In the latest news, Bitcoin ETFs recorded the fifth straight week of net outflows – exceeding $838 Million.

This has only served to hurt BTC’s chances of recovery, as it keeps oscillating between $82k and $85k.

A barrage of negative news, both macro and on-chain, has exerted more sell pressure on Bitcoin, ensuring it remains stuck well below $85k.

Over the last 24 hours, its price barely moved only increasing by 1% to climb above $83k at the time of writing. However, its daily trade volumes have shot by almost 100% to reach $26.7 Billion.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment.Understand the risks here

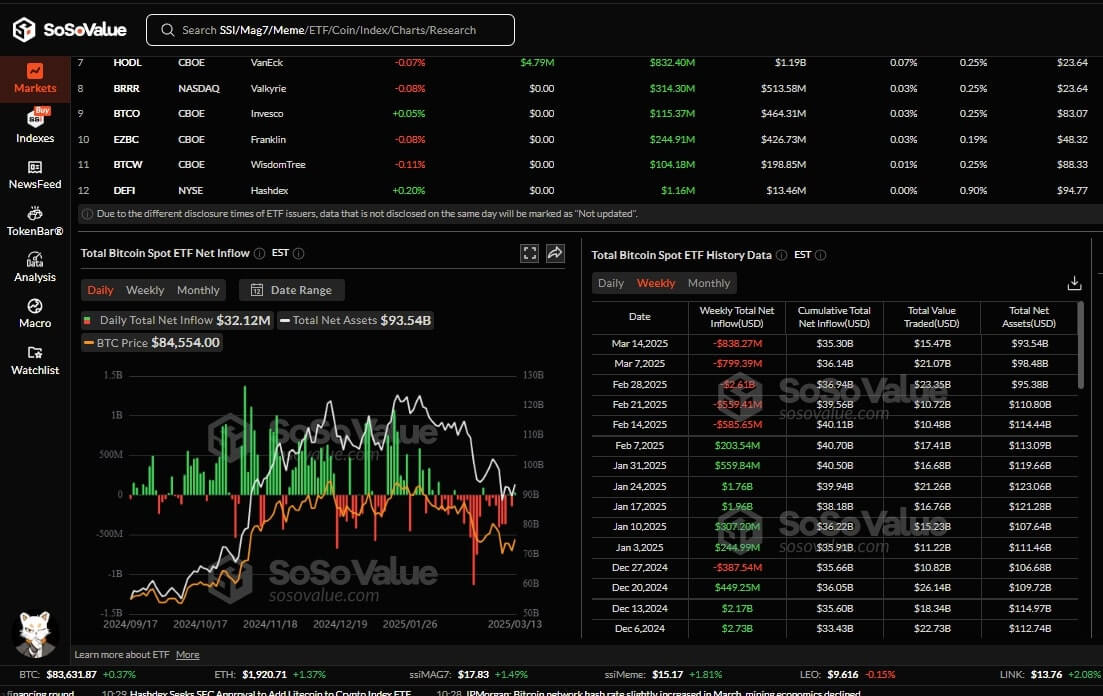

Among the factors dragging down Bitcoin prices was the report from Sosovalue that Bitcoin ETFs had their fifth straight week of net outflows.

For the week ending March.14, Bitcoin ETFs reported a net outflow of $838 Million, bringing the total outflows for the five-week period to $5.4 Billion.

Yet another report by Coinshares indicated that crypto ETPs had gone for a five-week negative outflow streak. Their outflows amounted to $1.7 Billion last week, compounding the total outflow to $6.4 Billion.

When Will Bitcoin Start Rebounding?

In an ideal market, Bitcoin should rally again or at least stabilize, not threatening to crash below $80K.

There has been a lot of positive news around the coin that should help it rebound.

For example, Strategy just reconfirmed the institutional investor sentiment interest in the legacy coin by buying $10.7 Million worth of BTC.

Even more importantly, it announced the launch of a $21 billion at-the-market stock offering program whose proceeds will be used to buy even more Bitcoins.

On-chain analysis of the coin also reveals that the market is slightly bullish. For example, during the daily timeframe, the MACD histogram started printing green bars.

The MACD line has also crossed the signal line from below, hinting at a bullish crossover. Its RSI has also increased from early last week’s oversold zone of 31 to the neutral territory above 44.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- The Time Window as of March 14 Should Bring Relief (March 11th)

- Buy The Dip Is Here (March 1st)

- BTC Very Close To Its 200 dma – Chart Looks Constructive (Feb 26th)

- How To Know Whether BTC Will Set A Bottom This Week? (Feb 25th)

- Crypto Markets Showing Strong Signs Of Selling Exhaustion. Buy The Dip?! (Feb 23d)

The easiest way to buy BNB is through a trusted crypto exchange like eToro,Coinbase, or Uphold. These platforms allow users to purchase and trade XRP instantly from any device, including smartphones, tablets, and computers.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment.Understand the risks here