Bitcoin News Today: Whale Accumulation Sends BTC Above to 97K – Is 100k the Next Stop?

Data aggregator CryptoQuant indicates that whales gobbled up 28,000 BTC worth $2.6 Billion during the recent dip.

The news and other macro factors help BTC climb back above $97k. Can this demand and declining Bitcoin exchange and miner reserves push BTC above 100K?

Institutional investor interest in Bitcoin is at an all-time high if a recent report by the data aggregation platform – CryptoQuant is anything to go by.

It reports that during the recent dip that saw Bitcoin prices crash below $94,000, big players went on a buying spree, aiming to leverage the dip.

By the time it climbed back above $97K, they had pocketed 28000+ Bitcoins worth more than $2.6 Billion.

It goes on to point out an important detail – that these were purchased by wallets not affiliated to crypto exchanges.

This confirms that institutional investor interest on the legacy coin hasn’t died down even though it comes days after the global crypto ETFs recorded the first week of net outflows in the year.

Who is Buying Bitcoins Right Now?

Hundreds of companies and governmental agencies have made public their intention to add Bitcoins to their balance sheets and portfolios.

The most recent big public purchase was carried out by Metaplanet when it acquired 2031 BTC worth more than $25.6 Million.

By the end of the year, the Japanese Hotel management company states that it intends to acquire at least 10,000 BTC.

Can Rising Demand Amidst Dwindling Supply Send BTC Above $100k?

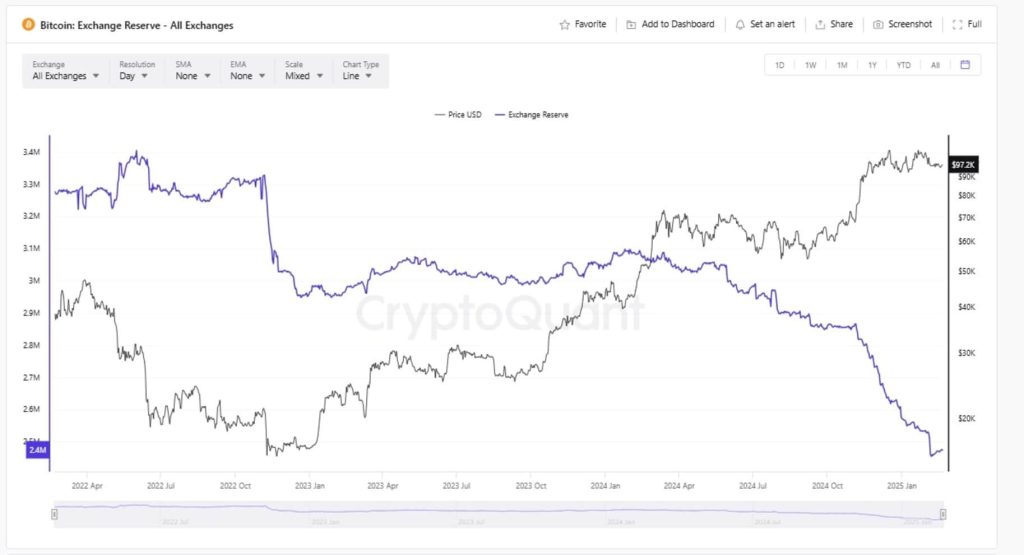

Days before these brands went on a buying spree, yet another report by CryptoQuant had indicated that crypto exchanges only had 2.5 million BTC in their reserves.

Today, this figure has shrunk by 100k to just 2.4 million coins. Bitcoin miner reserves have also dipped to 1.94 million – the lowest level since 2009.

Historically, such a huge demand against a dwindling demand often forms the base of the next bull run.

The demand witnessed over the last few days has already helped Bitcoin breach the key resistance level of $97k momentarily as its intraday highs soared to $97,800.

It remains to be seen if it is enough to help it recapture the all-important $100k mark.

Key technical indicators like MACD and the RSI show that the bullish momentum is gathering pace and will possibly continue fueling BTC’s further uptrend.

🚀 Don’t Miss the Next Big Crypto Move!

Our premium members received real-time alerts on major crypto plays before they happened. Will you be ready for the next one?

🔴 Latest Insider Alerts:

- 📢This Token Is Set To Emerge As An Outperformer as USD Breaks Down. (Feb 16th)

- 📢When Will This Market Finally Start Moving? (Feb 9th)

- 📢Will February 5th Come To The Rescue? (Feb 4th)

- 📢Top 5 Tokens for 2025: Essential and In-Depth Chart Insights (Jan 31st)

⏳ Limited Spots Available – Secure Yours Now!