Bitcoin is to start the fourth straight week of disappointing performance with a 6% dent on its price and ever-increasing pressure to drag it below $80k. Given the rising negative macros, traders expect it to crash by a further 14% to fall below $70k.

Bitcoin will enter a new week in the red after slipping by as much as 6.5% over the last 24 hours to an intraday low of $80,050. The disappointing price action today, Monday, March. 10, compounds its 7-day and 30-day losses to 11% and 15% respectively.

The legacy digital currency has been on a sustained freefall that dragged it from the highs of $109K set less than 2 months ago.

Not even the white house crypto summit, the signing of the Crypto Reserve executive order, or the passing of bitcoin reserves in Utah could help stop BTC’s hemorrhage. To the contrary, investor sentiment towards the industry has slipped further, with the fear and greed index falling to multi-year lows of 17.

Sparked volatility and Continued Negative Bitcoin ETF Outflows

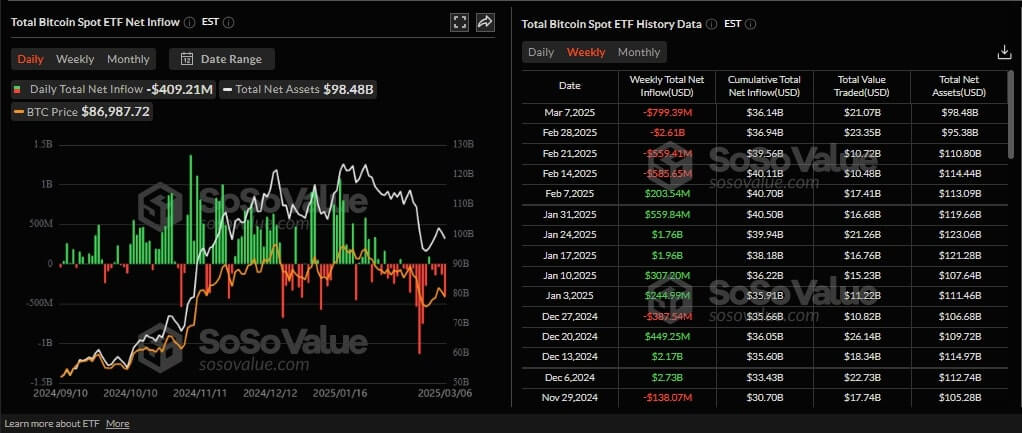

Bitcoin’s continued value loss has parked massive volatility with its daily trade volumes surging by 200% to $44 Billion. For the first time since the establishment of Bitcoin ETFs, net outflows were recorded for the fourth straight week.

After losing $2.61 Billion last week, these indices lost another $799.4 Million, bringing the total BTC ETF outflows in the four-week period to more than $4 Billion.

Experts and Traders Expect Bitcoin to Dump Further and Drop to $70K

Moving forward, a growing number of analysts and investors expect Bitcoin to continue dumping. Among the factors fueling this price crash are the unresolved Trump tariffs that have spooked investors who fear the impacts a trade war between the US and her trading partners would have on the market.

Away from the US, the yield for the 20-year Japan Government Bond (JGB) has climbed to 2.265% – the highest level since 2008.

Historically, high bond yields locally and internationally have always pulled liquidity from the crypto markets because they are considerably less risky.

Taking these factors and the prevailing bearish market sentiment, analysts are concerned that there won’t be enough buying pressure to help BTC defend the $80K price level.

Some, like Arthur Haye’s have warned that Bitcoin could fail to 75K in the coming weeks.

Others, including Timothy Peterson – the author of “Metcalfe’s Law as a Model for Bitcoin’s Value” & “The Debauchery of Currency: A Bloody History of Money” expect deeper drawdowns that push it to around $70K.

🚀 Don’t Miss the Next Big Crypto Move!

Our premium members received real-time alerts on major crypto plays before they happened. Will you be ready for the next one?

🔴 Latest Insider Alerts:

- 📢Buy The Dip Is Here (Feb 28th)

- 📢How To Know Whether BTC Will Set A Bottom This Week? (Feb 25th)

- 📢This Token Is Set To Emerge As An Outperformer as USD Breaks Down. (Feb 16th)

- 📢When Will This Market Finally Start Moving? (Feb 9th)

- 📢Will February 5th Come To The Rescue? (Feb 4th)

⏳ Limited Spots Available – Secure Yours Now!