity

Curve focuses on assets that move in tight ranges, such as stablecoins and liquid staking tokens.

This lets the platform offer low slippage even for large trades, which attracts traders who need reliable pricing.

Curve’s total value locked sits in the low billions, showing that users continue to rely on its stable pools and liquidity design.

Strong TVL supports active markets, steady fees, and predictable trading conditions.

If you are looking to hold CRV for the long-term, this deep and consistent liquidity is important because it shows real usage rather than temporary spikes.

Curve’s role as a stable-swap platform makes it likely to remain useful as DeFi expands and more assets require low-friction trading.

2. Direct Revenue Potential And Fee Flows

Curve collects trading fees from swaps and interest from certain lending-style products.

These revenues move through the protocol and can be distributed to users who lock their CRV into veCRV.

This structure gives long-term holders access to ongoing fee rewards rather than relying only on price moves.

The DAO can vote on how revenue gets allocated, which adds flexibility for future updates.

Clear, recurring fee generation makes CRV different from tokens that have no direct link to protocol activity.

If you want exposure to a DeFi platform that produces measurable revenue, Curve offers a simple and transparent model for capturing a share of it.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

3. Vote-Escrow Alignment

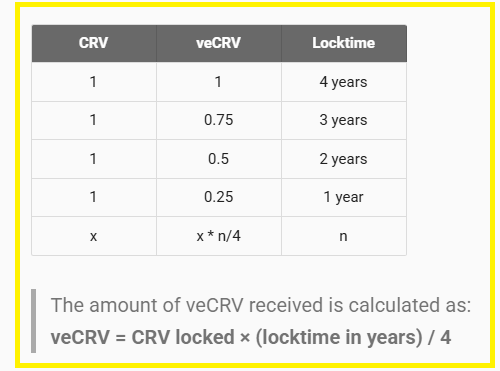

The vote-escrow system converts locked CRV into veCRV. Lock periods can last up to four years, and longer locks give more voting power, higher reward boosts, and access to distributed fees.

This setup encourages holders to commit for the long run because deeper participation brings clearer benefits.

It also reduces circulating supply, since locked tokens stay off the market. Investors who want more influence over Curve’s future can use veCRV to vote on reward allocations and pool incentives.

The model creates a system where patient holders gain the most value. So, if you prefer long-term positioning instead of short-term trading, veCRV adds a practical layer of alignment.

4. Ecosystem And Composability

Curve plays a central role in DeFi because many platforms depend on its liquidity.

Lending markets, liquid staking tokens, yield optimizers, and other protocols route assets into Curve pools for stable and efficient swaps.

Convex and other liquid locker platforms also lock large amounts of CRV, giving their users access to veCRV rewards without managing locks themselves.

This creates steady demand for CRV and keeps activity flowing through the ecosystem.

When many services rely on a protocol, its utility becomes part of the broader financial stack.

Curve’s integrations show that it is more than a single-product platform. It acts as a core building block that other products use to deliver yield and liquidity.

5. Maturity And Security Posture

Curve has operated through several market cycles, upgrades, and governance changes. It has experienced security incidents, including multi-million dollar pool exploits, but the community responded with fixes, audits, and detailed post-mortems.

This track record gives investors more information about how the protocol behaves under stress and how quickly issues get addressed. Many newer platforms have not faced similar tests, which makes risks harder to judge.

Curve’s long history does not remove risk, but it helps reduce uncertainty. A platform that has survived multiple challenges and continues to maintain active governance offers a more predictable environment than untested alternatives.

Conclusion

CRV brings together deep liquidity, meaningful fee rewards, long-term incentives, broad ecosystem use, and a proven record of stability. These qualities create lasting value that extends beyond market conditions.

As always, you should consider smart contract and regulatory risks and size your positions based on comfort and long-term goals.

Before you invest in Curve Finance

Is this one of our top picks in our cryptocurrency alert service?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- A Crucial Week & One Critical Level (Dec 7th)

- How We Think About The Current Bounce And What Matters in December (Nov 30th)

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts? (Nov 16th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower