Internet Computer’s upgrades, developer growth, and ecosystem traction position it as a strong Web3 infrastructure investment in 2025.

The Internet Computer (ICP) has quietly evolved into one of the most intriguing infrastructure plays in Web3. After its explosive debut in 2021 near all‑time highs of $600+, it now trades around $5–6 mid‑2025.

Yet despite this dramatic price compression, ICP ecosystem growth and technical upgrades are accelerating.

This article explores 5 compelling reasons to consider buying ICP in 2025. From rising developer momentum and protocol improvements to bullish price forecasts, the case for investment is framed around data‑backed trends and strategic entry timing for long‑term holders.

1. Accelerating Ecosystem Growth & Developer Momentum

Internet Computer has seen a notable uptick in developer activity through the first half of 2025. According to DFINITY’s roadmap, initiatives like the Dynamo and Apex milestones aim to simplify token discovery, streamline DeFi dApp deployment, and expand the DFINITY grants program and hacker league to attract builders.

The World Computer Summit held on June 3 in Zurich served as a focal point, showcasing new tools like Orbit for DAO management and spotlighting projects boosting cross‑chain interoperability and decentralized artificial intelligence (AI) applications.

These ecosystem-building efforts have helped bring more than 2,000 new developers into ICP over recent months, with rising grants, hackathons, and platform tools encouraging on‑chain innovation.

The expanding number of dApps – especially in DeFi, AI, and chain fusion – demonstrates how ecosystem adoption and real‑world usage makes Internet Computer a great investment choice.

2. Major Protocol Upgrades Fueling Capability

ICP’s underlying protocol continues to gain capability through key upgrades. In May 2025, the Flux and Stellarator themes delivered major improvements: subnet storage capacity increased, while sharding and load‑balancing were enhanced to boost throughput and reduce latency.

Additional releases—including vetKeys privacy vaults and the Caffeine platform – enable AI‑powered smart contracts to run directly on chain, allowing users to build dApps via natural‑language prompts rather than code.

Chain Fusion technology now connects ICP natively with Bitcoin, Ethereum and Solana smart contracts, enabling multi‑chain interoperability without third‑party bridges. These upgrades not only enhance performance and privacy but also open ICP to more use cases in DeFi, AI, and secure cross‑chain applications.

Sure, here’s a refined Reason 3 section (~100 words) without any price forecasts, integrating the latest web insights and Reddit quotes for credibility:

3. Bullish Catalysts — Tech Events & Ecosystem Visibility

The Internet Computer’s 2025 momentum is powered by high-impact ecosystem events and mounting developer interest.

The World Computer Summit in Zurich brought together developers, researchers, and media to showcase ICP’s “Self‑Writing Internet” vision, DAO tools like Orbit, and cross-chain interoperability sessions, spotlighting projects like LiquidiumFi and Tap Protocol.

The updated ICP roadmap launched in early 2025 introduced over 40 new features across AI, Chain Fusion, identity enhancements, and tools like Caffeine and Orbit, driving community excitement. Community events via ICP HUBS have expanded globally, amplifying visibility and grassroots adoption.

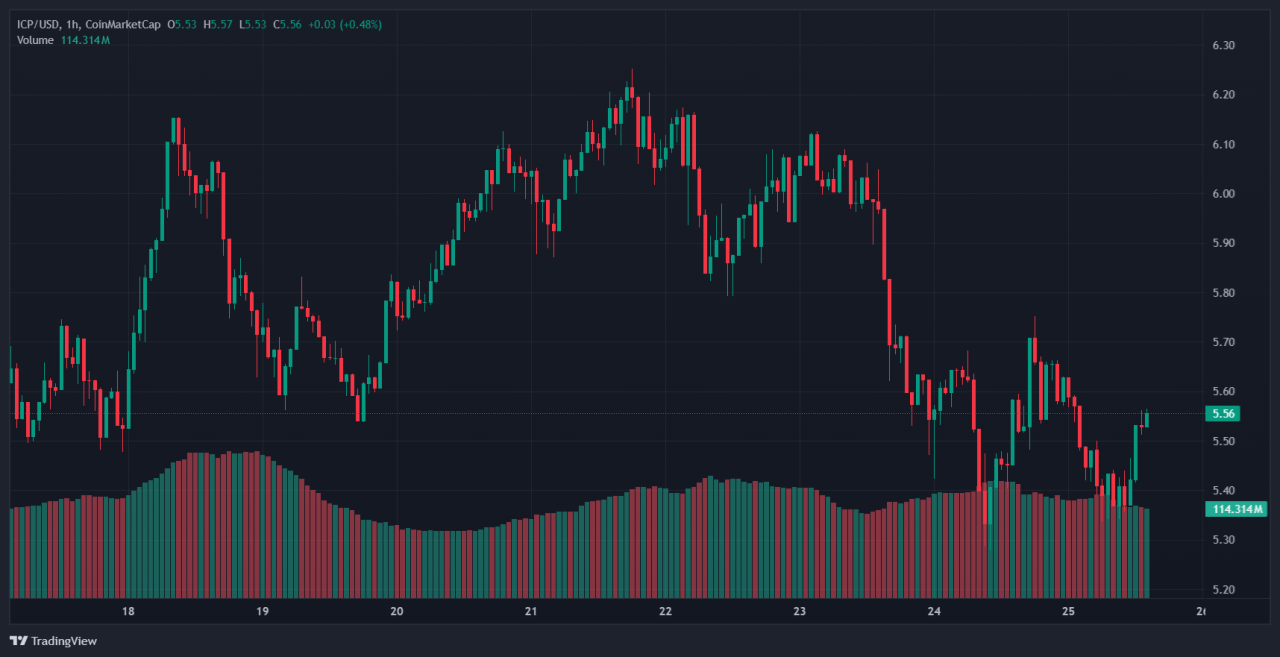

4. Favorable Price Discovery & Risk–Reward Profile

From a price discovery standpoint, ICP in mid‑2025 trades in the $5.5–6.0 range, but forecasts suggest meaningful upside ahead. CoinCodex expects prices to reach the upper $7s by year‑end, offering 30–35% return potential from current levels.

Cryptopolitan analysis sees a broader 2025 range up to $12.90 for aggressive scenarios, while Investing Haven places a peak of $20.21.

Even conservative models suggest modest gains: TradingBeasts and WalletInvestor estimate ranges around $5.65–5.88. This sets up a compelling risk‑reward: downside appears capped near present levels, while upside scenarios reach mid‑double‑digit forecasts.

For long‑term investors prioritizing infrastructure with real utility, the risk‑adjusted return profile makes a strong argument to invest based on the Internet Computer price forecast and the ecosystem fundamentals. Natural accumulation during this phase supports a long‑term investment strategy.

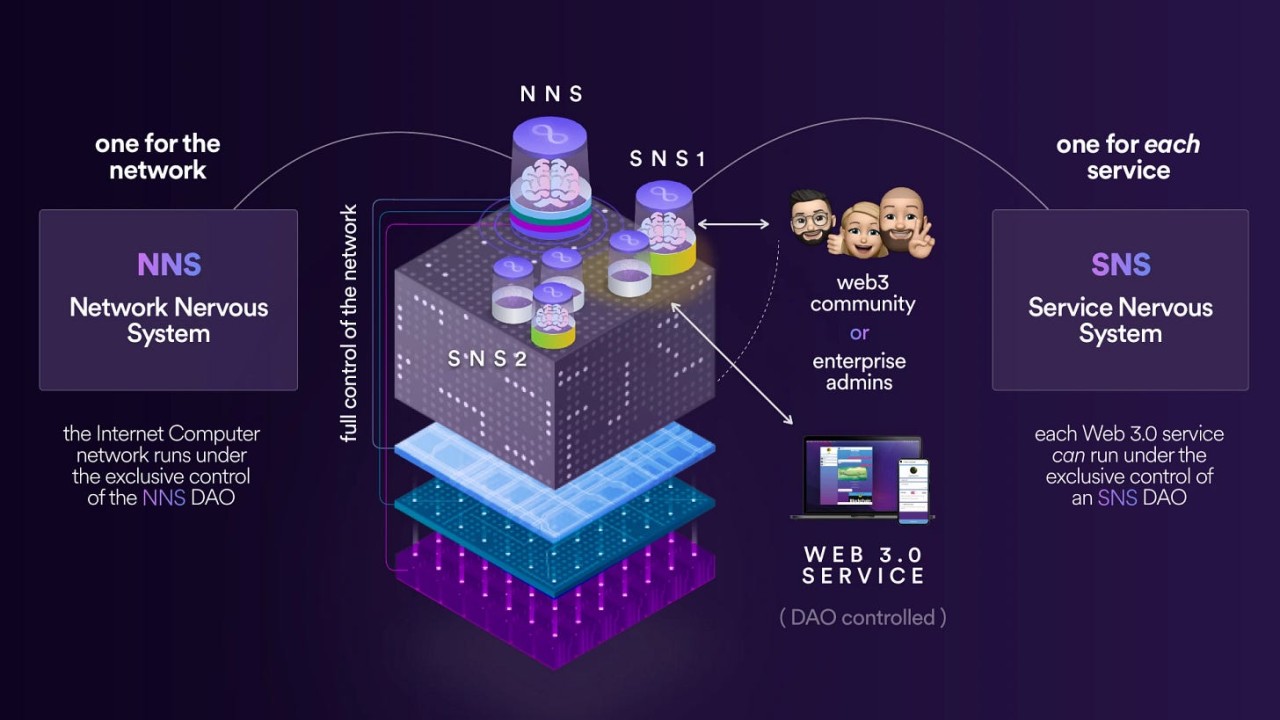

5. Strong Protocol Design & Governance Potential

The Internet Computer protocol boasts robust architectural design coupled with a forward‑looking governance model. Its Network Nervous System (NNS) supports liquid‑democracy style voting via neuron staking, enabling token holders to guide upgrades and resource allocation.

Importantly, recent audits in mid‑2025 highlighted no core protocol vulnerabilities; issues stemmed from developer errors in smart‑contract code rather than foundational flaws. That demonstrates solid base‑layer resilience.

Further, ICP’s roadmap explicitly integrates governance incentives alongside technical upgrades. Projects like vetKeys and the Chain Fusion architecture align with decentralized governance and user‑centric design.

Conclusion

ICP presents a compelling infrastructure investment with strong upside potential in 2025. With accelerating developer momentum, powerful protocol upgrades, growing event‑driven sentiment, and balanced risk‑reward dynamics, buying ICP in 2025 sounds like a great decision.

Its robust governance and roadmap governance suggest enduring value. While market volatility remains a risk, for investors drawn to Web3 infrastructure, ICP sits at an inflection point and deserves a strategic BRIEF entry this year.

Our most recent alerts – instantly accessible

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)

- Silver Breakout Confirmed Now, Check These Stunning Silver Charts (July 12)

- The Two Only Silver Charts That Matter In 2025 (July 6)

- Quarterly Gold & Silver Charts Are In, Here’s the Big Picture (June 29)

- Gold & Silver – The Big Picture Charts That Matter (June 21)