How concerning is the fact that Bitcoin’s 200 day-moving average (dma) is pointing lower for the first time since 640 days? It’s a concern, for sure, and chart analysis helps understand concern vs. opportunity.

RELATED – Bitcoin’s 2025 price prediction

As explained in (BTC) Below Its 200 Day Moving Average, This One Chart Is Much More Important, we covered the 200 dma recently. We also highlighted the fact that intermarket relationships, i.e. Bitcoin vs. the Nasdaq, is a much more important data point to consider. With this in mind, we’ll still focus on BTC charts in this post but we acknowledge that it’s only part of the story.

Bitcoin’s (BTC) 200-day moving average now dropping

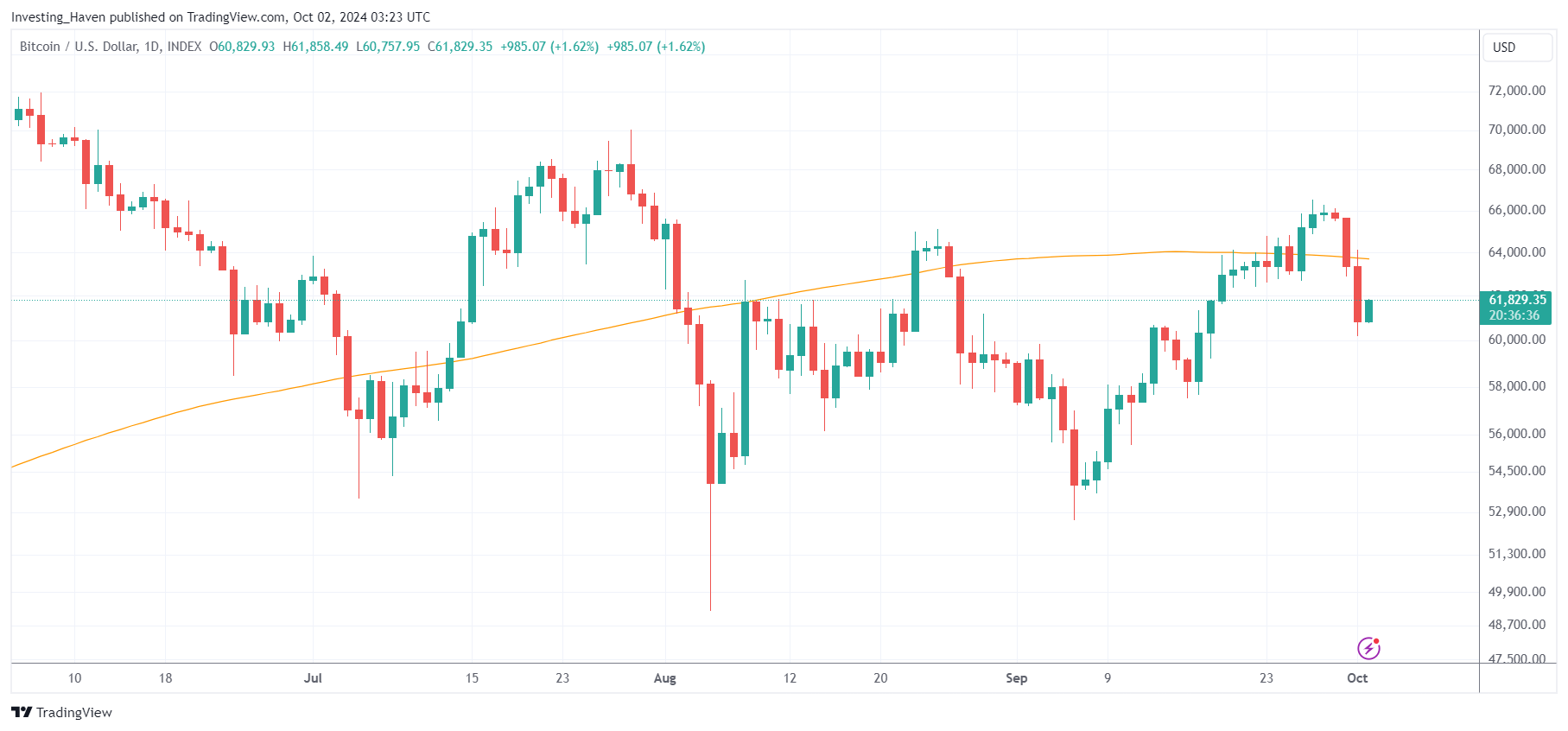

First things first, we visualize the Bitcoin price chart and its 200 dma.

As seen below, on the close-up of Bitcoin’s daily price chart, Bitcoin’s 200 dma has been flat since mid-September.

Since October 1st, 2024, Bitcoin’s 200 dma is starting to point lower.

It’s the start of a period that may last days, weeks, months, we cannot know purely based on a technical indicator like a moving average.

That’s also our criticism with technical indicators – they are lagging. They may flag a potential concern, but that’s as far as they can go.

The only solution to this problem is complementing technical analysis (which is what moving averages belong to) with forward looking techniques from (our) chart analysis.

Bitcoin’s 200 dma in the last 640 days

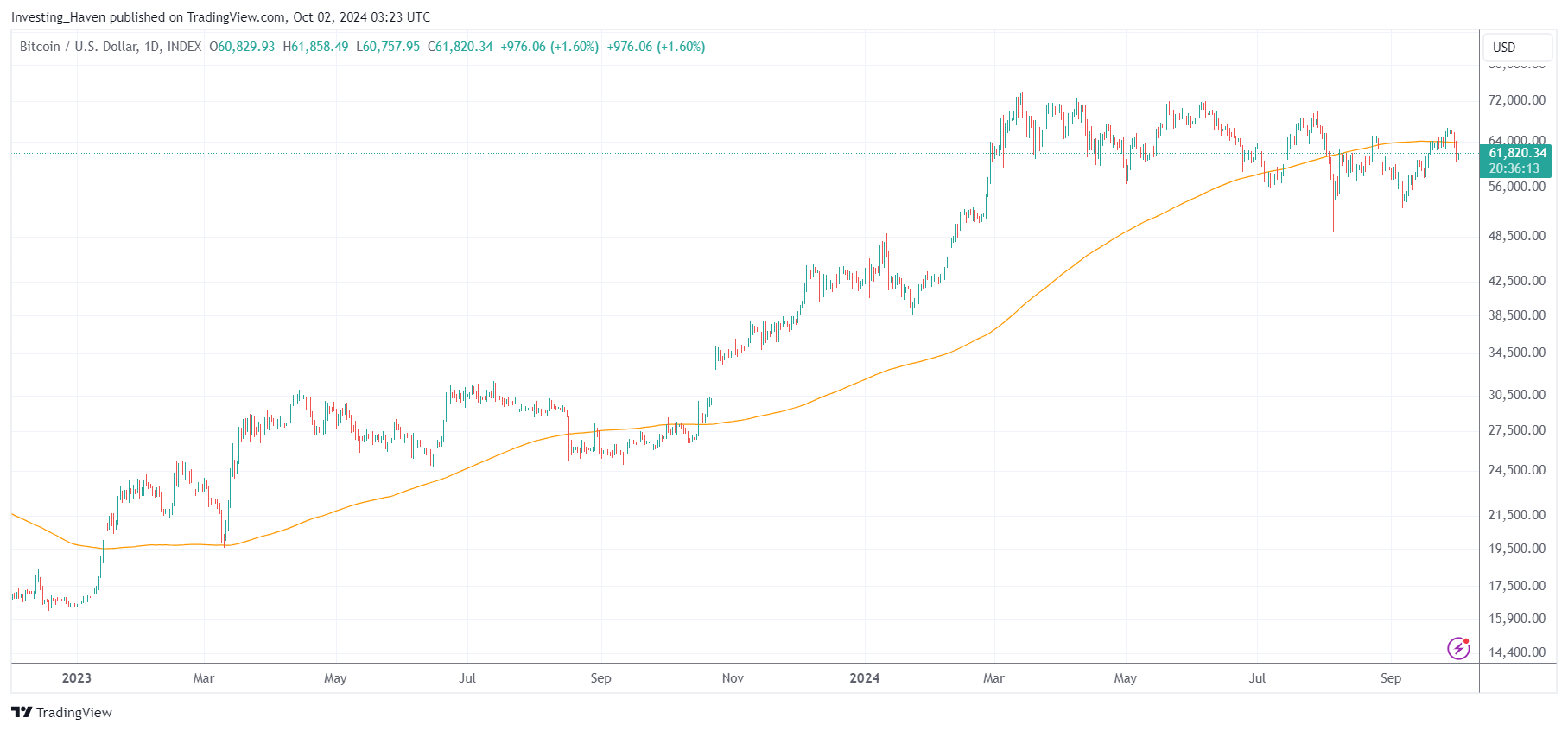

Before looking at chart analysis, we have to show the greatness of Bitcoin’s phenomenal rise in the last 640 days.

The last day that Bitcoin’s 200 dma was falling was Jan 1st, 2023, exactly 640 days ago.

Since then, the 200 dma is either flat (January & February of 2023) or rising (slowly to strongly).

A break is a natural thing, and Bitcoin deserves a break without any doubt. Why not simply allow the market to figure out what’s next, and be patient?

Make no mistake – patience is not what you’ll exercise when tracking the $BTC cash tag on X, on the contrary – BTC posts like this one with a very short term oriented focus will make you feel act which is the worst thing to do as Bitcoin’s 200 dma starts falling.

Bitcoin’s (BTC) chart structure

Now, let’s add chart analysis to understand what’s next.

As said, technical analysis (which is what moving average analysis is all about) does not give you any clue about the future. That’s because technical analysis (often referred to as TA) is lagging.

Case in point – when Bitcoin’s 200 dma was flat, in Jan & Feb of 2023, Bitcoin started a strong rally, on a flat 200 dma. Following moving averages would have given you the false perception that Bitcoin will be flat. On Jan 7th, 2023, we flashed strong buy alerts on AI-tokens in our premium crypto research service, two days before they took off like a rocket (10x on some of them), which shows the power of chart analysis compared to TA.

It makes you think why InvestingHaven decided to post this article on the same day Bitcoin’s 200 dma started pointing lower Which Cryptocurrencies Will Be Explosive in 2025? – there is certainly a good reason for the timing of our article.

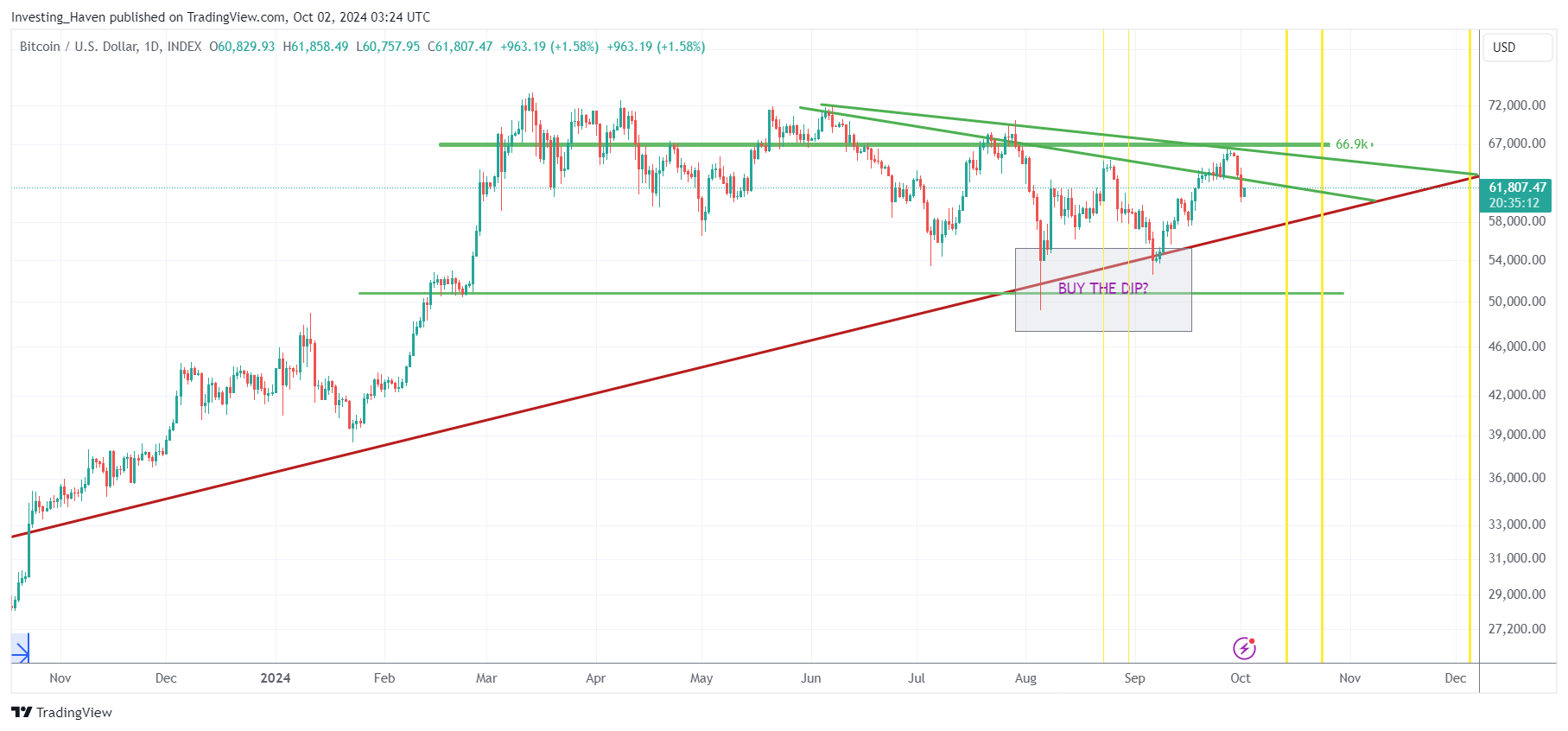

That said, the BTC chart structure looks not that bad to be honest.

There is one, and only thing to watch out for on Bitcoin’s chart – the long term rising trendline must be respected – in no way should Bitcoin breach the rising trendline (in red on our chart).

In fact, the BTC chart is self-explanatory. The chart structure that it created since June 2024 suggests this:

- Best case: BTC moves in this triangle pattern, before breaking out in December or January.

- Base case: BTC drops below the rising trendline, but not for more than 3, 5, 8 days (Fibonacci numbers).

- Worst case: BTC drops below the rising trendline, and starts a downtrend, triggered by its dropping 200 dma.

In which camp are we? In-between the base case and best case. But we’ll stick to our chart analysis to find out, as the market evolves, which scenario will be unfolding.

How concerned should crypto investors be?

We believe crypto investors should take the first drop in Bitcoin’s 200 dma seriously.

It’s not a sign that it will crash, on the contrary, the falling dma may stay flat with a slight bearish basis after which it recovers in a few weeks or months. However, it might also stay flat for longer.

All that matters is this – how will BTC behave as it relates to its chart structure shown on our last BTC chart.

It’s truly the only thing that matters combined with segment specific behavior of altcoins.

We track BTC charts for our premium members and provide more detail than what is provided in this blog post. You too may want to follow our premium crypto work.