Bitcoin is in great shape. Period. The price of Bitcoin (BTC) started a new bull market on April 2nd, 2019, as reported in Bitcoin & Crypto: Bear Market Officially Ends Today. Almost 2 months earlier we forecasted the Crypto Winter Has Ended. And 8 months earlier we forecasted 5 bullish crypto market predictions our Bitcoin price prediction of $25k to be achieved at a later point in time. But wait a second, the internet is full of reasons why Bitcoin should go down. We collected the top 8 reasons why Bitcoin should go down from others, and we hold it against just 2 reasons why InvestingHaven says Bitcoin will go up. Interesting, 8 against 2, who to believe?

So here we go with the top 8 reasons why the price of Bitcoin must go down.

- The top spot, absolute number one, is one we read recently on a social trading site: the spread of the price of Bitcoin between exchanges like Coinbase, Bitfinex, and others is so large that it indicates elevated risk, therefore Bitcoin will go lower. InvestingHaven says: don’t mix up institutional credit markets with the price of Bitcoin between exchanges. Credit spread is as unrelated as possible to Bitcoin price spread, the only thing that they have in common is the 6 character word ‘spread’.

- There is a head and shoulders formation on Bitcoin’s chart, therefore Bitcoin will go down. InvestingHaven says: there are head and shoulders everywhere. With a bit of creativity you will find 1000 head and shoulders on Bitcoin’s chart since its inception, especially on short term timeframes. Be very careful with short term timeframes, at InvestingHaven we never do short term forecasts, it’s almost impossible to do this right. Moreover, as per our 50 cryptocurrency investing tips, you need 3 timeframes to confirm each other before doing a forecast!

- There was a trendline on Bitcoin’s chart pointing to 1k. InvestingHaven says: there are thousands of trendlines on each price chart. The only thing that matters is RELEVANT trendlines. It’s not because you have found a trendline that you know price will evolve according to that line. If charting was THAT easy every chartist would be a billionaire. Be extremely careful with charts and trendlines, chart analysis is a research domain not some playground.

- Jamie Dimon from the mighty JP Morgan told Bitcoin is a scam. InvestingHaven says: admittedly, this is a classic one, in the meantime as old as the street. But after 2 years it became blatantly clear why he made that statement: he started developing his own cryptocurrency. Watch out with extreme statements especially from influential people, they mostly have their own interest and (hidden) agenda.

- Gurus who are very smart told there is no future in blockchain. We will not reveal any name other than the smartest among all of them which is Mr. Roubini. This economic genius of Mr. Roubini says Bitcoin fans are clueless, he pretends Bitcoin is the mother of all scams and predicts the technology has no basis for success. InvestingHaven says: economic analysis is not the same things as technology analysis. In fact, those are two totally separate things. An economist that is has a great, world class thought leadership on one or more economic topics will not ‘by default’ know anything meaningful about technologies.

- The long term gold chart and Bitcoin chart are correlated, therefore Bitcoin cannot go up again (similar to gold). InvestingHaven says: don’t mix up asset classes. Gold is a totally different and unrelated asset class compared to Bitcoin which is a new and emerging technology, again entirely unrelated.

- Ernst & Young says 10% of ICOs are scam, therefore Bitcoin is a scam. InvestingHaven says: probably our answer is a mix of all things outlined above, we’ll not repeat ourselves.

- My banker adviced to stay away from Bitcoin and cryptocurrencies. InvestingHaven says: no comment other than your banker has a track record of being the ultimate contrarian indicator!

All we can say to this list of reasons why Bitcoin must go down is this: keep them coming. We love them!

Why do we like this?

Very simple, the higher the consensus that a market goes in one direction the higher probability it will move in the opposite direction.

Bitcoin tried to go lower, and did not ‘succeed’ in doing so. If prices do not go down, they have only 2 options left: sideways or up. Crypto has a track record of _not_ going sideways, it is way too volatile.

As per our investing tips for successful investors:

‘From failed moves come fast moves.’ This essentially means that if an expected outcome does not materialize the move in the opposite direction takes place fast and in a furious way. If a market or stock continues to consolidate near its all-time highs, and decides to move lower it mostly declines in an aggressive way. Similarly, a failed breakdown tends to result in a sudden an strong rally!

Stated differently, we truly LOVE silent bull markets!

Crypto, driven by Bitcoin, is in a silent bull market right now. Period.

So which 2 reasons can we come up with why Bitcoin will go up?

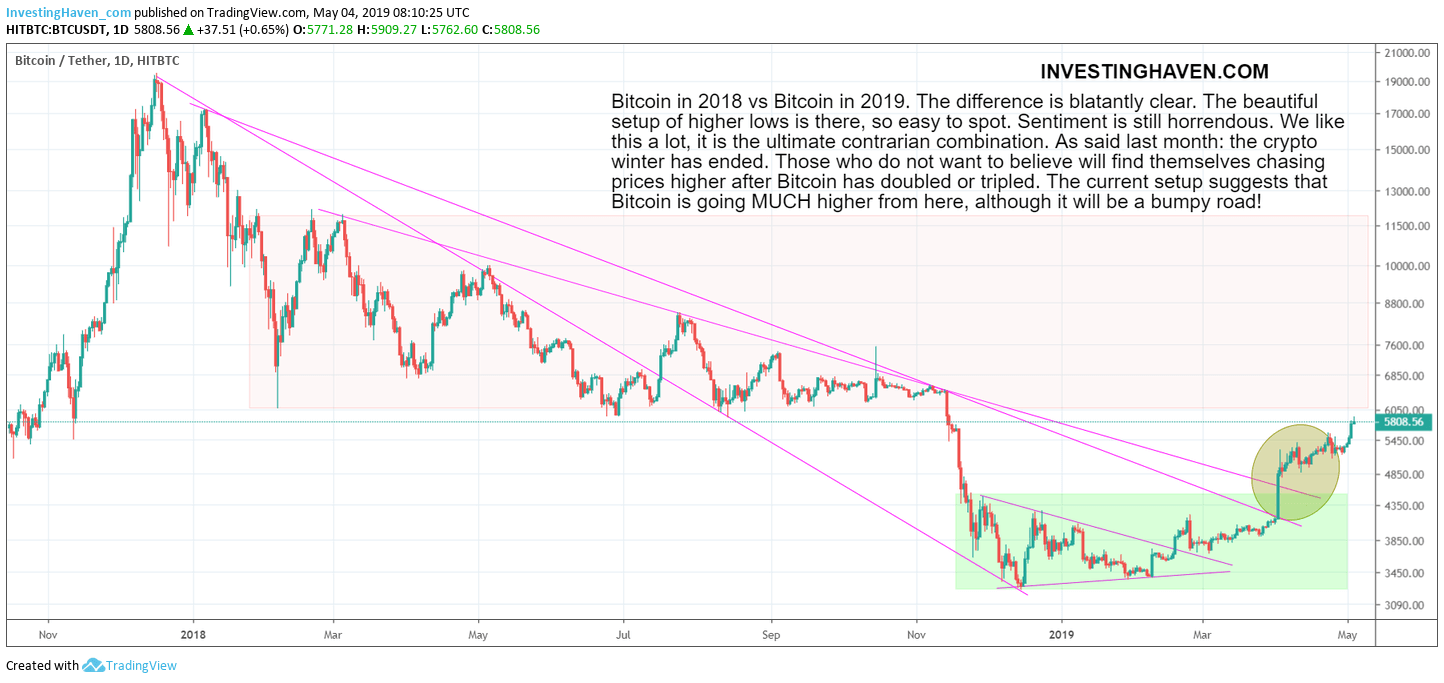

- The Bitcoin price chart with the *really* relevant trendlines says a new bull market started, and the findings on the different timeframes confirm each other. Simple as that? Yes!

- The average profit/loss of Bitcoin holders was slightly positive when Bitcoin was trading around $5k.

That’s it? Yes, that’s it!

Market analysis does not have to be complicated, it has to be laser sharp. ‘Less is more’.

We have updated all our top cryptocurrency picks with annotated charts, and our top picks are doing amazingly well. They are not available on our public website. Get instant access to our restricted crypto research area >>