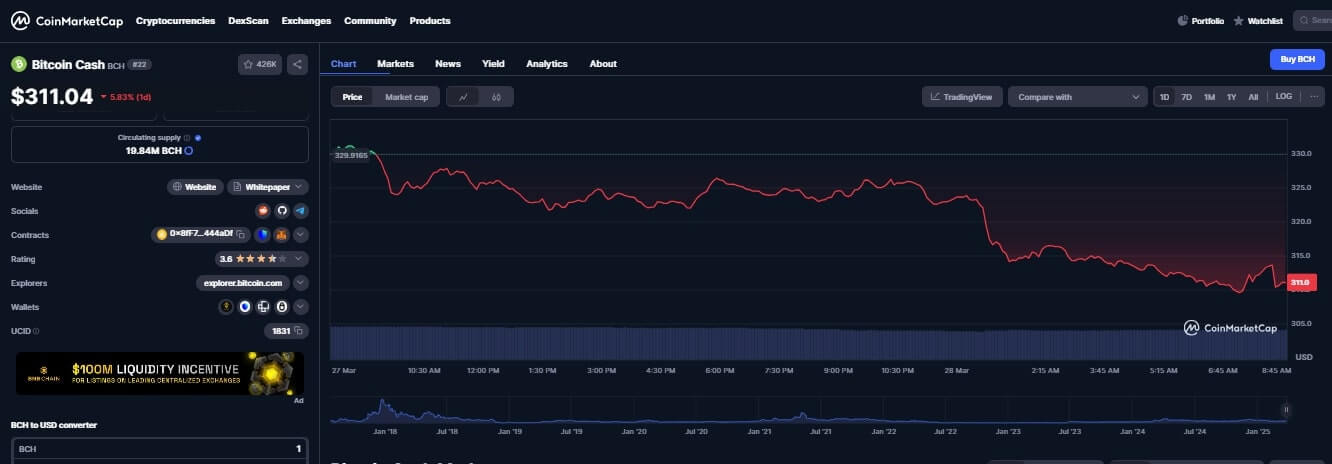

In the latest Bitcoin Cash news, BCH’s price crashed by 9% in the last 24 hours, wiping most of the gains made in the month and confirming that BCH will end the first quarter of 2025 in the red.

Before today’s Friday, March. 28 price action, Bitcoin Cash was poised to end the month, having rallied by more than 15%.

Should the market-wide FUD continue exerting downward pressure on BCH prices, it may well end the month having gained less than 5%.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

The overnight crash also saw BCH drop below $310 – for the first time in 3 months. The slip was, however, short-lived as it bounced back above $310.

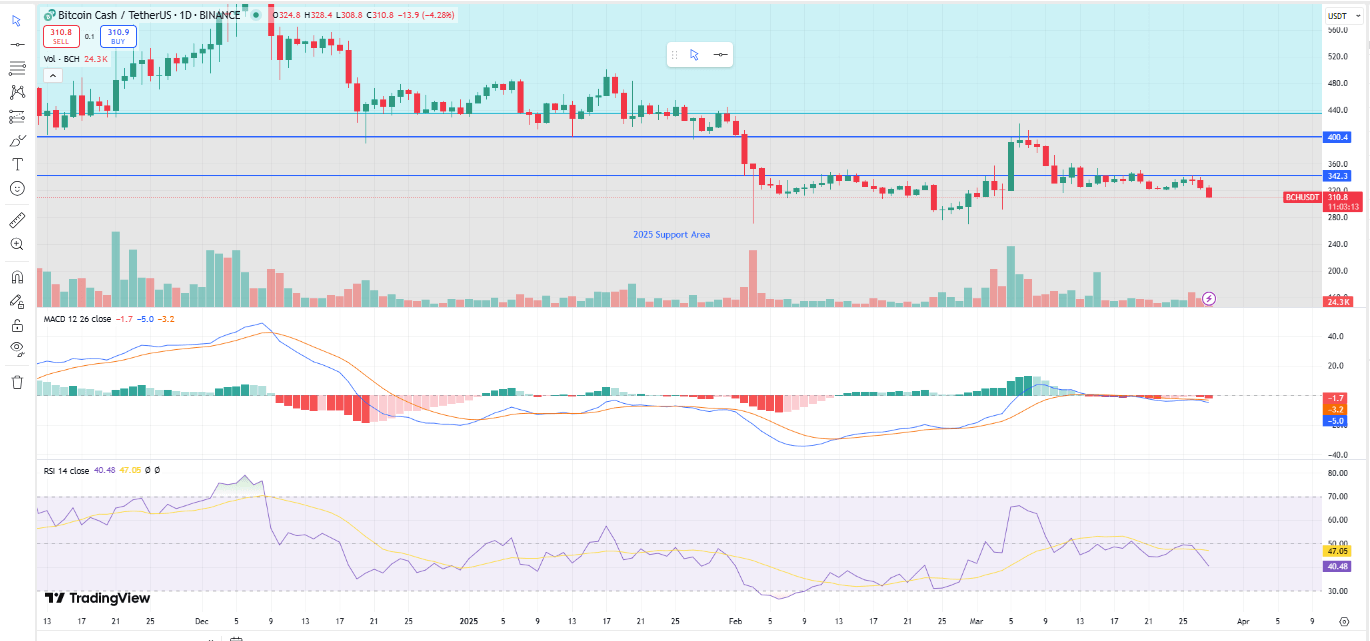

BCH Faces Stiff Resistance at $340

Heading into 2025, Bitcoin Cash was trading in the $450 price range and had set the psychological support level at $400.

Soon, the market started tumbling under the weight of uncertainty, triggered by Trump tariffs and the cautious approach to interest rates by the FED.

These factors crashed Bitcoin Cash’s prices, even forcing it below $270 – albeit temporarily in mid-February.

The coin has, however, reported significant gains throughout the month, thanks to the calmer markets.

At the start of the month, Bitcoin cash rallied back above $400, reigniting investor confidence in the brand.

Even though it later slipped back to the high $300s territory, there was hope it could end the month and first quarter above $350 and close to $400.

That was until the Trump Administration announced that it would be enforcing reciprocal tariffs on April 2nd

The move has spooked Bitcoin Cash investors and increased the selling pressure. As this date fast approaches, technical indicators paint a gloomy picture of BCH’s next price action.

The RSI is on a downtrend and now threatens to fall into the oversold territory below 40.

The MACD line has converged with the blue line crossing the signal line from above and is dipping into the negative territory fast.

For more than a week, any attempt at recovery has been strongly rejected at around $340, and these indicators confirm this support as BCH’s newest resistance level.

Bitcoin Cash (BCH) Next Price Action

It is likely that Bitcoin Cash prices will continue oscillating between $300 and $340 for the next few days.

If the April tariffs cause another shock to the market, BCH will likely dip $300.

But if Bitcoin and the larger crypto industry can hold its ground in the face of the watered-down tariffs, BCH could rebound and set its next target as conquering $400.

Get Instant Access to Our Latest High-Potential Crypto Alerts

This is how we are guiding our premium members (log in required):

- A Promising And Welcome Evolution On Crypto’s Leading Indicator Chart (March 24th)

- The Dates & Data Points To Watch In The Next 3 Weeks (March 17th)

- The Time Window as of March 14 Should Bring Relief (March 11th)

- Buy The Dip Is Here (March 1st)